What to expect

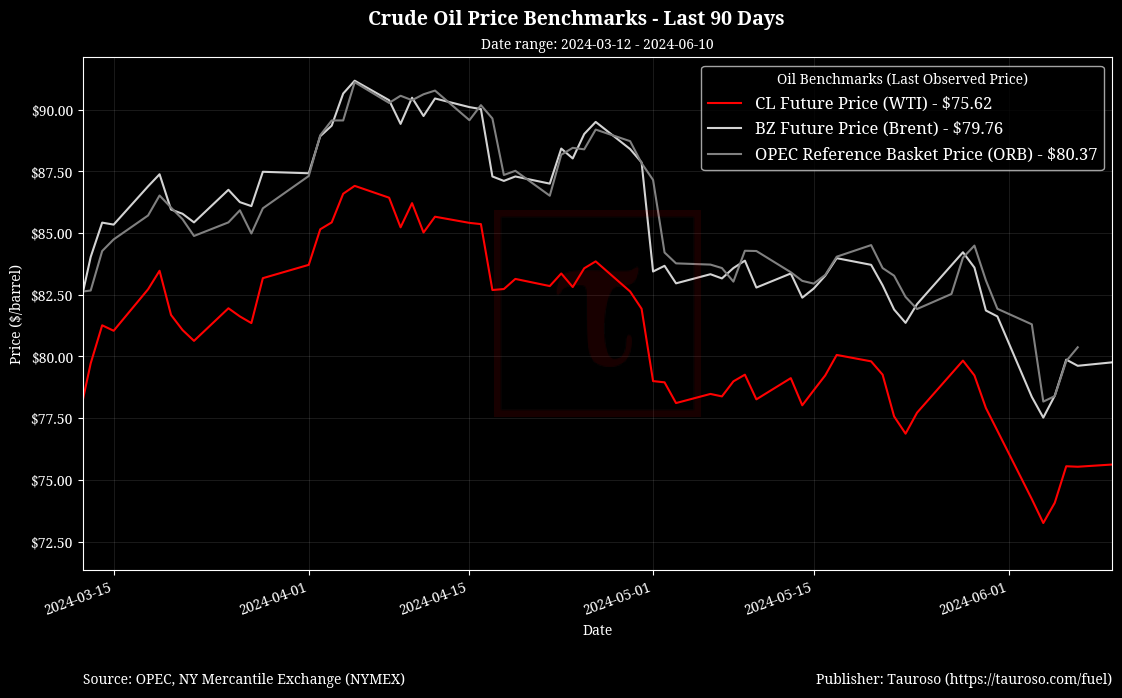

Crude oil had some price swings last week as OPEC+ members agreed to unwind some production cuts but then taking back statement stating that at any point it can be reconsidered and turned back. The expectation of additional supply in the market got popular benchmarks trading lower with WTI seeing a low of $73 per barrel. Afterwards, we saw crude oil in the US stabalize at around $75 per barrel to close off the week.

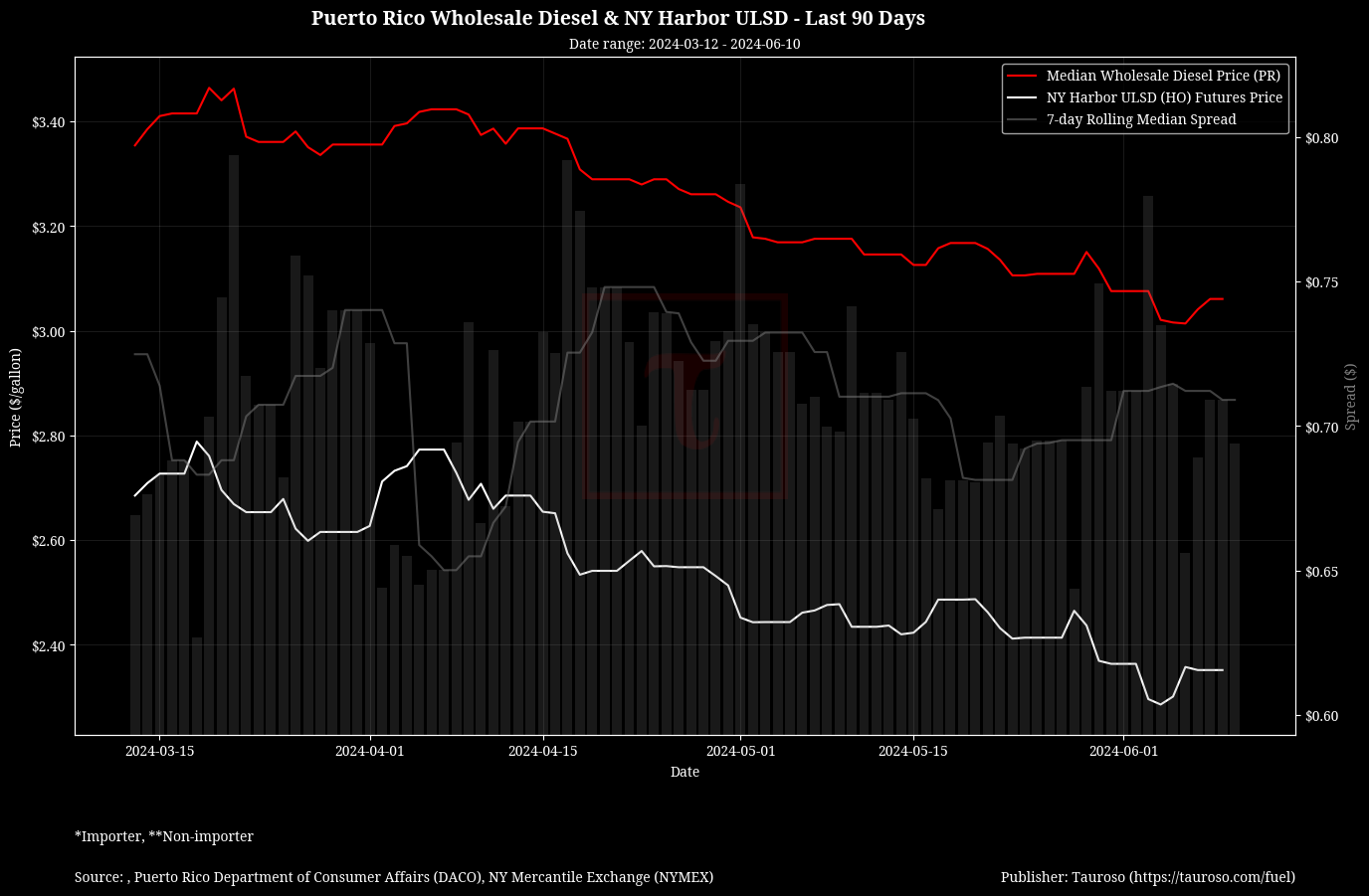

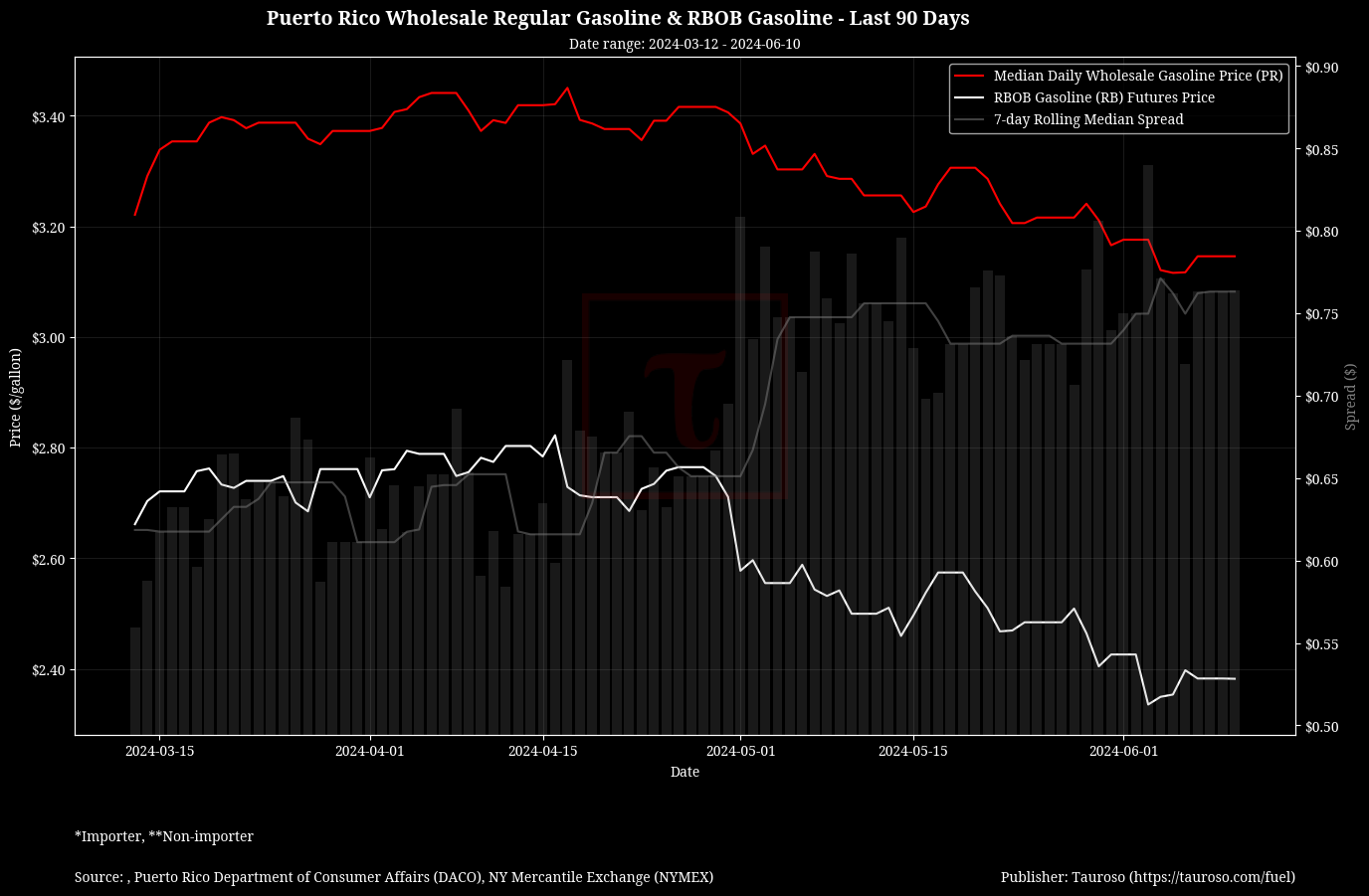

Generally, local wholesale fuel prices followed closely the crude oil benchmark price swings. We continue to expect some minor drops in fuel prices over coming weeks before bottoming out and increasing towards the end of the summer.

Highlights

- OPEC+ production cut statements: OPEC+ had agreed to phase out voluntary cuts of 2.2 million barrel per day over a year starting on October 2024, but have clarified this can be rolled back at any time. These statements drove majority of activity for crude oil and fuel prices last week.

"OPEC+ can pause or reverse oil production increases if the market weakens" - Saudi Energy Minister Prince Abdulaziz bin Salman

- Possible gasoline price hike due to refinery pressures: Demand on refineries could drive uptick of gasoline prices over the summer.

"Over the course of the summer, we're going to see a lift in gas prices, probably closer to that kind of $3.65, $3.70 level. Nowhere near the point where it starts to make people change their mind on consumption, but I would expect we see a bottoming here, and throughout the course of the summer we see a little incremental rise as demand picks up..." - CIBC Private Wealth US Senior Energy Trader Rebecca Babin

- Crude oil expected to head back to the high $80: Seasonal demand could bring upwards price pressure to crude driving Brent towards the high $80s-$90 per barrel range.

"Summer inventory draws should be enough to get Brent back into the high $80s-$90 range by September. We expect a seasonal uptick in demand to begin shortly and project demand for both products and crude to surge by 2.5 mbd [million barrels per day] and 4.0 mbd, respectively, between April and August." - Natasha Kaneva, JPMorgan's head of global commodities strategy

Crude Oil Benchmarks

References

- https://finance.yahoo.com/quote/CL%3DF

- https://finance.yahoo.com/quote/RB=F/

- https://www.reuters.com/markets/commodities/opec-could-tweak-oil-pact-if-needed-ministers-say-2024-06-06/

- https://finance.yahoo.com/video/oil-prices-energy-markets-were-215219614.html

- https://finance.yahoo.com/news/oil-falls-3-on-opec-production-cut-as-demand-worries-surface-175052930.html

- https://finance.yahoo.com/news/gas-prices-see-biggest-weekly-drop-of-2024-but-a-spike-may-come-later-this-summer-194117913.html

- https://finance.yahoo.com/news/oil-expected-to-head-back-into-high-80s-by-september-jpmorgan-analysts-say-163528060.html