What to expect

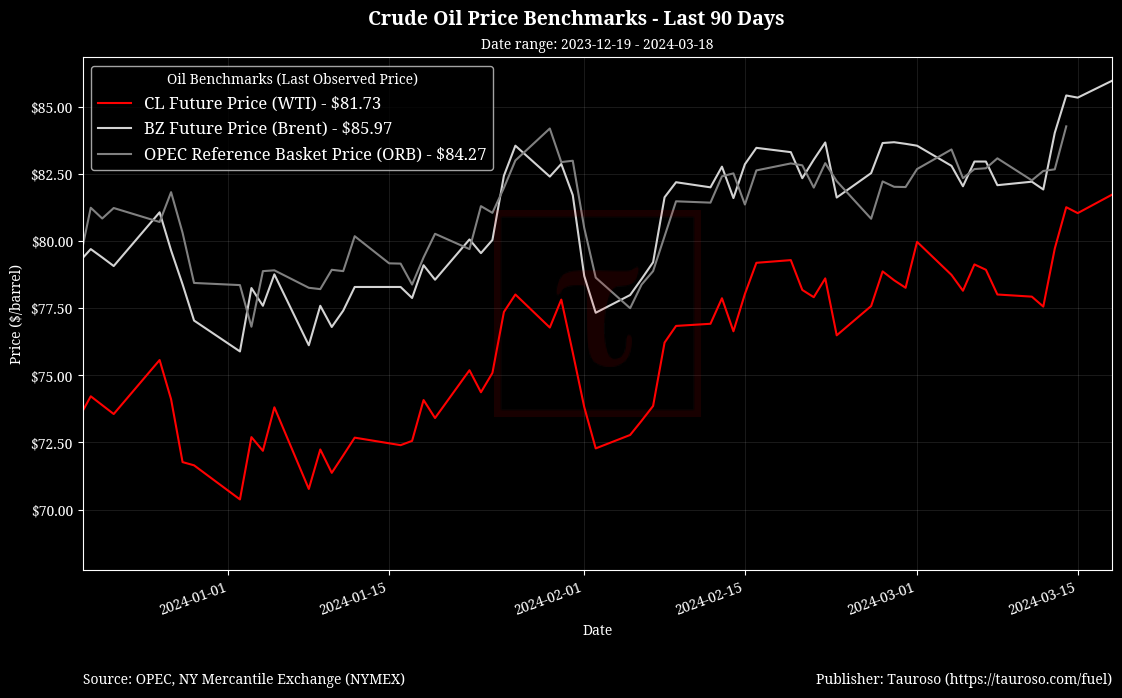

We have seen a sharp increase across the fuel markets driven mostly by crude oil price increases, summer month gasoline prices and hotter than expected inflation with fuel prices being a main driver.

Crude oil in the US (WTI via CL=F) was trading slightly higher at the open of Asian markets, closer towards $82 per barrel. Should this upward price motion continue, expect higher wholesale fuel prices.

Highlights

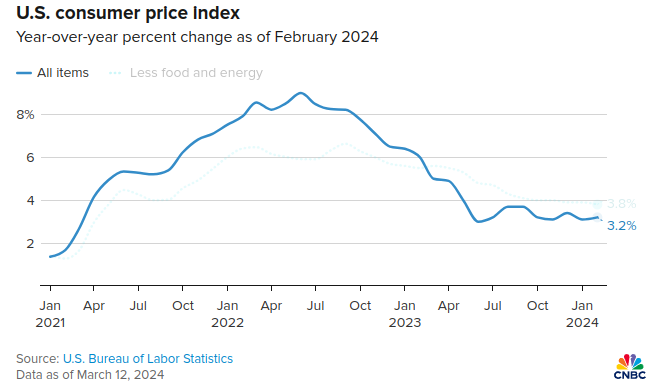

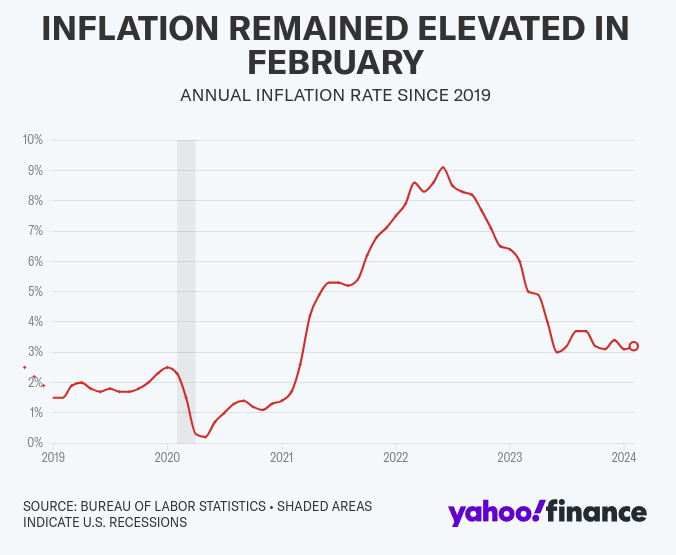

- US inflation increase driven by shelter and fuel: A 2.3% increase in energy costs contributed to higher inflation as measured by the Consumer Price Index (CPI). Food costs were flat on the month, while shelter climbed another 0.4%.

“Inflation continues to churn above 3%, and once again shelter costs were the main villain. With home prices expected to rise this year and rents falling only slowly, the long-awaited fall in shelter prices isn’t coming to the rescue any time soon. Reports like January’s and February’s aren’t going to prompt the Fed to lower rates quickly.” - Robert Frick, corporate economist at Navy Federal Credit Union

- Oil Demand Forecasts: OPEC maintains its world oil demand at 2.25 million barrels per day (bpd) while IEA has revised its demand forecast with higher estimates at around 1.3 million barrels per day (bpd)

a slight increase up by 110,000 bpd from last estimate.

"Quite a bullish report, with upward revisions on demand growth, and lower supply growth estimates," - UBS analyst Giovanni Staunovo

Provocative piece by The Economist on how we are approaching an inflection point where oil prices will no longer be driven by supply, but by demand.

Oil’s endgame could be highly disruptive - The Economist

Crude Oil Benchmarks

References

- https://finance.yahoo.com/quote/CL%3DF

- https://finance.yahoo.com/quote/RB=F/

- https://www.reuters.com/markets/commodities/opec-sticks-oil-demand-view-nudges-up-economic-growth-again-2024-03-12/

- https://www.msn.com/en-gb/money/other/iea-raises-oil-demand-outlook-again-but-still-lags-opec/ar-BB1jT8c8

- https://www.cnbc.com/2024/03/12/cpi-inflation-report-february-2024-.html?&doc=107386073

- https://finance.yahoo.com/news/gasoline-higher-prices-are-ahead-for-consumers-165718865.html