What to expect

We are expecting overall higher wholesale gasoline prices in Puerto Rico when compared to last month (February 2024) due to US summer month specifications reaching the market. Should crude oil prices sustain its level at $80 per barrel we also expect higher wholesale diesel prices.

Highlights

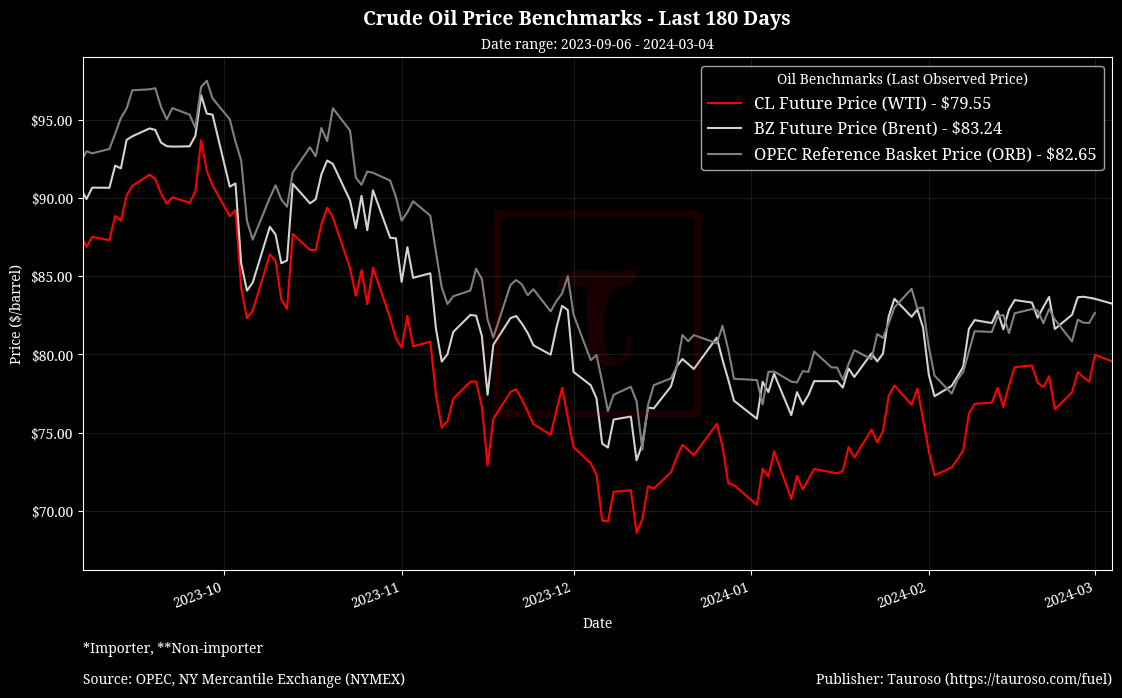

- Crude oil price: WTI crude oil (CF=F) closed last week around $80 per barrel, which was last seen at that level around November 2023, intraday trading today marks a bit lower around $79.68 per barrel

"I think the rally in crude oil prices is on the expectation that OPEC+ will continue with their voluntary production cuts well into the second quarter of 2024," Andy Lipow of Lipow Oil Associates told Yahoo Finance on Friday.

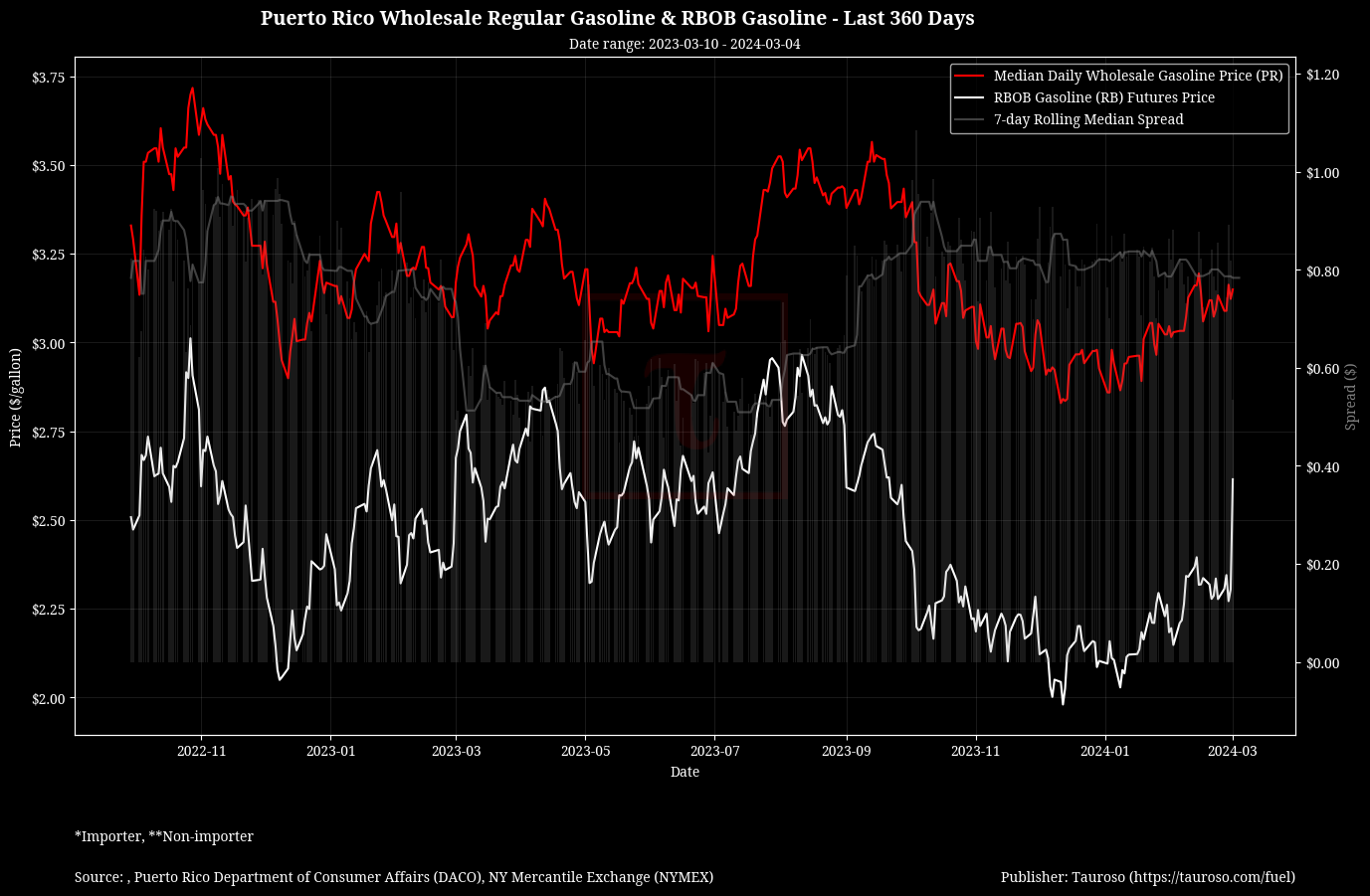

- US Summer month specifications: As seen by reformulated gasoline futures price (RF=F) on Friday March 1st, we note +$0.30 spike due to US summer months gasoline specifications kicking in. Note that Puerto Rico wholesale gasoline prices typically trade at approximately

+$0.80, while during the summer months this drops to about +$0.50 (a $0.30 spread). Reminder that US summer month gasoline specifications cost refiners a bit more to produce since it requires more refining to handle higher temperatures during the summer.

- OPEC Production Cuts: Several OPEC+ members have announced extended production cuts, with expactions being prodcutions cut will continue remain to sustain current oil prices. We note, current OPEC+ barrel price target is around $90 per barrel

“They’ll have to extend their cuts,” Bob McNally, president of consultants Rapidan Energy Group and a former White House official, told Bloomberg Television. “Supply is exceeding demand, and to keep prices stable, OPEC+ has to keep that oil off the market.”

- US Supply Inventory Growth: US crude oil inventory stockpile grew moderetely by 4.2 million barrels, a bit lower than expected

US crude inventories rose 4.2 million barrels last week, the Energy Information Administration said, a smaller buildup than the 8.4 million barrel gain projected in an industry report.

- Asia Demand: Demand for crude oil in Asia remains high, yet impacted by curbs in production from the Middle East

New refineries in Kuwait and Oman have taken crude oil off the market and refiners in Asia and elsewhere need to look for alternative supplies. - Andy Lipow of Lipow Oil Associates.

Crude Oil Benchmarks

References

- https://finance.yahoo.com/video/oil-prices-rise-second-straight-161805017.html

- https://finance.yahoo.com/news/opec-watchers-predict-extension-oil-120759886.html

- https://finance.yahoo.com/news/oil-gains-for-second-month-in-a-row-up-more-than-8-in-2024-202916911.html

- https://www.opec.org/opec_web/en/press_room/7305.htm

- https://finance.yahoo.com/news/oil-declines-us-stockpiles-opec-235931875.html