What to expect

We expect further volatility for fuel prices as we witness what will evolve out of the situation in the Middle East. Monday market opening saw some relief given minor damage from a direct attack of Iran on Israel. This week should continue seeing ups and downs as the market settles and tensions subside.

Our short to mid-term expectation continues to be an upside in gasoline as we get deeper into the summer season. We see mutiple market signals such as investor positions, household income growth, and inflation that are hinting at continued increases of gasoline prices in the US.

"We think oil into the summer months will kind of top out at around $95+ a barrel," Bank of America head of global commodities Francisco Blanch

Highlights

Tension in the Middle East: Last week tensions rose between Israel and Iran driving crude oil prices upward but since have subsided. Iran’s production is estimated at 3 million barrels of crude oil per day.

"If a large percentage of that [production] were to move away or be delayed to the world market the supply/demand picture could tighten further very quickly" - Dennis Kissler, senior vice president at BOK Financial

A ceiling for crude oil: Demand desctruction and Strategic Petroleum Reserve (SPR) are possible levers that will keep crude under $100 per barrel

"Right now what they [OPEC+] have is a beautiful position of controlling the market. They've got their hands on the steering wheel here. They don't want to lose that," Babin tells Yahoo Finance."You let it go too far, you get SPR (Strategic Petroleum Reserve). So, let's bring back some barrels. I think this puts a damper on this rally to $100 [per barrel] that some people are talking about. And he second big factor I think is demand destruction. You can't just have an explosive rally to the upside and think demand is going to be completely inelastic." - Rebecca Babin, CIBC Private Wealth US Senior Energy Trader

Gasoline again drives energy inflation upwards: According to Bureau of Labor Statistics (BLS), U.S. electricity and gasoline prices increased sharply in March, with electricity up 0.9% and gasoline up 1.7%, leading the energy sector to far outpace broader inflation for the month, according to Bureau of Labor Statistics data released on Wednesday.

Investors see upside in US gasoline: Investor positions in futures and options show an anticipation of high upside for gasoline in the United States

"Relatively low inventories, employment gains, strong household income growth and the prospect of an active hurricane season are expected to keep gasoline consumption high and inventories under pressure." - Reuters market analyst, John Kemp

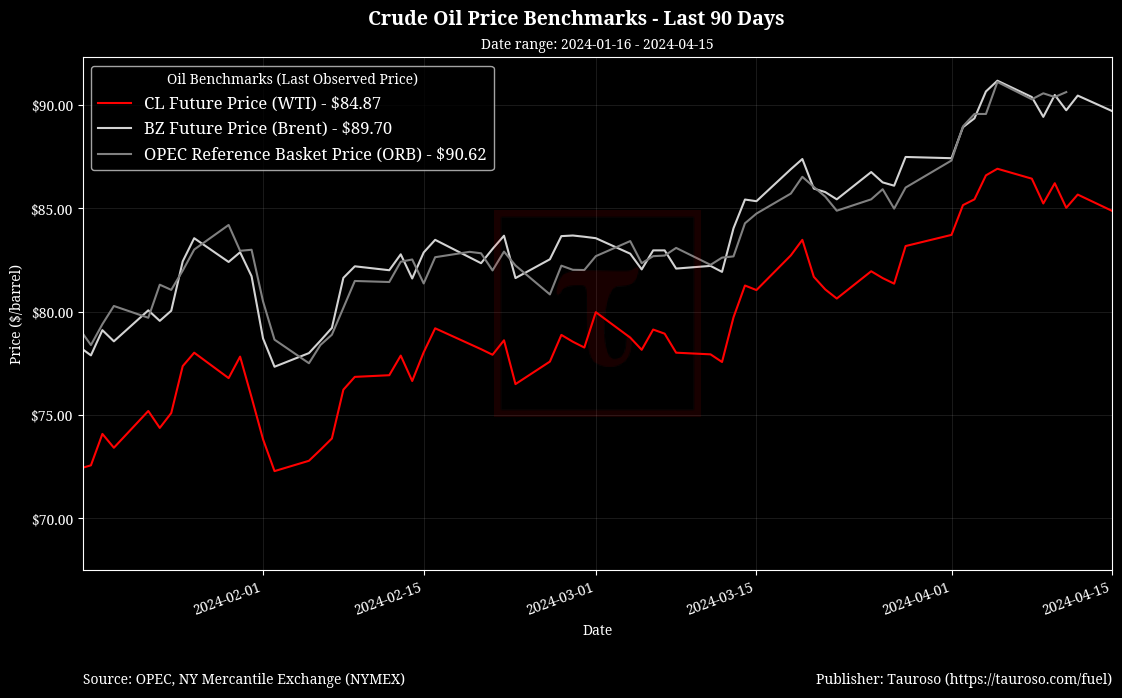

Crude Oil Benchmarks

References

- https://finance.yahoo.com/quote/CL%3DF

- https://finance.yahoo.com/quote/RB=F/

- https://finance.yahoo.com/news/oil-surges-to-highest-level-since-october-on-escalating-middle-east-tensions-151217189.html

- https://www.msn.com/en-us/money/markets/oil-prices-retreat-after-iran-attack-on-israel-traders-are-braced-for-what-happens-next/ar-BB1lDzKa

- https://finance.yahoo.com/news/column-investors-bet-further-rise-174642160.html

- https://finance.yahoo.com/news/us-electricity-gasoline-prices-push-174029068.html

- https://finance.yahoo.com/video/oil-opec-hands-steering-wheel-152525294.html