What to expect

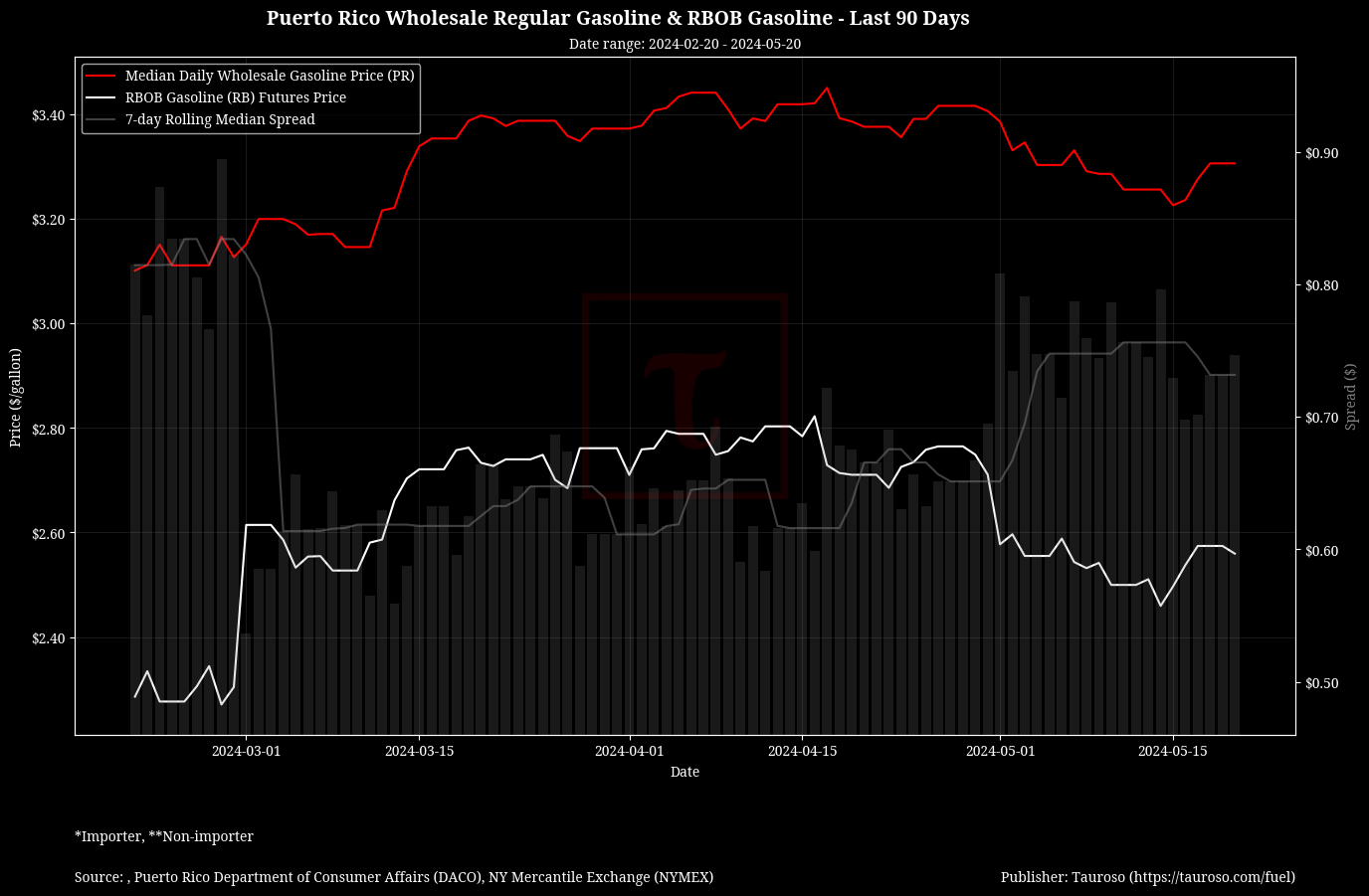

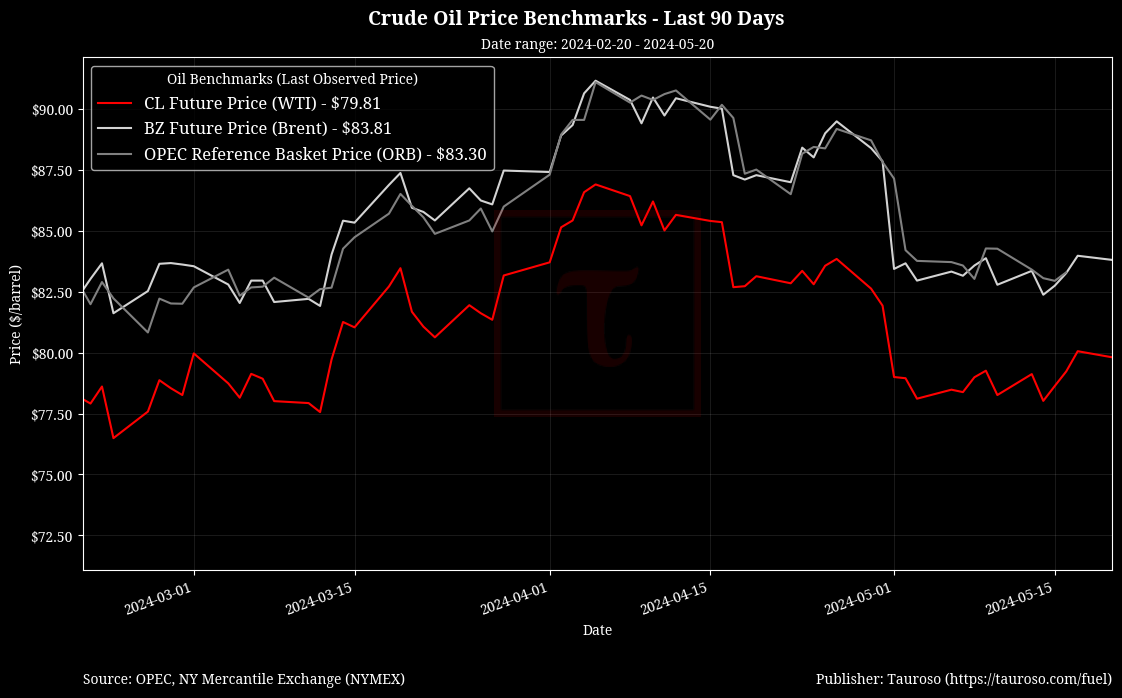

Crude oil benchmarks and fuel prices have been mostly stable this past week with mild volatility. We expect to continue seeing this behavior with some slight price increases due to expected drops in refining capacity in the US.

Highlights

- Falling refining capacity could lead to higher gas prices this summer: Less refining capacity has STEO forecasts with an additional $0.10 to a gallon of gasoline at $3.70 this summer, current US average is at $3.60 per gallon.

"US retail gasoline prices will average about $3.70 per gallon for the summer driving season, which runs from May to September when the United States will have 3%, or 620,000 barrels per day less refinery capacity compared with the 2019 peak" Report by Energy Information Administration

- Inflation decelerates but gas pirces had an uptick: Gas prices rose 2.8% over the prior month in April, up from the 1.5% monthly increase seen in March.

"Overall, gasoline and shelter combined accounted for over 70% of the monthly increase in the Consumer Price Index (CPI), which rose 0.3% over the prior month in April. Over the prior year, gas prices rose 1.2% while the headline CPI rose 3.4%." - BLS

- Shift from geopolitics to seasonal dynamics: Geopolitical impact on crude oil supplies unwinds having seasonal production and demand kick gears as main driver of prices

"While the Middle East unrest and Russian/Ukraine issues will linger, with no real supply issues being noted the trade will focus more on seasonal demand and production numbers," - Dennis Kissler, senior vice president at BOK Financial

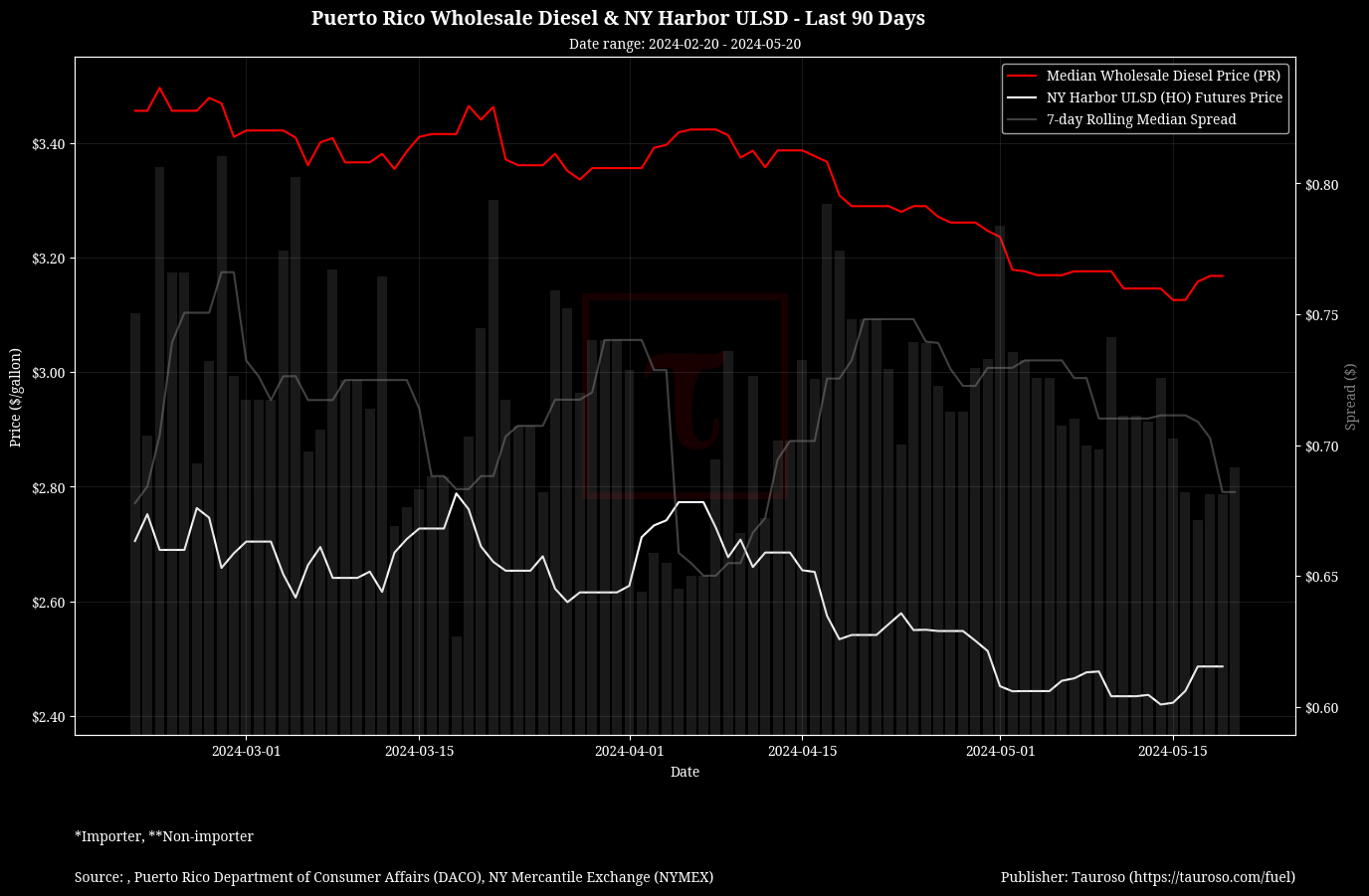

Crude Oil Benchmarks

References

- https://finance.yahoo.com/quote/CL%3DF

- https://finance.yahoo.com/quote/RB=F/

- https://www.eia.gov/todayinenergy/detail.php?id=62064

- https://finance.yahoo.com/news/gas-prices-expected-to-jump-this-summer-on-refinery-constraints-153129964.html

- https://finance.yahoo.com/news/gas-price-increases-accelerate-in-april-as-overall-inflation-pressures-ease-135310738.html