What to expect

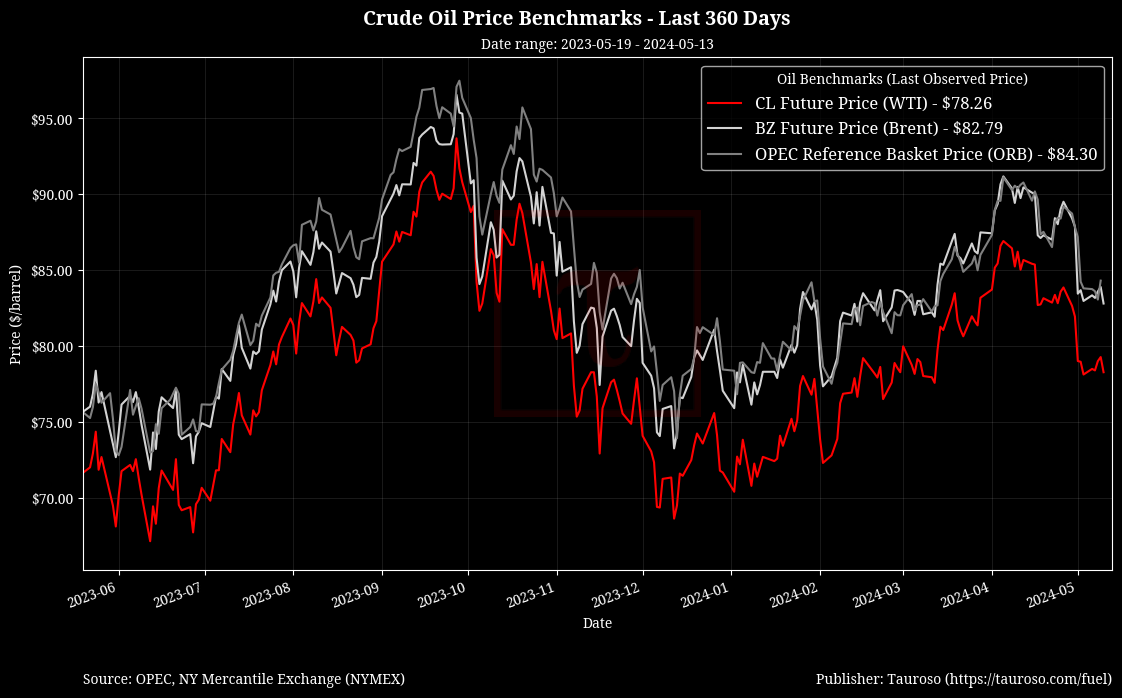

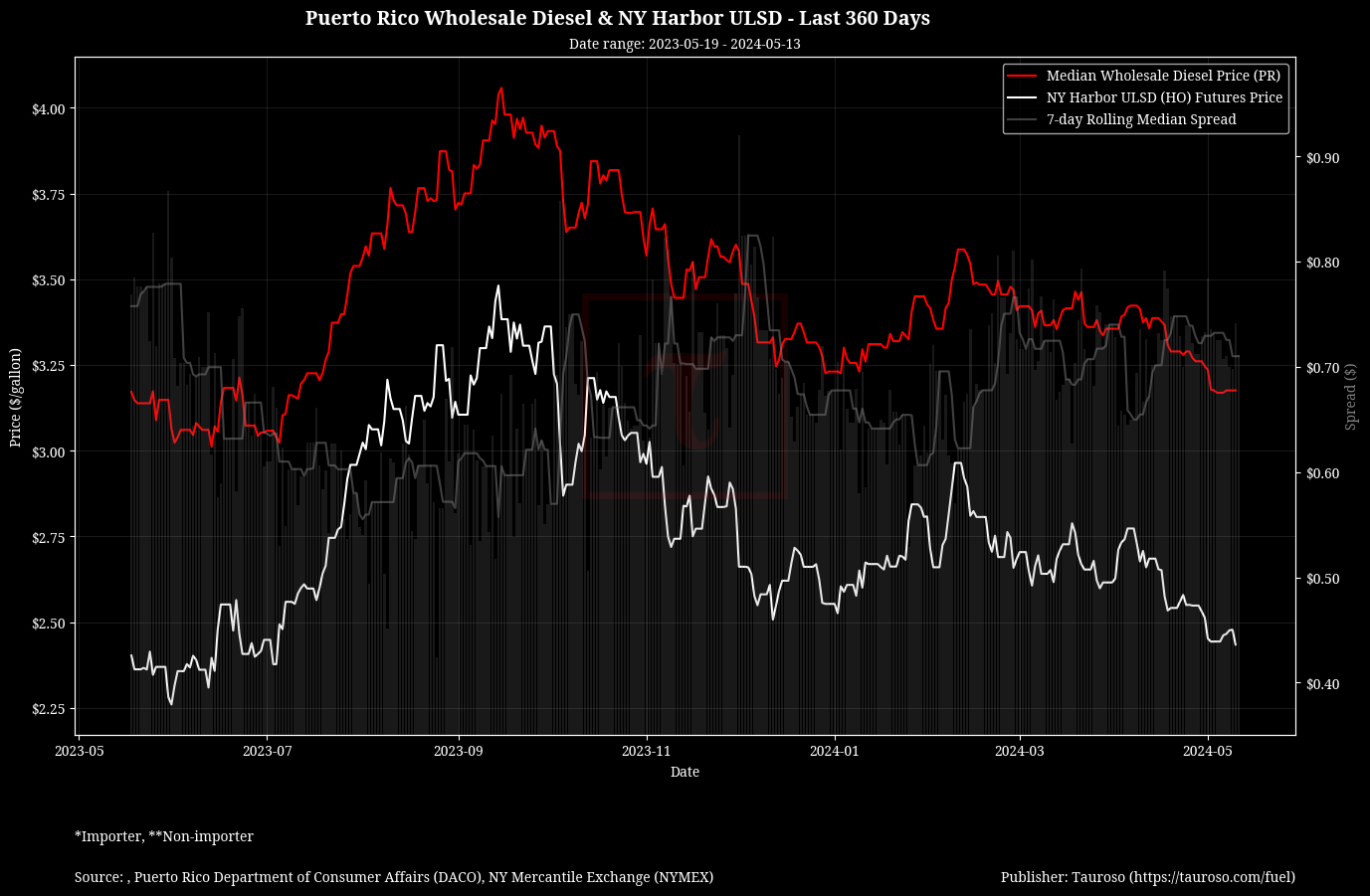

Crude oil and derived fuels has seen some positive relief on prices during the past week bringing it back to levels seen during March 2024. We still see some space for continued price reduction before stablizing.

Stay tuned this upcoming week to see how price activity unfolds. Below we can appreciate local wholesale fuel trends in Puerto Rico over the past year compared with some market derivative contracts during the same period.

Highlights

- US Crude Oil Inventory Drop: US based EIA, reported a drop in crude oil inventories

"U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 1.4 million barrels from the previous week. At 459.5 million barrels, U.S. crude oil inventories are about 3% below the five year average for this time of year."

- Middle East Cease Fire In Sight: Hightened hopes of a ceasefire by Israel and Hamas could bring additional relief to crude oil prices.

"Headlines regarding a potential cease fire could further reduce crude prices by $3-4, but only if it signifies a genuine move to long lasting peace rather than a temporary pause in hostilities,” Rebecca Babin, US senior energy trader at CIBC Private Wealth

- OPEC+ Production Cuts Expectation: Expectation has OPEC+ extending prodcution cuts well beyond Q2 2024.

“Incrementally bearish fundamentals increase the probability of a full extension of OPEC+ cuts beyond Q2” - Goldman Sachs

Crude Oil Benchmarks