What to expect

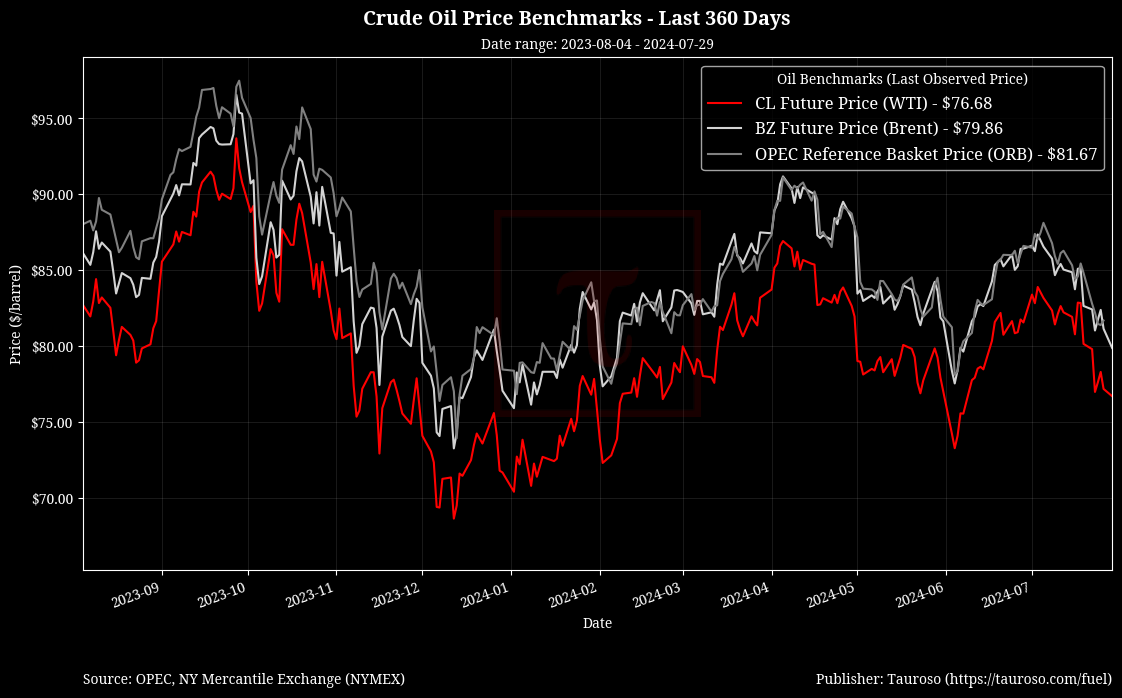

Crude oil benchmarks have been sliding down for the last couple of week, where US WTI currently marking at around $76 per barrel. We are finding two contributing factors impacting crude oil and wholesale fuel prices. First, US summer driving demand is less than expected causing an oversupply of fuel leading to the current downward pressure reflected in lower fuel prices. Secondly, we perceive reduced geopolitical risks causing bechmarks to slide lower over the past weeks.

We dont expect much activity this week apart from upcoming July closing numbers that could potentially drive short term market activity.

Highlights

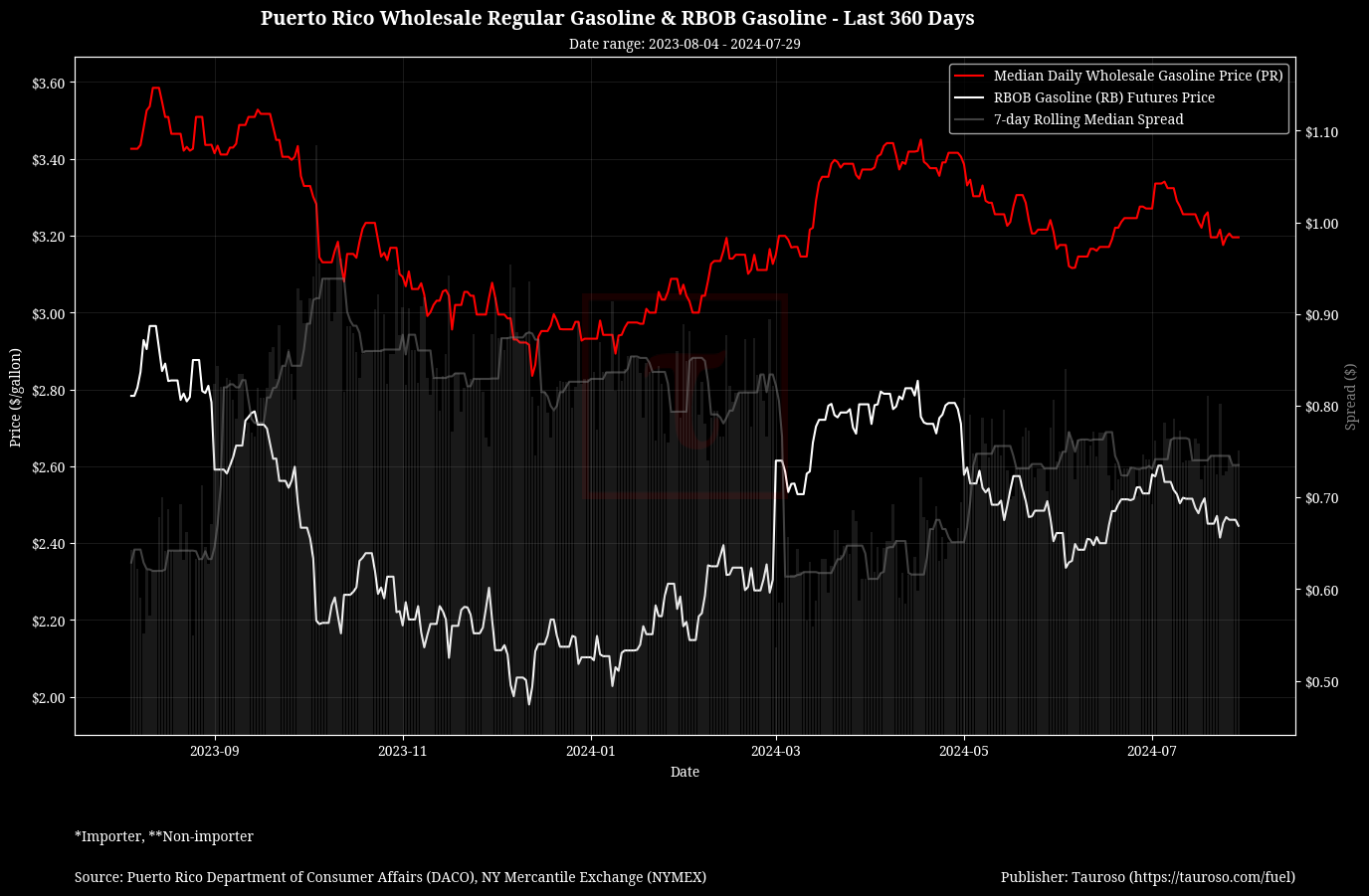

- Gasoline demand lower then expected: Gasoline demand declined during the week ending July 23, as reported by the Energy Information Administration. The reduction in driving activity following the July 4 travel period, along with Hurricane Beryl disrupting exports, contributed to an increase in supply.

- Hedge funds slash bets at gasoline demand underwhelm: Hedge funds are experiencing a level of disappointment in gasoline demand not seen since the height of the pandemic, leading speculators to significantly reduce their net-bullish bets during the underwhelming US summer driving season. In the week ending July 23, money managers' net-long position in gasoline futures dropped by 9,001 lots to 22,158, according to the Commodity Futures Trading Commission. This marks the lowest level in four years, defying the usual seasonal increase in gasoline demand during the summer travel period. Additionally, these funds now hold their largest short-only position in approximately seven years.

- Elections weigh on energy prices: Neal Dingmann, Truist Securities energy research managing director, discussed oil price movements, predicting prices to stay around $80 for the rest of the year. He attributed the recent selloff to reduced geopolitical risk. Looking towards the presidential election in November, Dingmann suggested that if former President Trump takes office, energy restrictions would likely decrease, potentially stabilizing prices. Conversely, if Kamala Harris is elected and Democrats maintain energy restrictions, production might drop, causing prices to rise above $90 per barrel.

Crude Oil Benchmarks

References

- https://finance.yahoo.com/quote/CL%3DF

- https://finance.yahoo.com/quote/RB=F/

- https://finance.yahoo.com/news/hedge-funds-send-bullish-gasoline-202903510.html

- https://finance.yahoo.com/video/us-election-restrictions-could-drive-144829808.html

- https://finance.yahoo.com/news/trump-wants-to-bring-down-energy-prices--why-thats-not-easy-172143525.html