What to expect

We expect local fuel markets catch up this week with broader interntional market up ticks seen last week. However, these should quickly subside and remian steady.

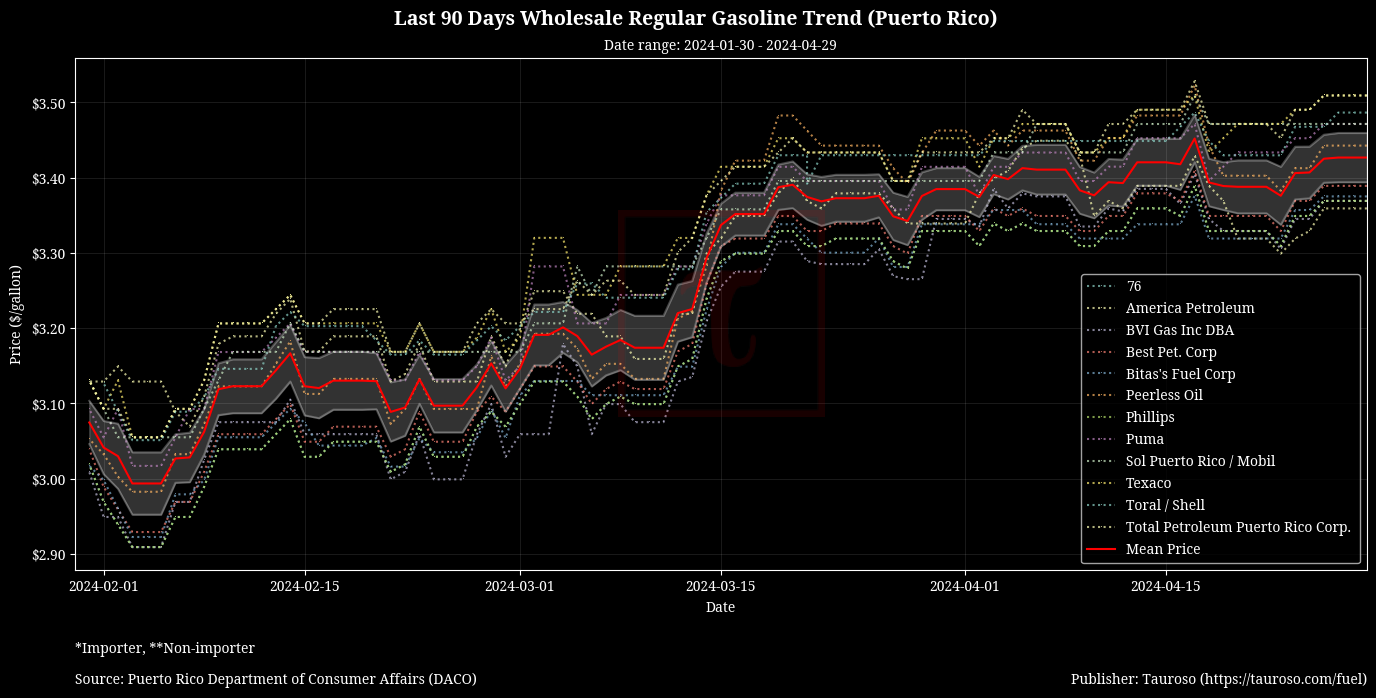

Wholesale gasoline has crossed wholesale diesel in Puerto Rico, starting to trade slighly higher. Crude oil trades the early hours of Monday at around $83 per barrel.

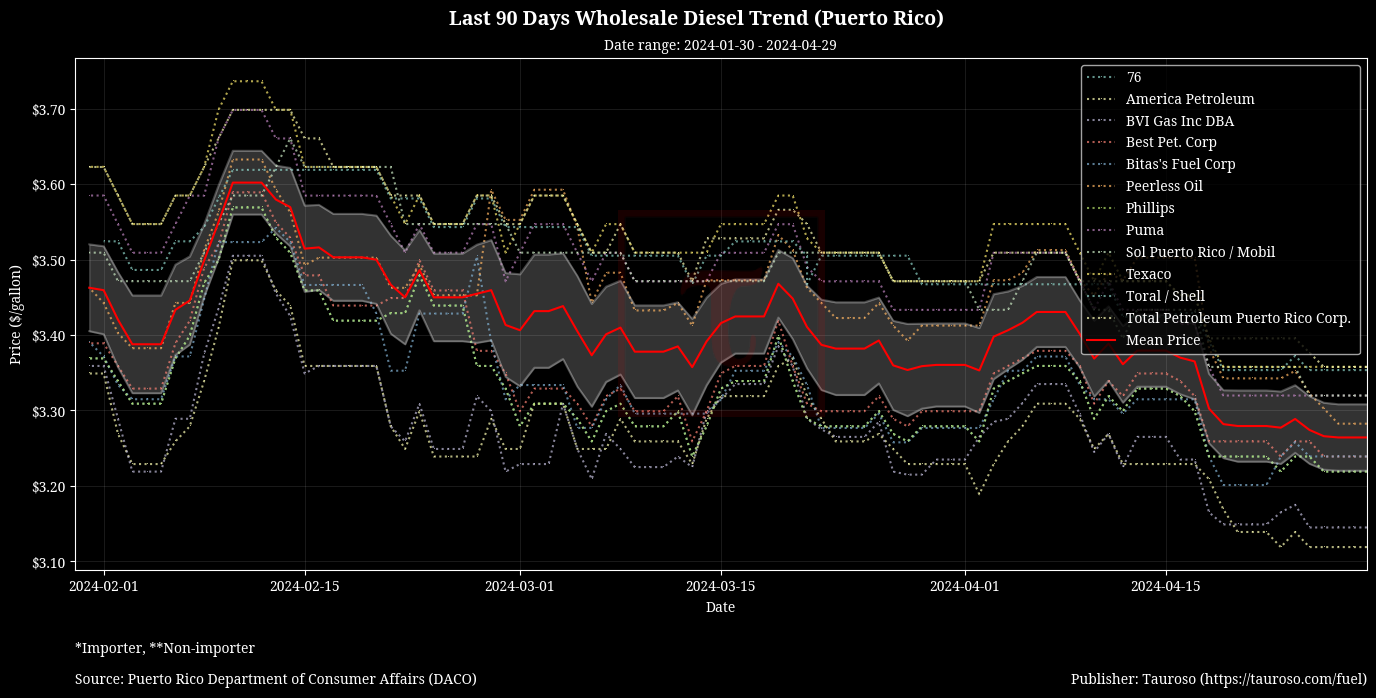

As seen below, wholesale diesel prices has seen a 90 day downtrend, while gasoline has been slowly increasing. We continue to expect these trends, with gasoline possibly starting to see some relief in the coming weeks before June.

Highlights

Expected relief for gasoline prices before June: A variety of mixed factors have gasoline prices in the US possibly falling before June. Some highlightable events to sustain this:

Reduction in escalations between Israel and Iran keeping the Middle East out of a regional war

EPA allows E15 sales over summer months

More refinery capacity in the US out of spring maintainance

Quick turnaround time to fix damaged Russian refineries from Ukranian attacks

"Money managers were reducing their bets on higher energy prices last week, in what appears to be an unwind of the positions added the prior week when it seemed like we might have an all-out war between Israel and Iran," traders at wholesale fuel supplier TACenergy

Exxon and Chevron Q1 earnings: Big Oil stocks fall last week due to year over year profit declines reported for Q1 due to lower natural gas prices and a decrease in refinery margins.

"While consensus estimates forecast a decline from profit levels a year ago, the drop was a bit more severe than anticipated," Peter McNally, global sector lead for industrials, materials, and energy at Third Bridge

Crude Oil Benchmarks

References

- https://finance.yahoo.com/quote/CL%3DF

- https://finance.yahoo.com/quote/RB=F/

- https://finance.yahoo.com/news/chevron-exxon-stocks-fall-as-lower-refining-margins-falling-natural-gas-prices-hit-profits-092441200.html

- https://finance.yahoo.com/video/energy-exxon-chevron-drag-sector-203140131.html

- https://finance.yahoo.com/news/us-gasoline-prices-set-lose-175606710.html