What to expect

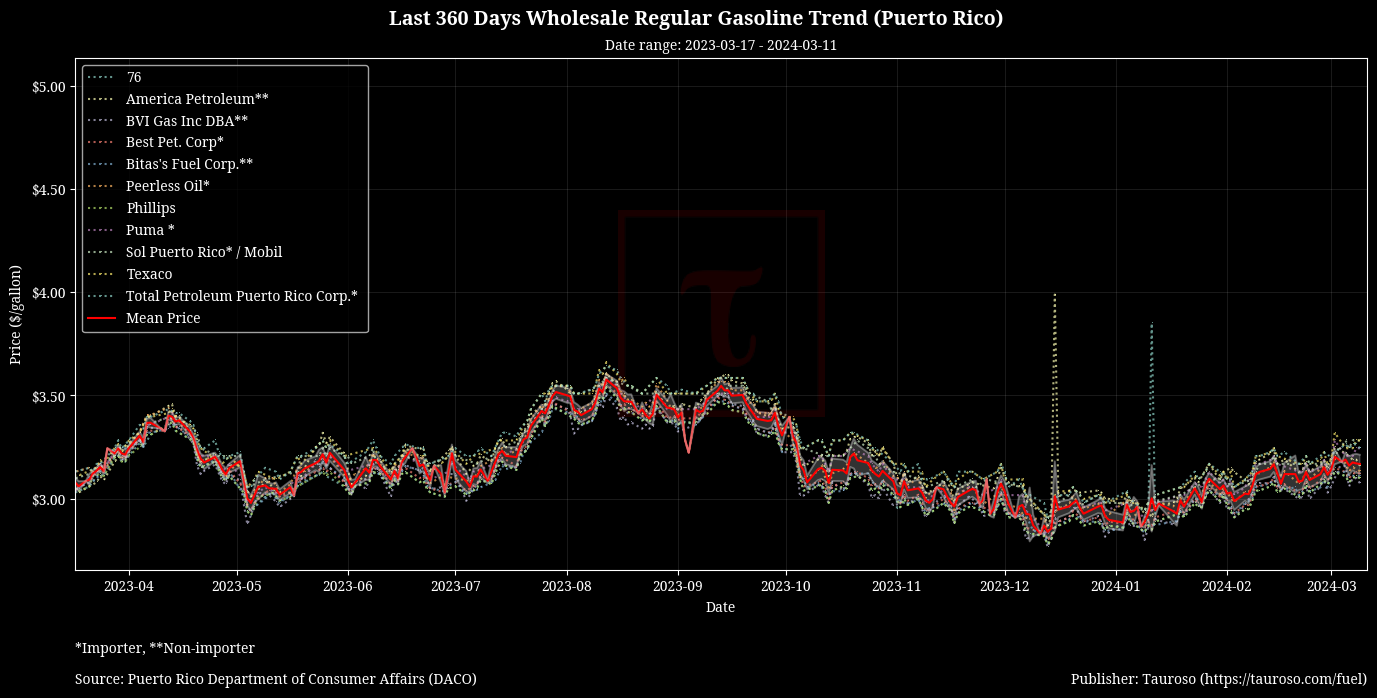

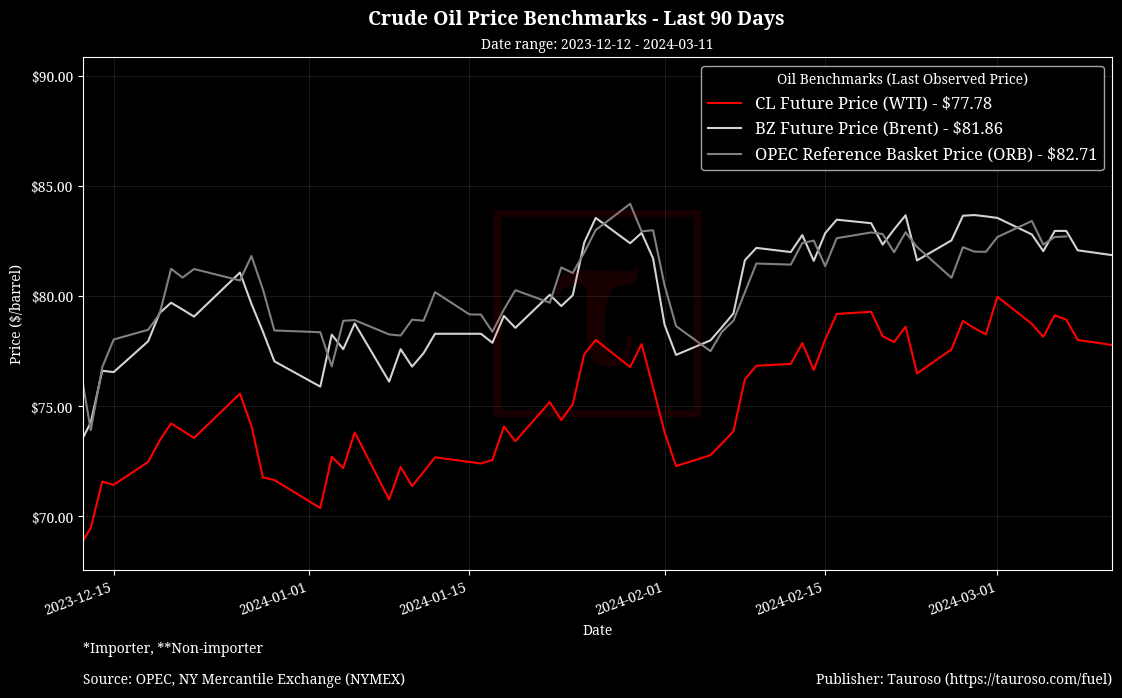

Crude oil has remained steady at near but less than the $80 per barrel mark throughout last week. We expect this coming week to see similar stability but with the general expectation of a rise in wholesale gasoline prices on the island. Comparing wholsale gasoline prices to last year, at the peak of the summer (2023), we saw wholesale gasoline prices at around $3.50 per gallon, we could reach these historical levels in the coming months.

Highlights

- Gas Prices in the US: The national average for regular gasoline stands around $3.397 per gallon ($0.208 difference from a month ago, a 6.52% increase)

"US refining has been stunted by severe weather and some power losses at key plants. We may in the next few days see US retail gas prices at a higher number than year-ago," Tom Kloza, global head of energy analysis at OPIS

"This is the time of year that there's a lot of pressure on refineries, they are doing maintenance before the summer. They are transitioning over to summer gasoline. In the background, demand is all going up at the same time. That puts a lot of pressure on refineries to finish that maintenance, to get back online and boost production." - GasBuddy head of petroleum analysis Patrick De Haan

- OPEC Production Cuts OPEC+ members agree to extend crude oil output production cuts of 2.2 million barrels per day in to the second quarter of 2024

"I think the rally in crude oil prices is on the expectation that OPEC+ will continue with their voluntary production cuts well into the second quarter of 2024," Andy Lipow of Lipow Oil Associates

- China demand: Oil prices has seen a decrease amid concerns over the demand outlook in China, the world's biggest crude importer

China's imports of crude oil rose in the first two months of the year compared with the same period in 2023, but they were weaker than the preceding months, data showed on Thursday, continuing a trend of softening purchases by the world's biggest buyer.

Crude Oil Benchmarks

References

- https://gasprices.aaa.com/

- https://finance.yahoo.com/quote/CL%3DF

- https://finance.yahoo.com/quote/RB=F/

- https://finance.yahoo.com/video/oil-prices-firm-opec-extends-065726576.html

- https://www.nasdaq.com/articles/crude-oil-news-today%3A-can-opec-cuts-offset-chinas-waning-demand

- https://finance.yahoo.com/news/gas-prices-more-bumps-in-the-road-ahead-for-the-national-average-194220690.html

- https://www.msn.com/en-us/money/markets/oil-prices-fall-on-china-demand-worries/ar-BB1jFmk2

- https://www.pna.gov.ph/articles/1220543