What to expect

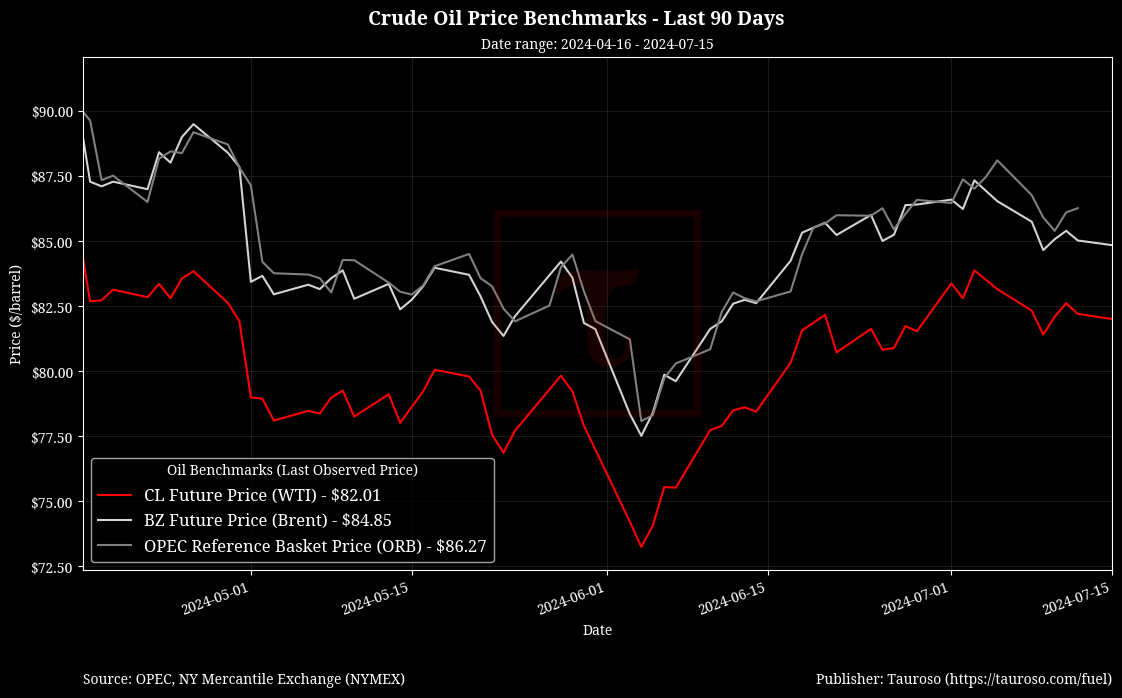

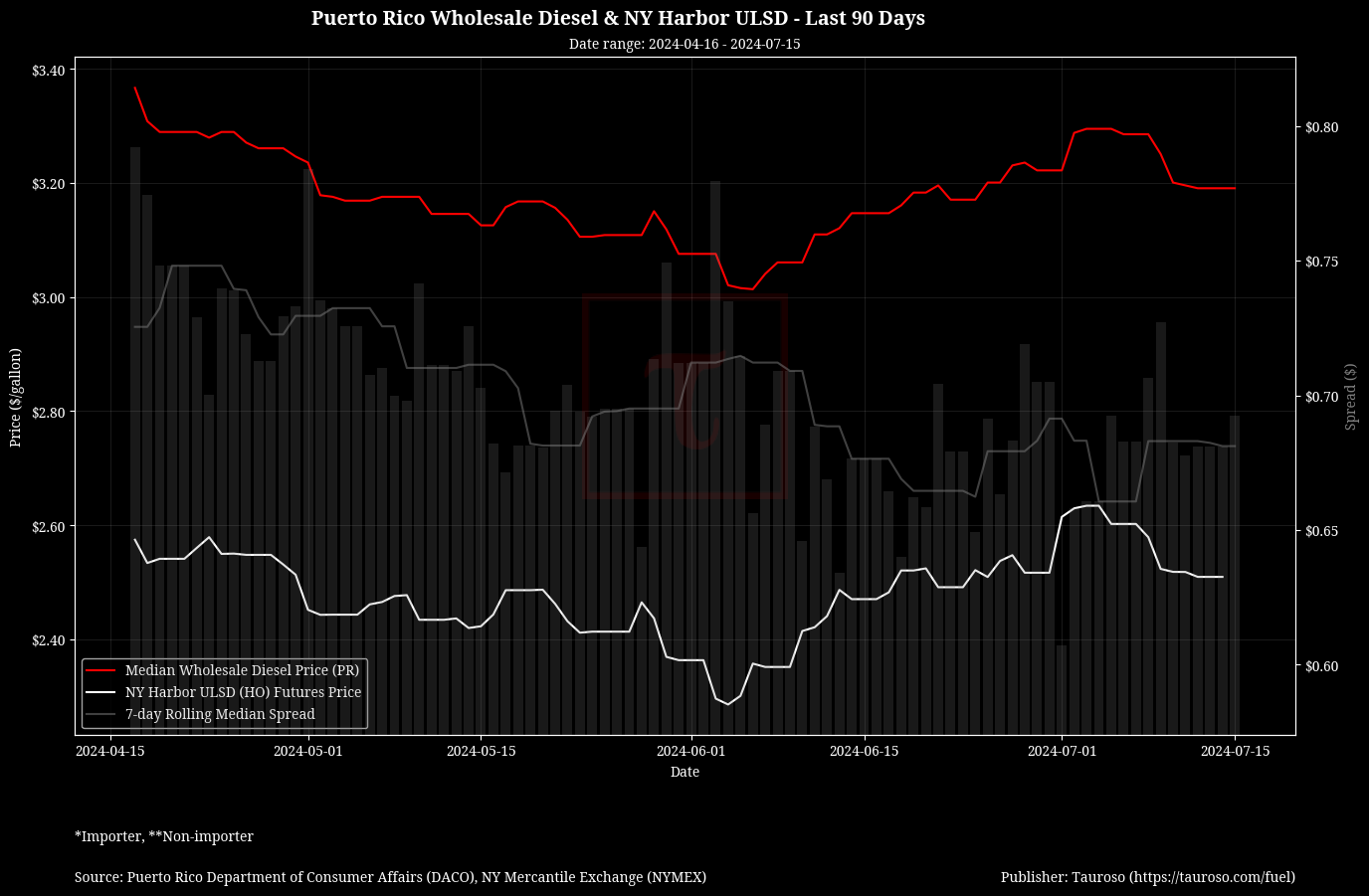

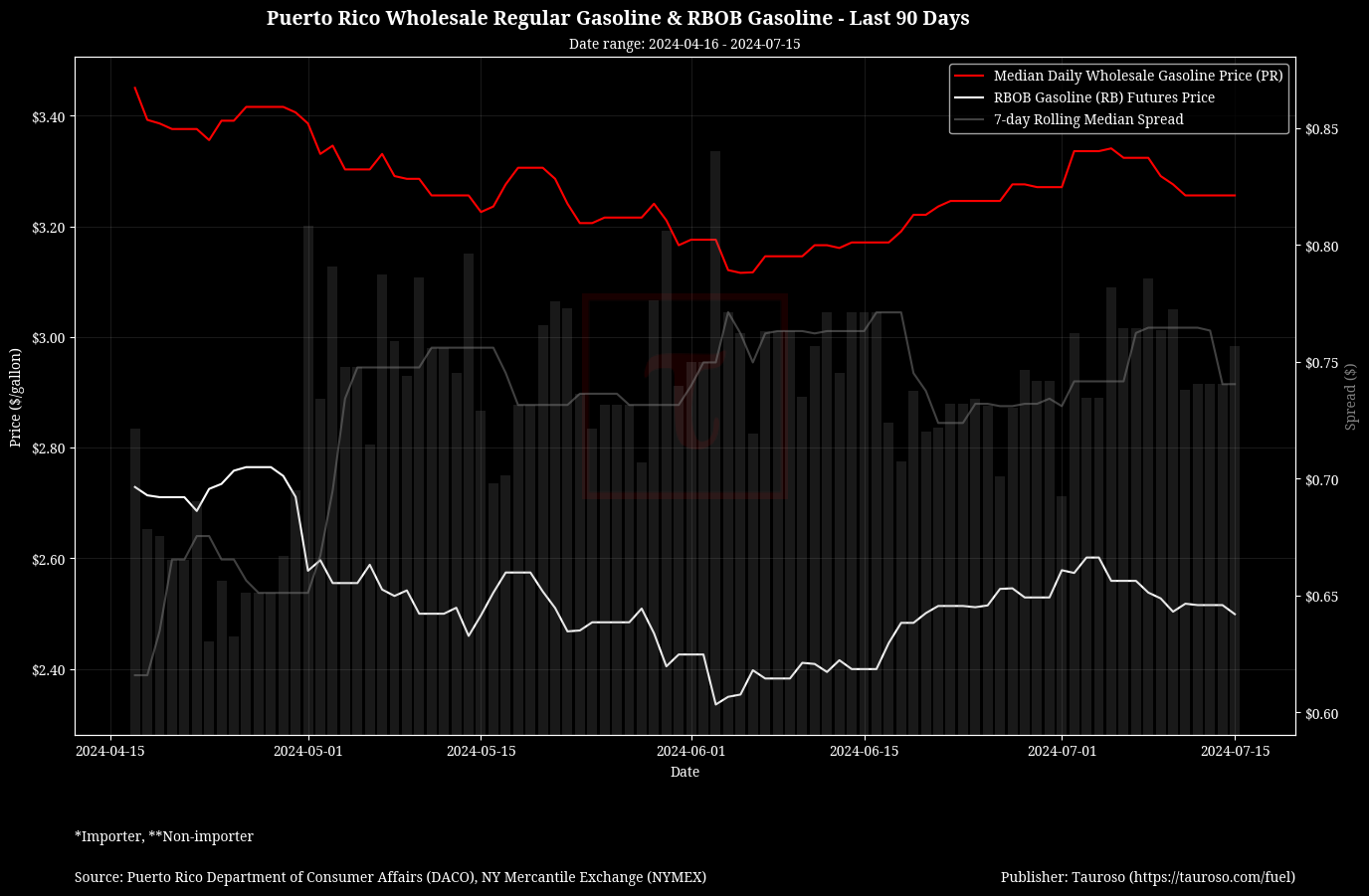

Caught midway through the summer season, we see crude oil benchmarks remain steady with US WTI around $82 per barrel and Brent at $84 per barrel. Early July we saw a spike in crude oil and local fuel prices and then a gradual decline. We believe more upward price activity is possible given what we have left for the summer and additional demand dynamics that can play out. In other words, we dont expect fuel prices to have reached a peak for the summer just yet.

Highlights

- Gasoline Index Decline and Inflation Trends in June: The gasoline index fell by 3.8% in June, following a 3.6% decline in May, effectively offsetting an increase in shelter costs, according to the BLS. Overall headline inflation decreased by 0.1% month-over-month and increased by 3.0% year-over-year in June, showing a deceleration from the 3.3% annual rise in May.

- OPEC Maintains Robust Oil Demand Forecast for 2024 : OPEC has maintained its strong oil demand forecast for 2024, predicting an increase of 2.25 million barrels per day driven by economic expansion and a resurgence in air travel. Yahoo Finance's Ines Ferr provides details from OPEC's report and the International Energy Agency's (IEA) contrasting outlook. While OPEC does not foresee peak oil demand this decade, BP's report predicts a peak in 2025 at 102 million barrels per day. The IEA expects 2024 demand growth to be lower than OPEC's forecast and sees peak demand by 2029 at 106 million barrels per day.

- Energy Sector Under Pressure Due to Tropical Storm Beryl: The energy sector (XLE) opened under pressure in Tuesday's trading session, driven by a decline in crude oil futures after tropical storm Beryl made landfall in Texas. Despite initial concerns, the storm caused less damage than expected, and refining operations are resuming. WTI crude remains up 5% over the past month, while Brent crude is at $85.29. BP and Exxon have lowered expectations for refiner margins, anticipating significant profit hits in the coming weeks as earnings reports are released.

Crude Oil Benchmarks