What to expect

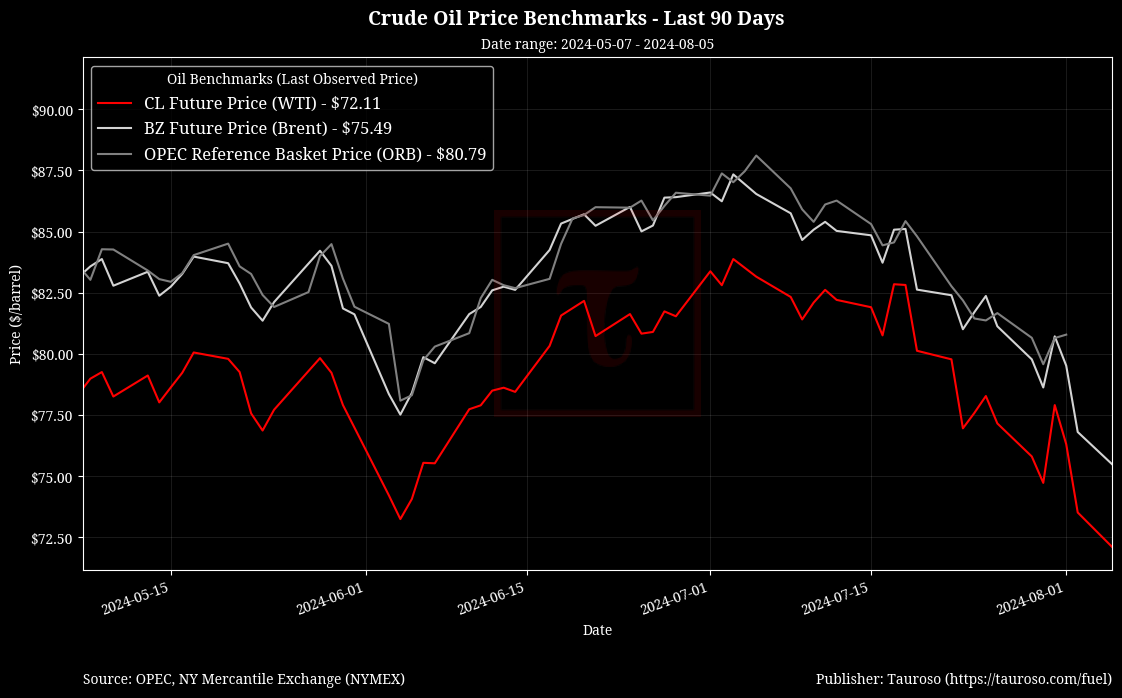

Crude oil benchmarks have seen a marked downtrend over the past weeks. US WTI closed last week at $73 per barrel and currently trades at $72 per barrel, down from a high of $83 per barrel during early July. As a suprising outcome during peak summer season, market demand has been lower than expected.

Some events could impact crude oil supply and demand dynamics such as tensions in the middle east and interest rate acitvity for next month. We remain vigilant to market events but for now we expect generally a steady week ahead.

Highlights

- Possible rate cuts in September: The Federal Reserve has decided to maintain current interest rates for July, acknowledging changes in the labor market. The Federal Reserve's next meeting is set for September 18, and Chair Jerome Powell indicated that officials will carefully assess upcoming economic data to determine whether to initiate a rate cut.

"If we do get the data that we hope, then a reduction in our policy rate could be on the table at the September meeting." - Jerome H. Powell, the Fed chair

- Middle east on edge: Amid heightened tensions in the Middle East, oil prices initially spiked due to fears of a broader conflict following the assassination of Hamas leader Ismail Haniyeh in Iran and the killing of Hezbollah's top military commander in Beirut. Despite these events, the market later refocused on global demand and noted no significant disruptions to oil supplies. Analysts remain cautious about potential impacts on oil shipping lanes, particularly with recent attacks by Iran-aligned Houthi militants in the Red Sea. The situation underscores the geopolitical risks influencing oil markets.

"Instead of de-escalation being the primary MO [modus operandi] of all the players analysts believe escalation is going to be the bigger factor now and de-escalation has got a kind of a lower odds of happening, at least in the near term." -Vikas Dwivedi, Macquarie global energy strategist

- Canadian crude oil imports: Canada's crude oil exports have become crucial to U.S. refineries, now constituting 60% of U.S. crude imports, up from 33% in 2013. Canadian crude production reached 4.6 million barrels per day in 2023, significantly surpassing its domestic refining capacity. The U.S. Midwest and Rockies regions benefit from proximity and pipeline connections to Canadian oil, with increased pipeline capacity aiding exports. However, the heavy nature of Western Canadian Select crude and limited access to global markets keep its prices below the U.S. benchmark West Texas Intermediate.

Crude Oil Benchmarks

References

- https://finance.yahoo.com/quote/CL%3DF

- https://finance.yahoo.com/quote/RB=F/

- https://www.eia.gov/todayinenergy/detail.php?id=62664

- https://finance.yahoo.com/video/fed-rate-decision-september-rate-215159203.html

- https://www.msn.com/en-us/money/markets/oil-slips-over-1-as-supply-intact-despite-middle-east-conflict-fears/ar-BB1r2LgQ

- https://finance.yahoo.com/video/crude-oil-prices-pop-assassination-145727507.html

- https://www.nytimes.com/2024/07/31/business/economy/fed-meeting-interest-rates.html