What to expect

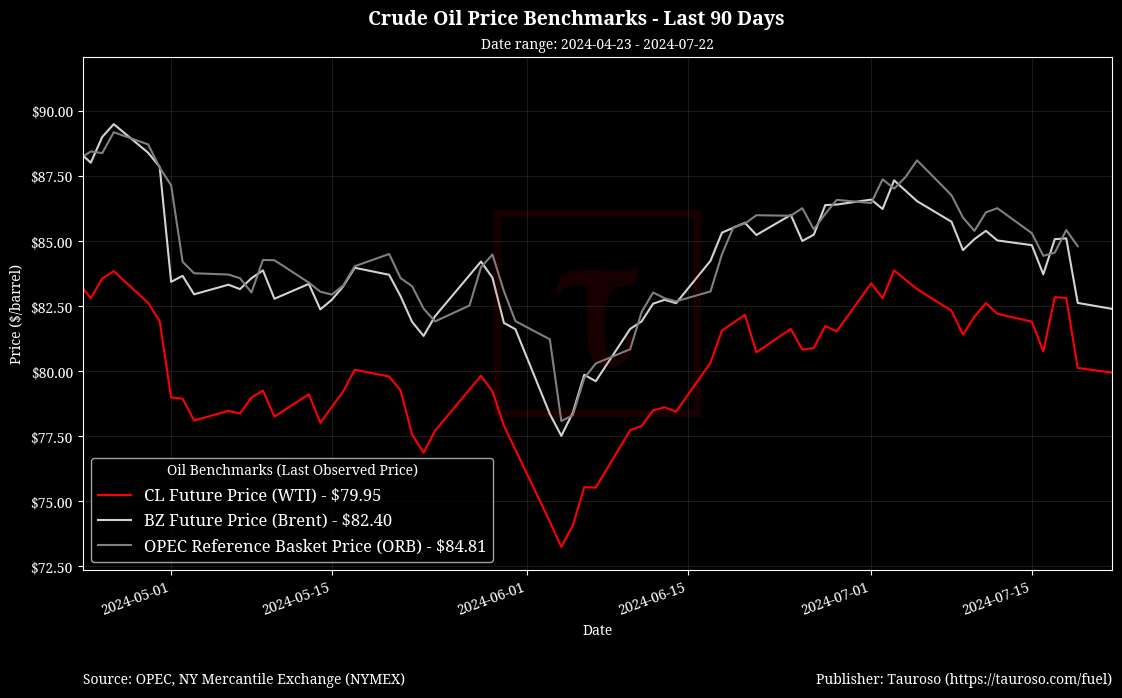

Crude oil benchmarks trade lower on a variety of factor playing into the dynamic which we discuss in the highlights below. We see these as minor impacts mostly caused by trading activity and dont represent market driven changes to our past expectations. We dont believe we have reached peak summer prices so we continue to monitor upward pricing pressure.

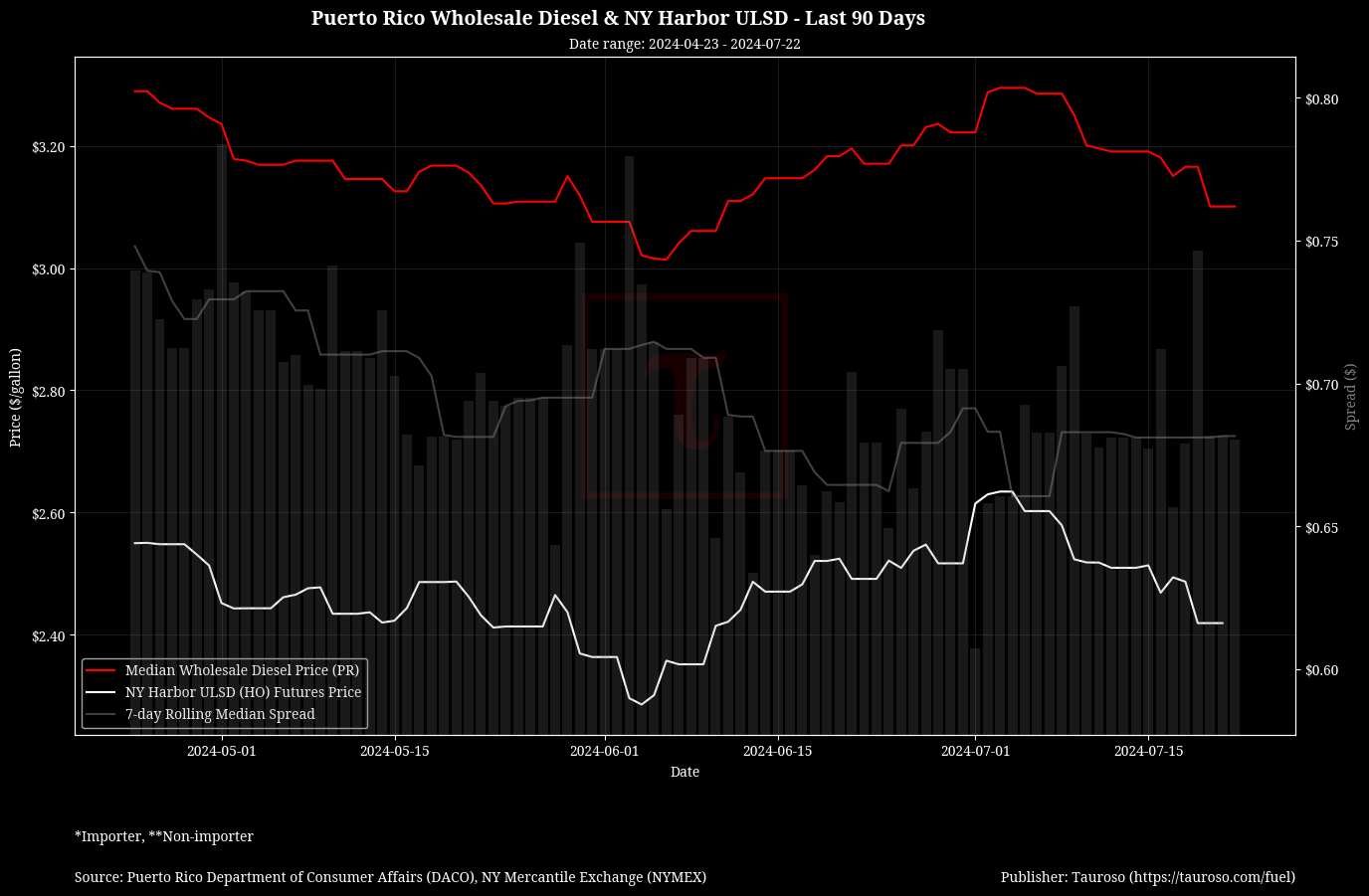

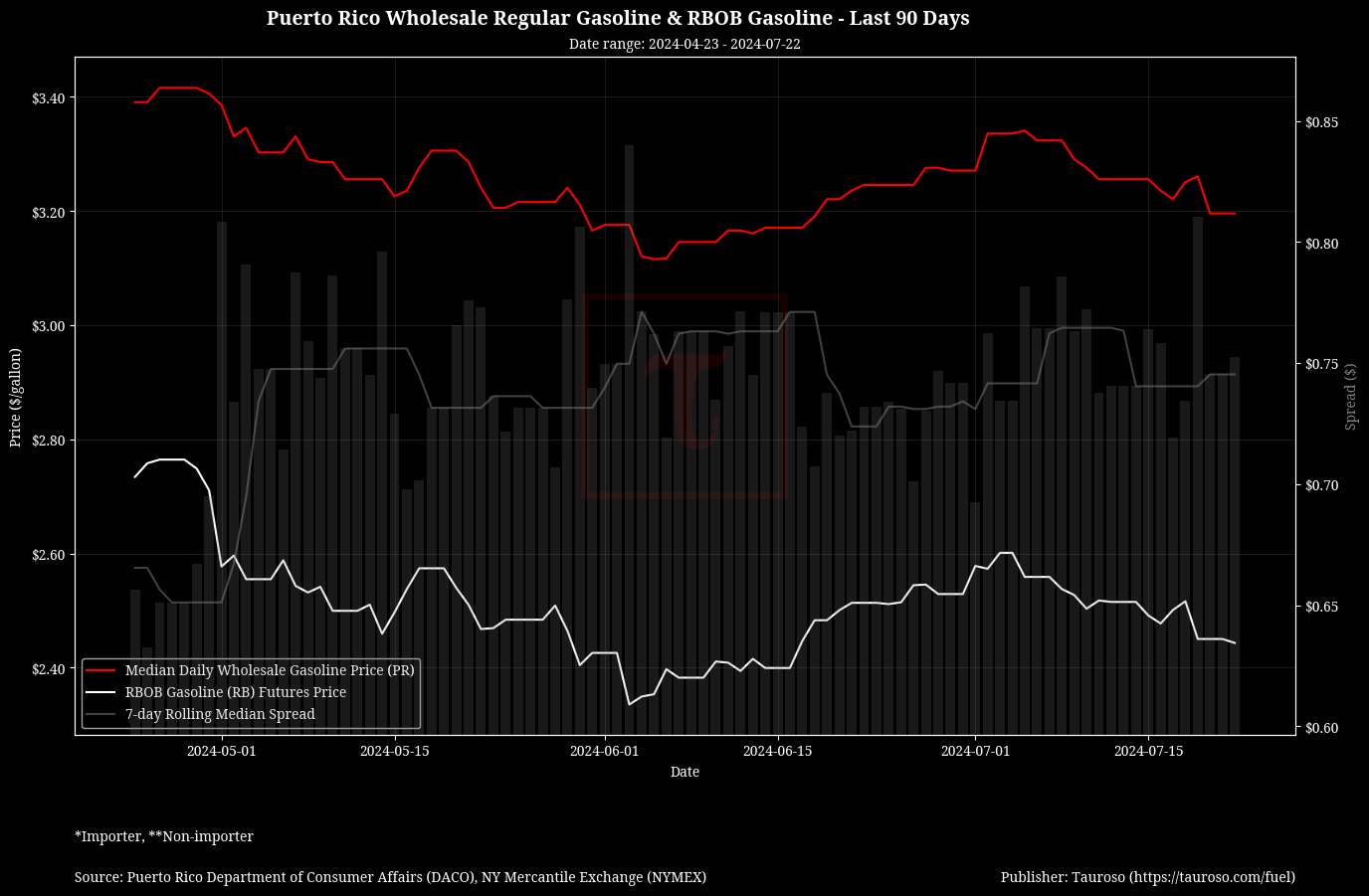

Nonetheless, the market benefits from lower crude oil prices which was reflected in local wholesale fuel prices.

Highlights

- US Stockpiles Drop: Oil prices (BZ=F, CL=F) rose on Wednesday after the US Energy Information Administration (EIA) reported a decrease in US crude oil stockpiles by 4.9 million barrels last week.

- China Growth Concerns: Oil prices fell more than 1% on Tuesday as traders reacted to disappointing economic data from China. The Chinese economy grew by 4.7% in the second quarter, missing the projected 5.1% GDP growth.

"Weaker economic data from China, along with disappinting government support programs, have led to reduced fuel demand and refinery cutbacks." - Dennis Kissler, senior vice president at BOK Financial

Crude Oil Benchmarks

References

- https://finance.yahoo.com/quote/CL%3DF

- https://finance.yahoo.com/quote/RB=F/

- https://finance.yahoo.com/news/oil-prices-fall-as-traders-assess-china-growth-worries-153829466.html

- https://finance.yahoo.com/video/2-reasons-why-oil-remain-160816063.html

- https://finance.yahoo.com/video/oil-gains-drop-us-crude-210455640.html