What to expect

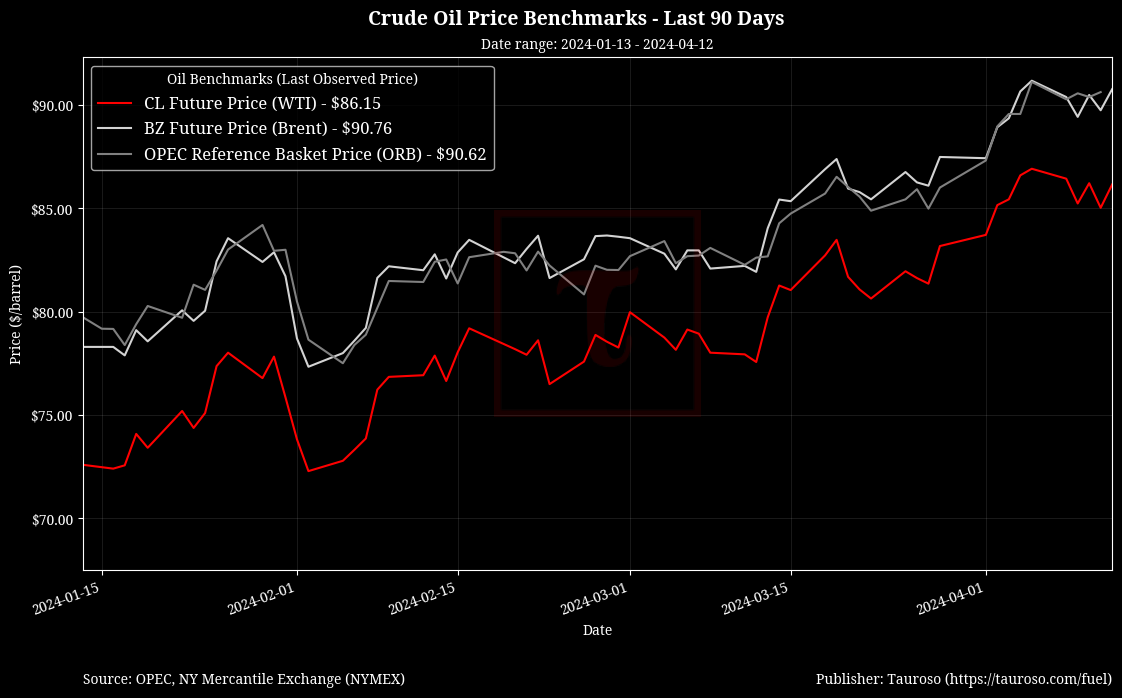

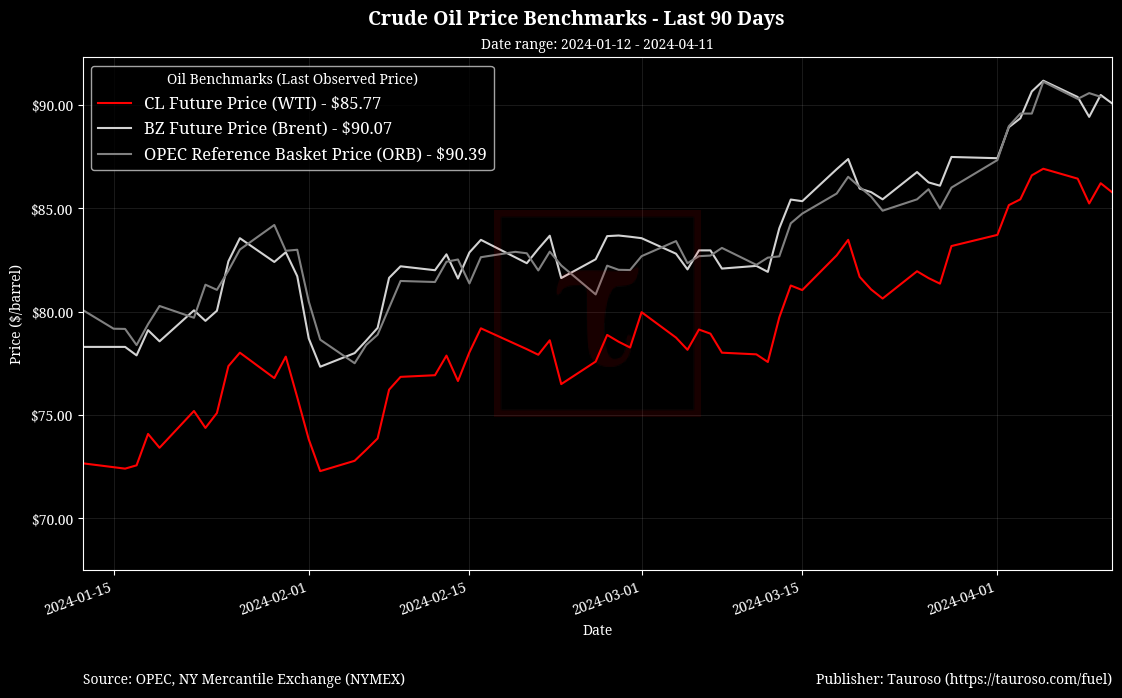

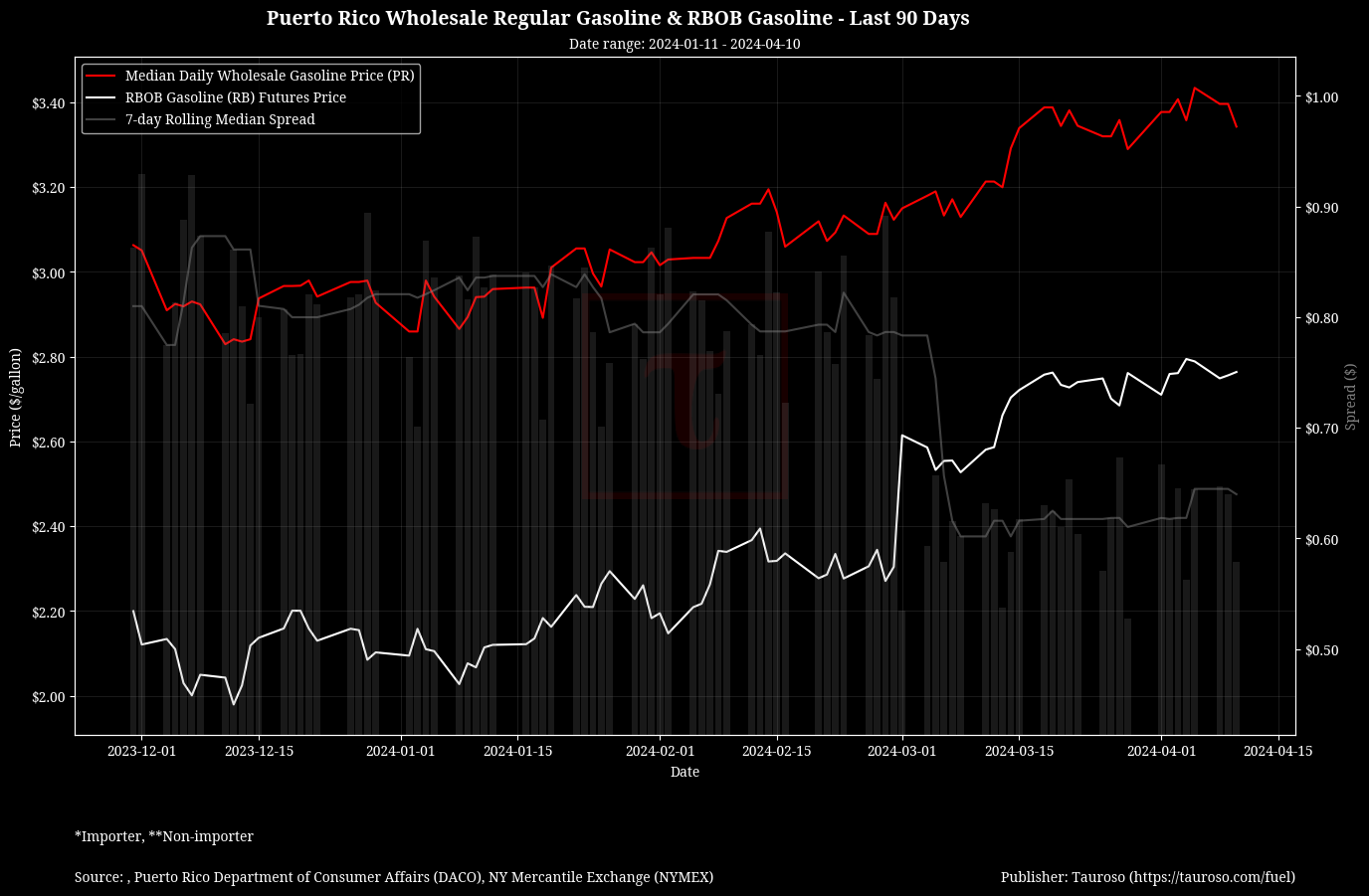

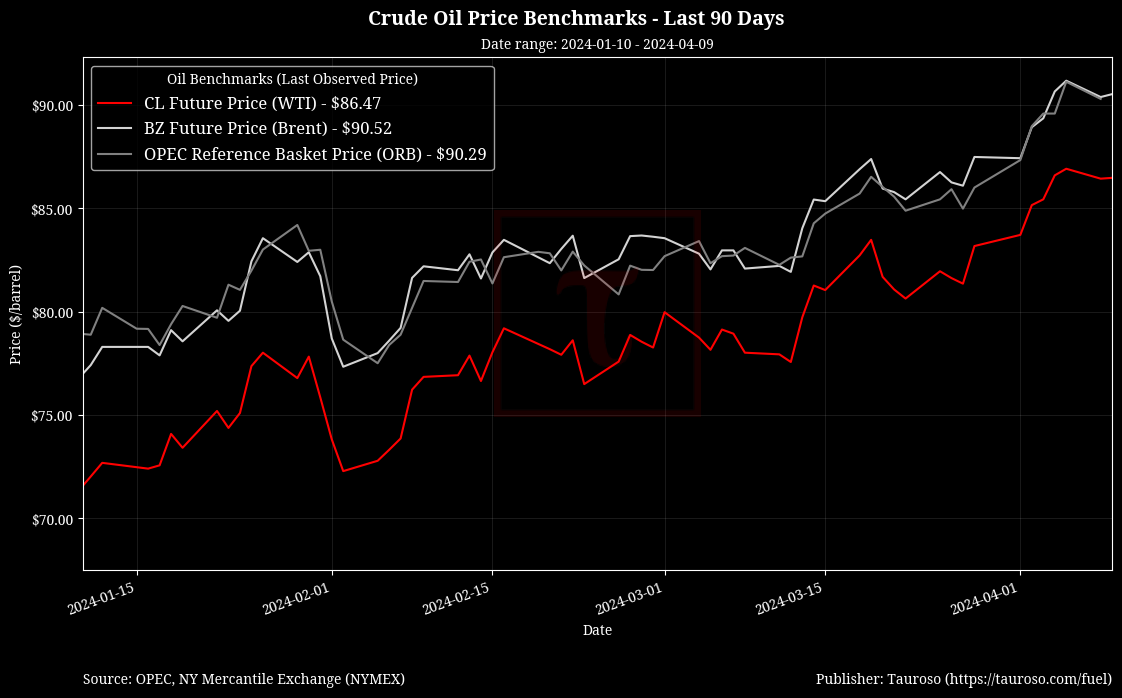

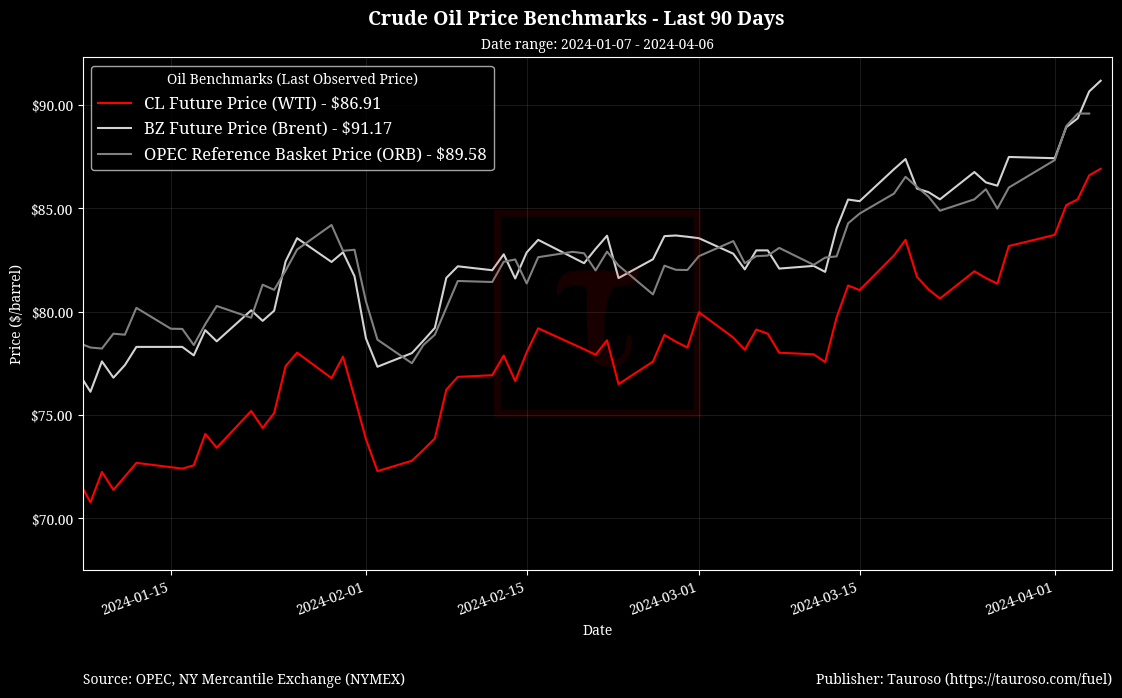

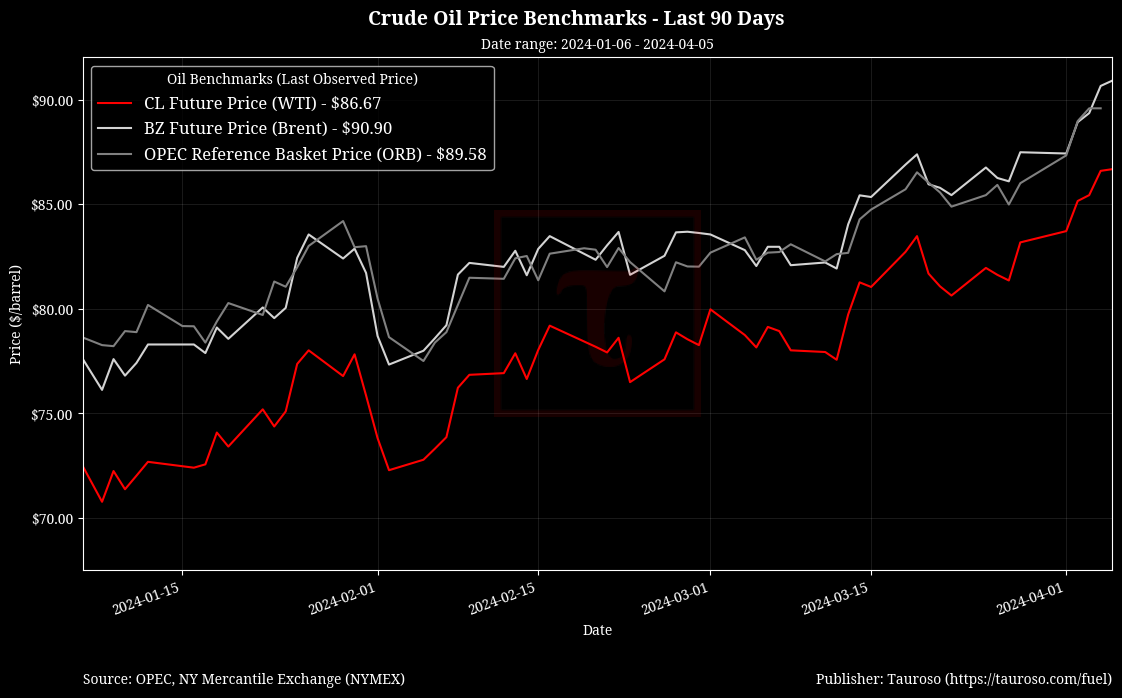

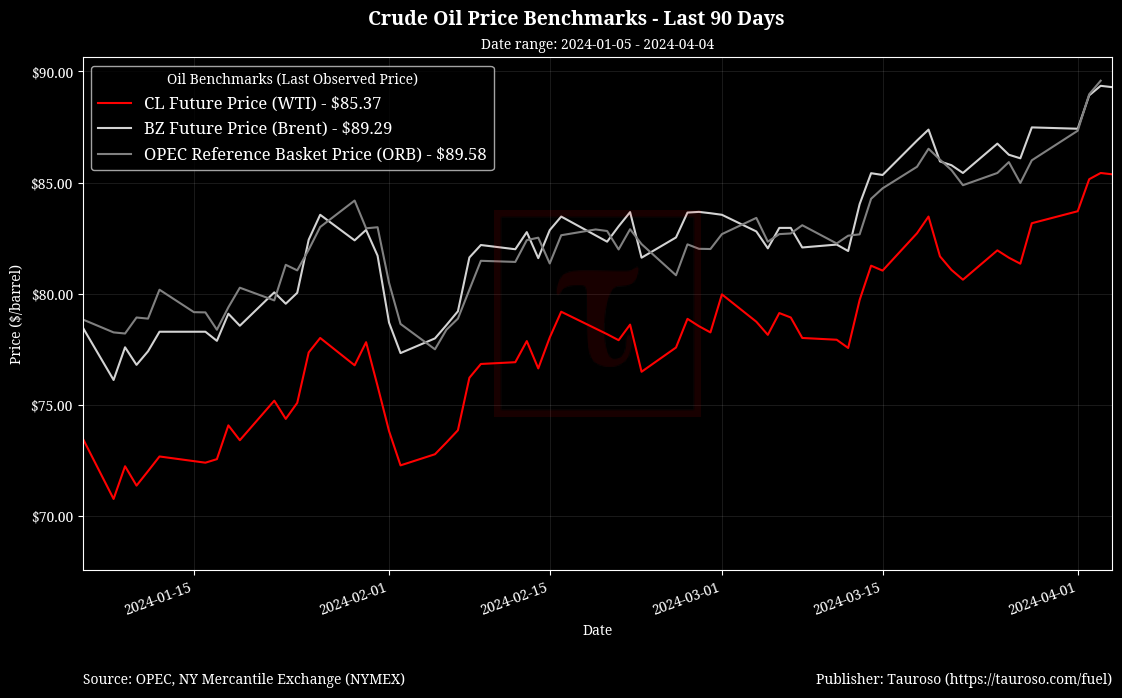

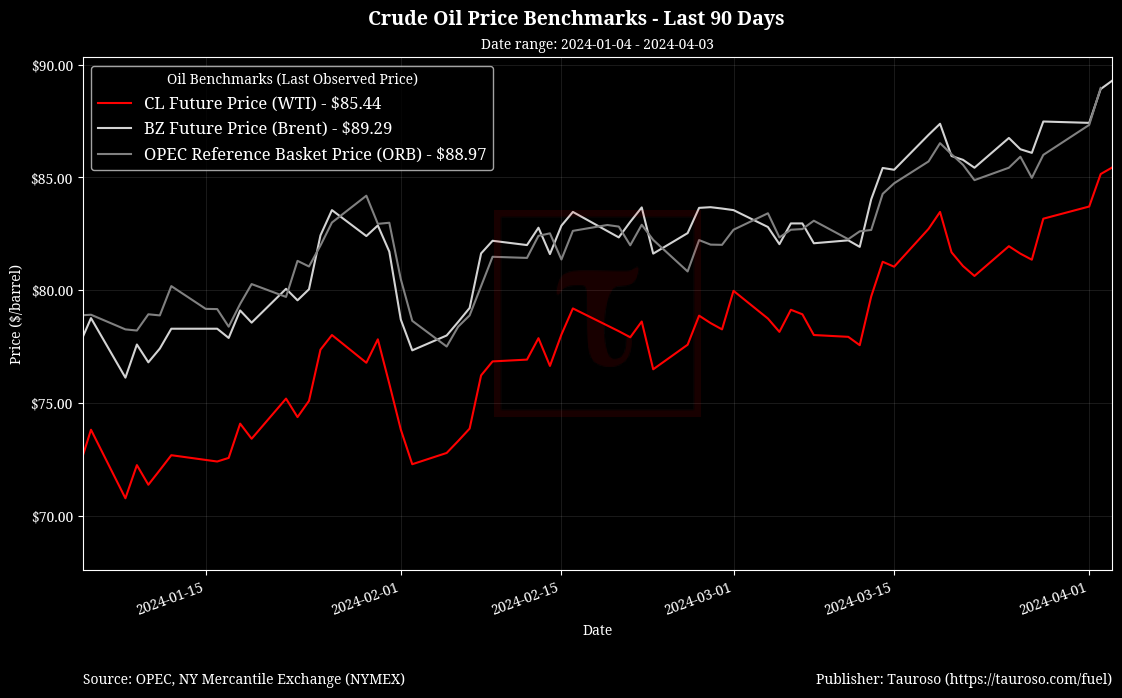

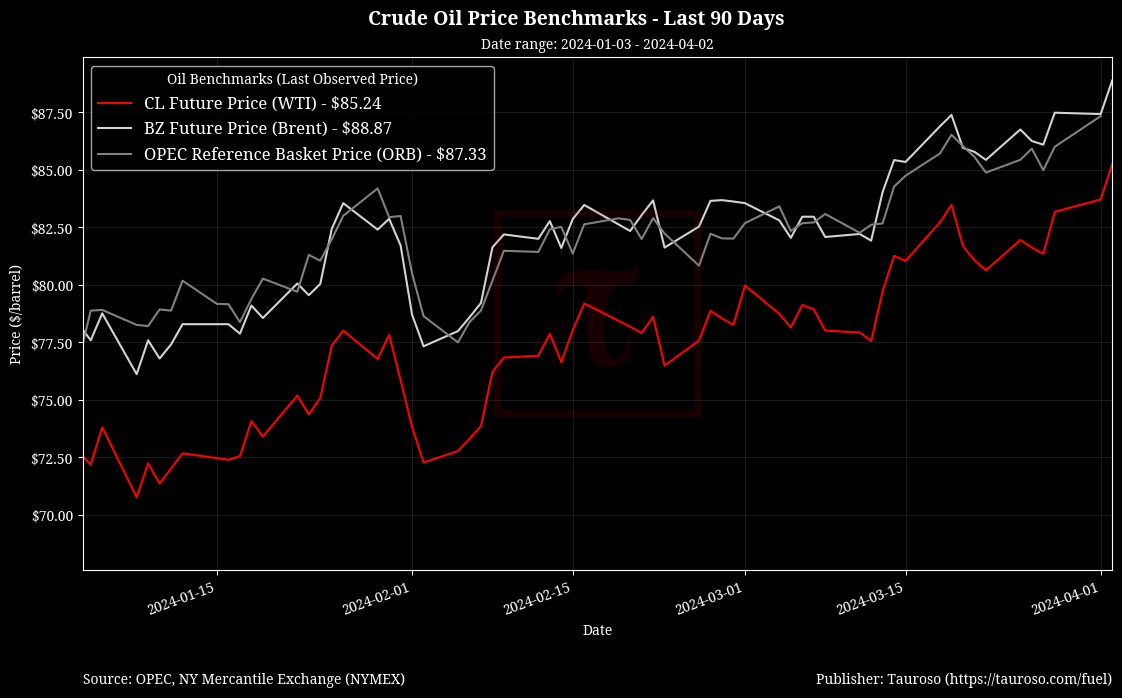

Largely driven by escalations in the Middle East, crude oil has risen to its highest level seen during the current year. US WTI (CL=F) currently hovers around $86 per barrel, while Brent (BZ=F) reached $90 per barrel. Should tensions remain and all else in the market remain equal, we could see

crude oil prices continue to rise.

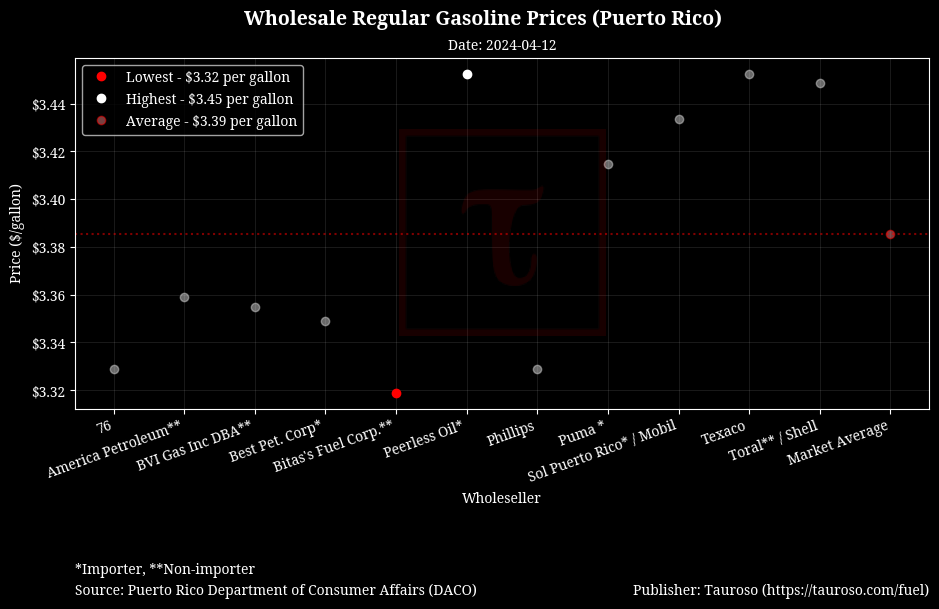

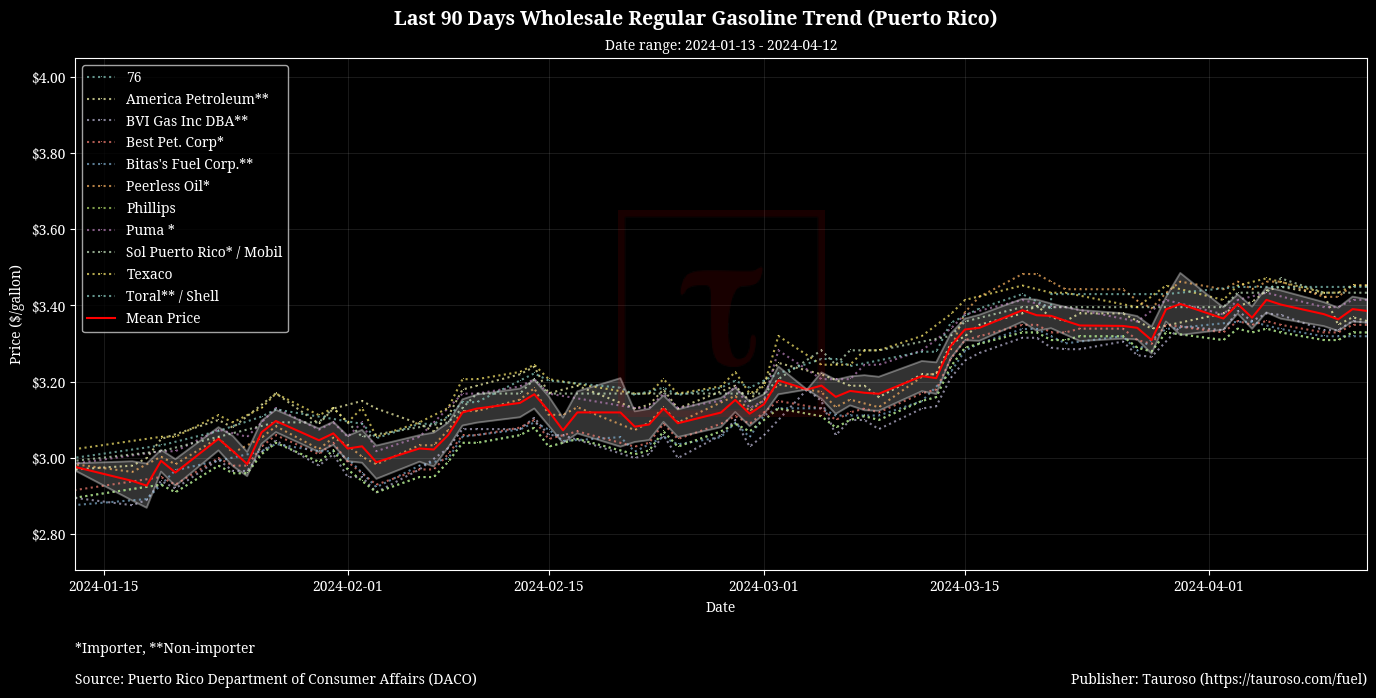

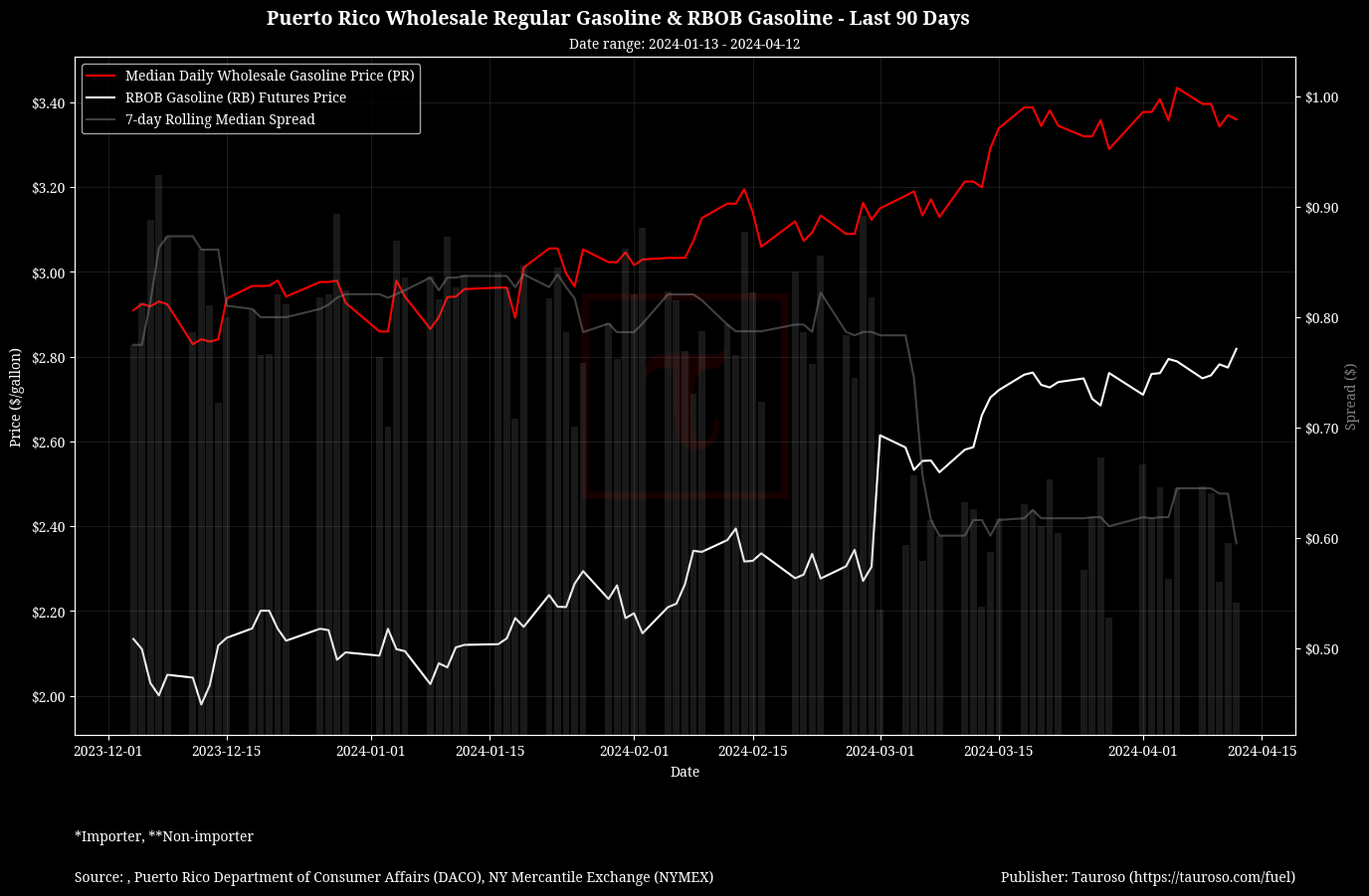

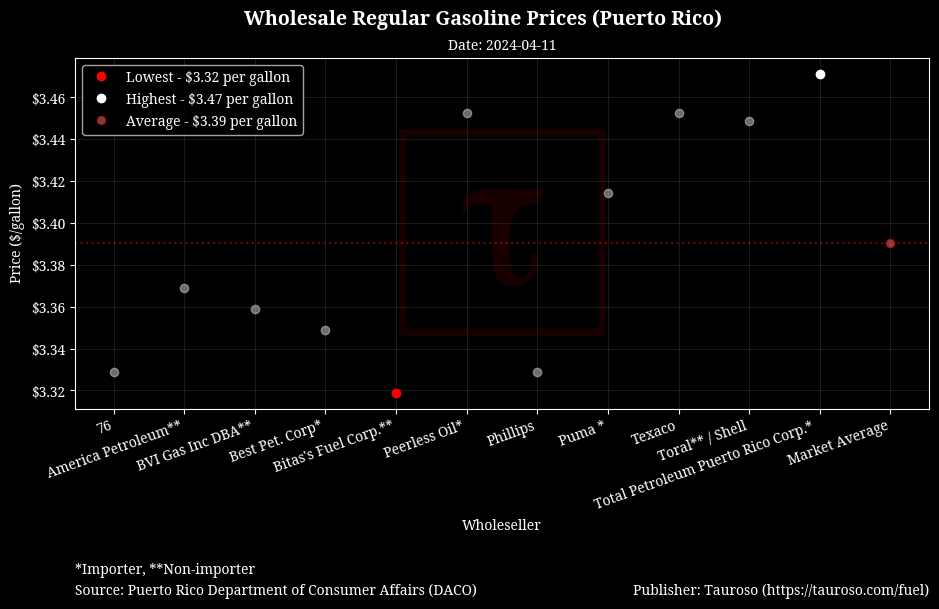

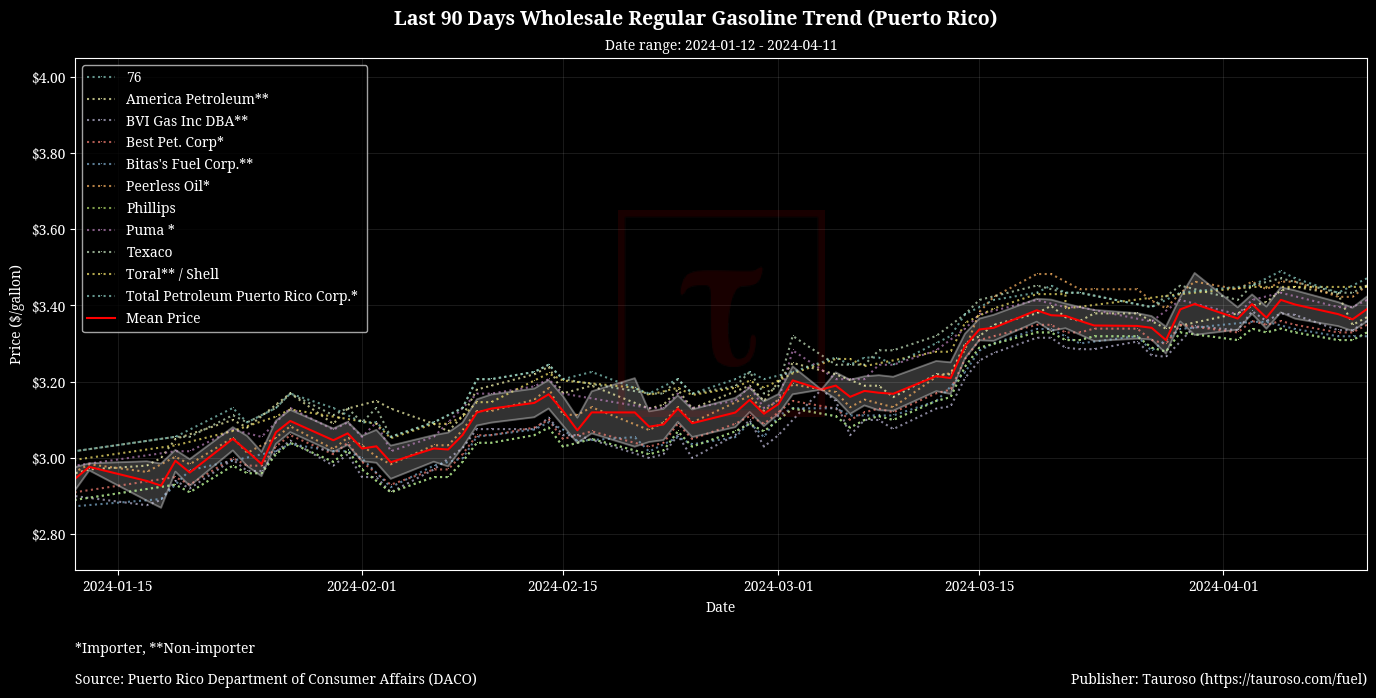

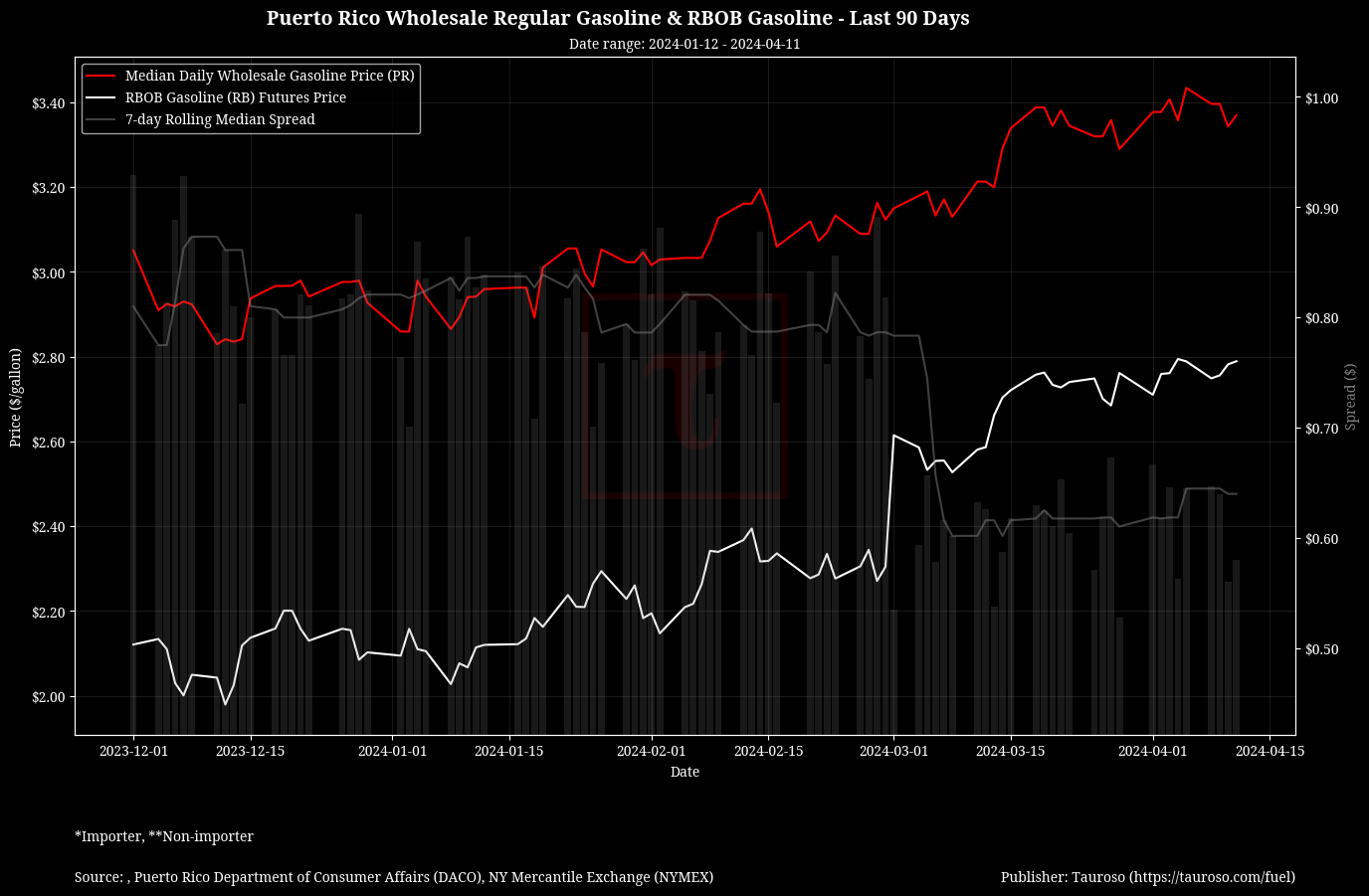

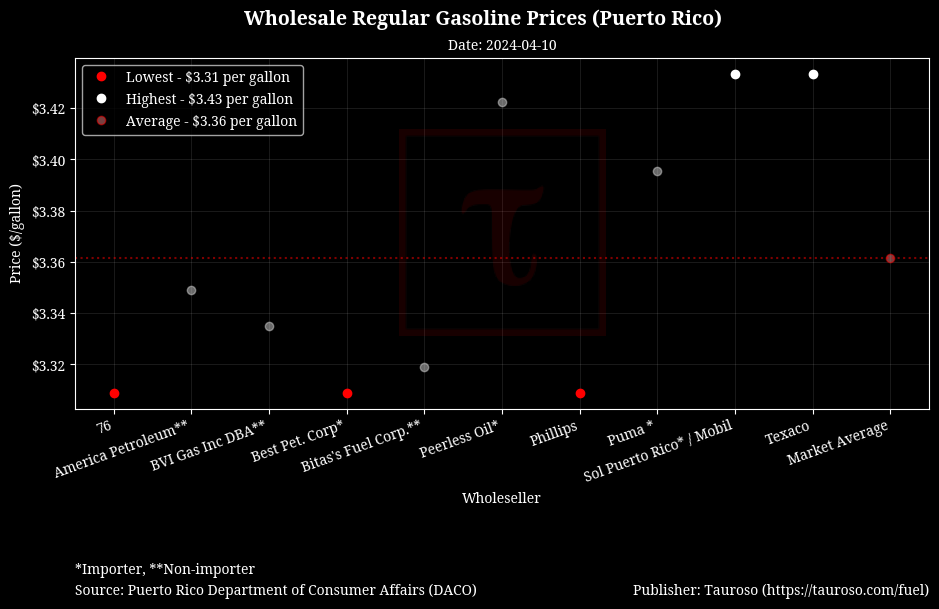

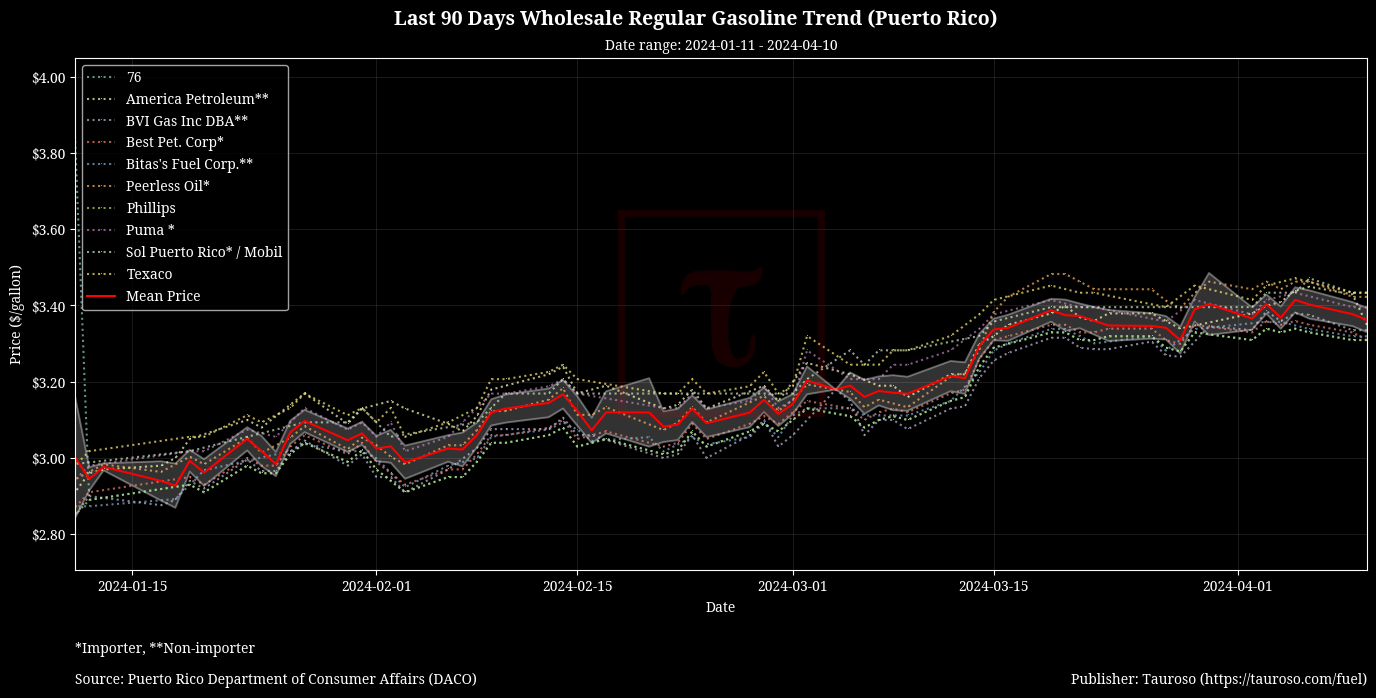

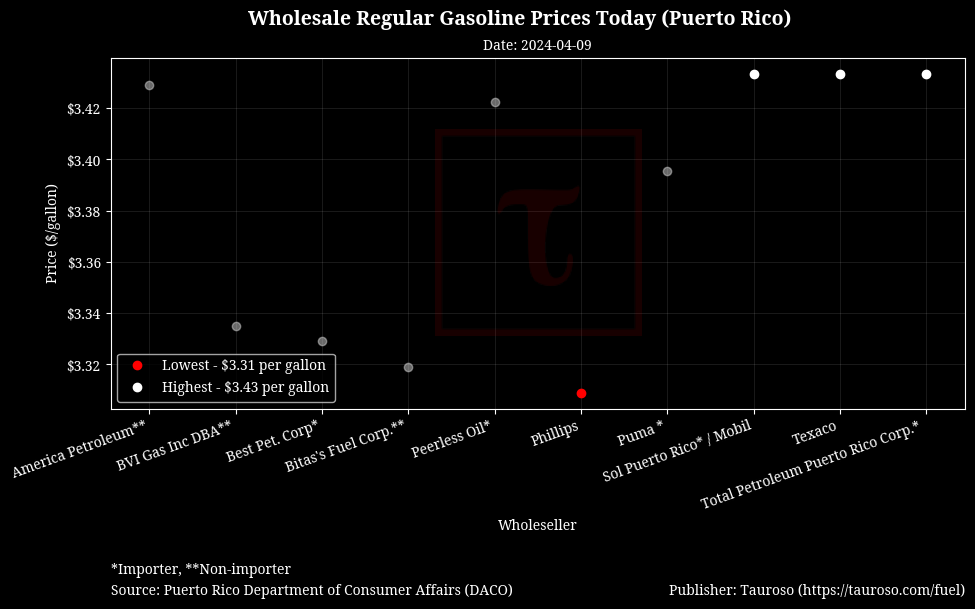

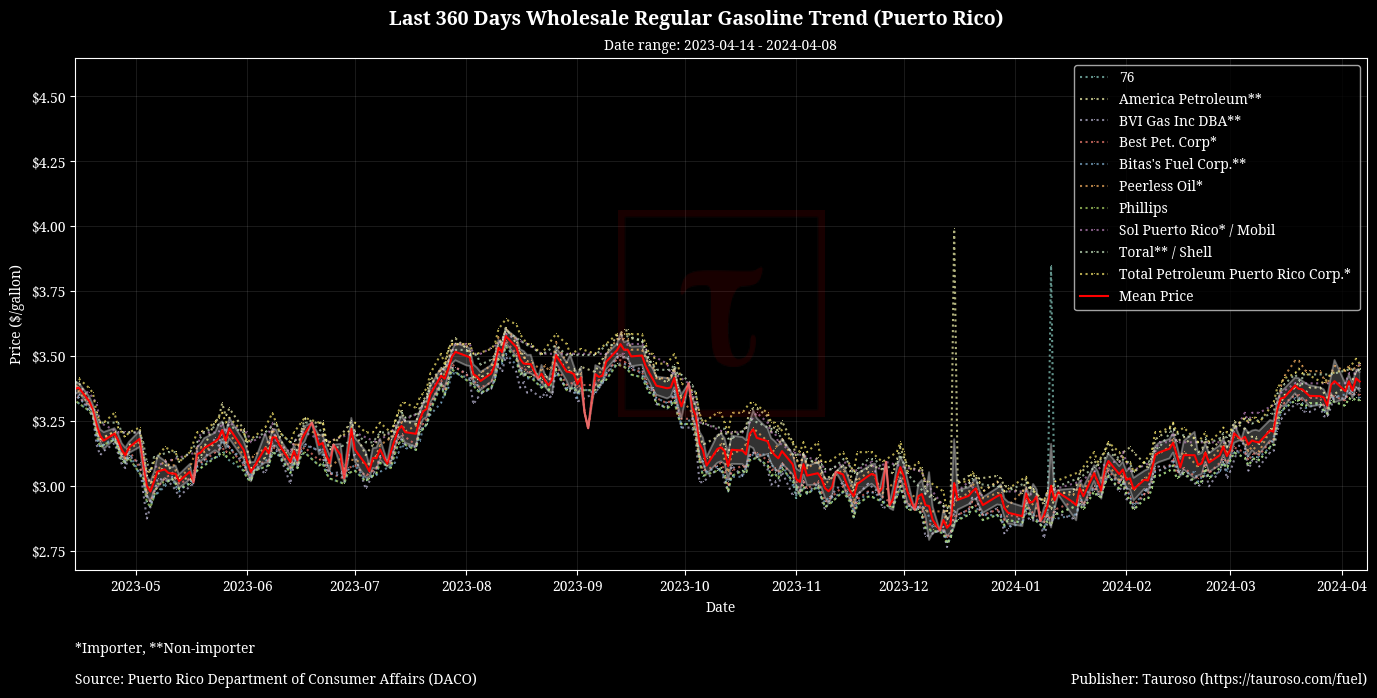

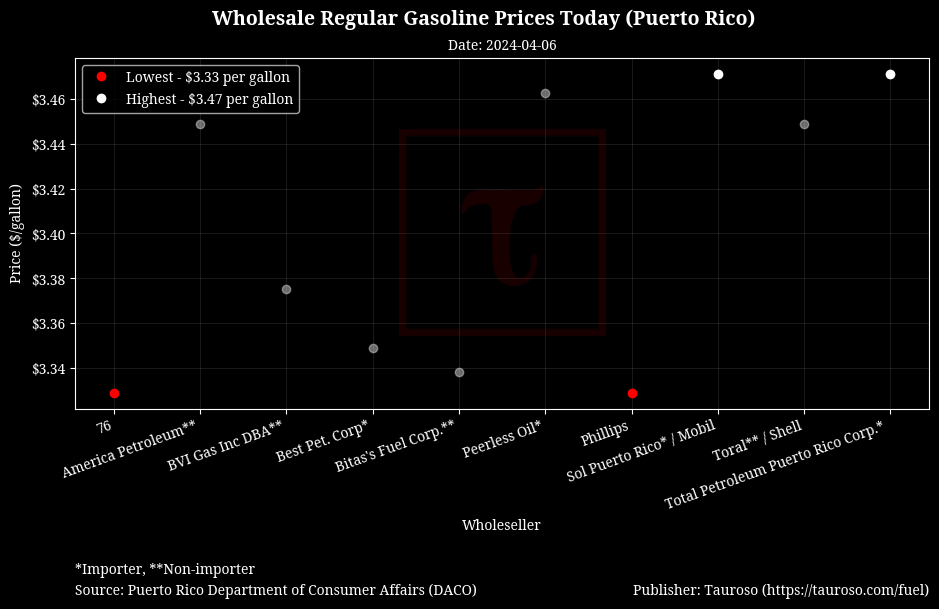

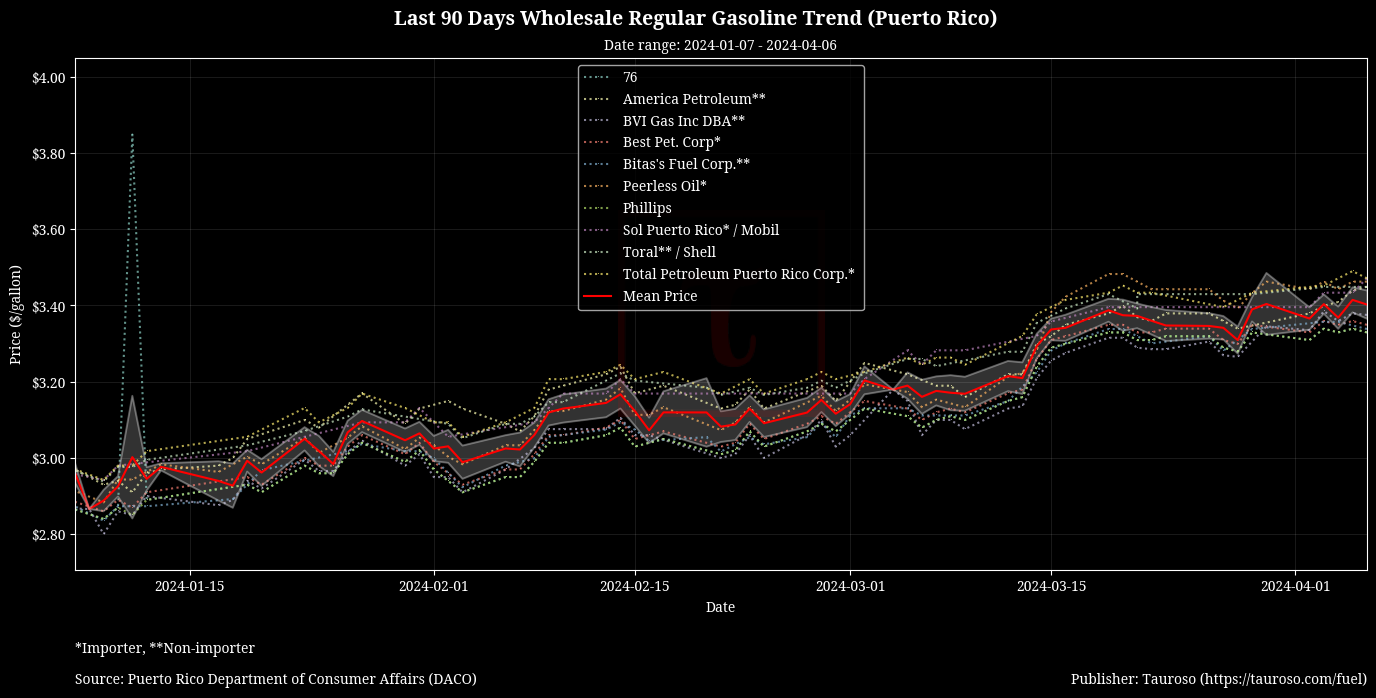

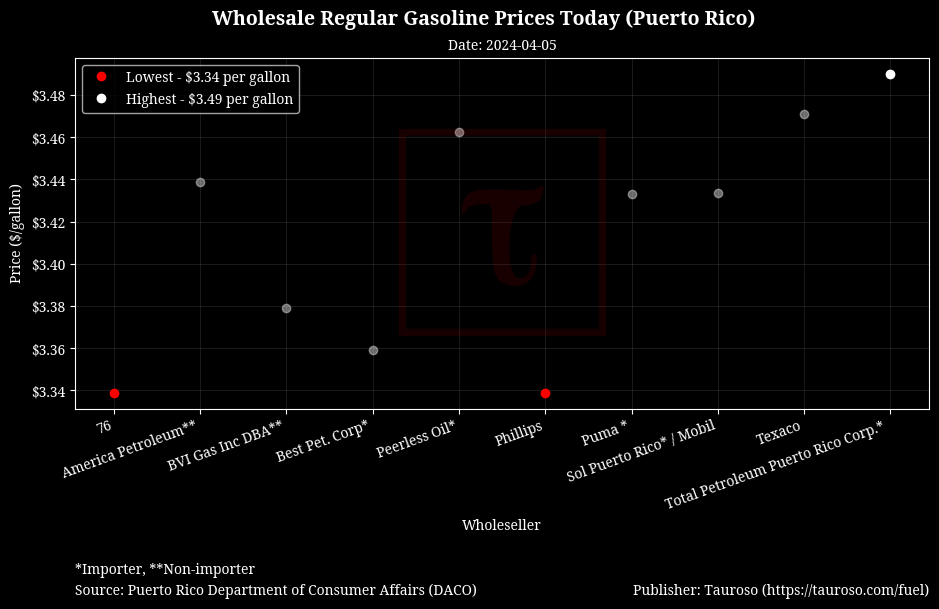

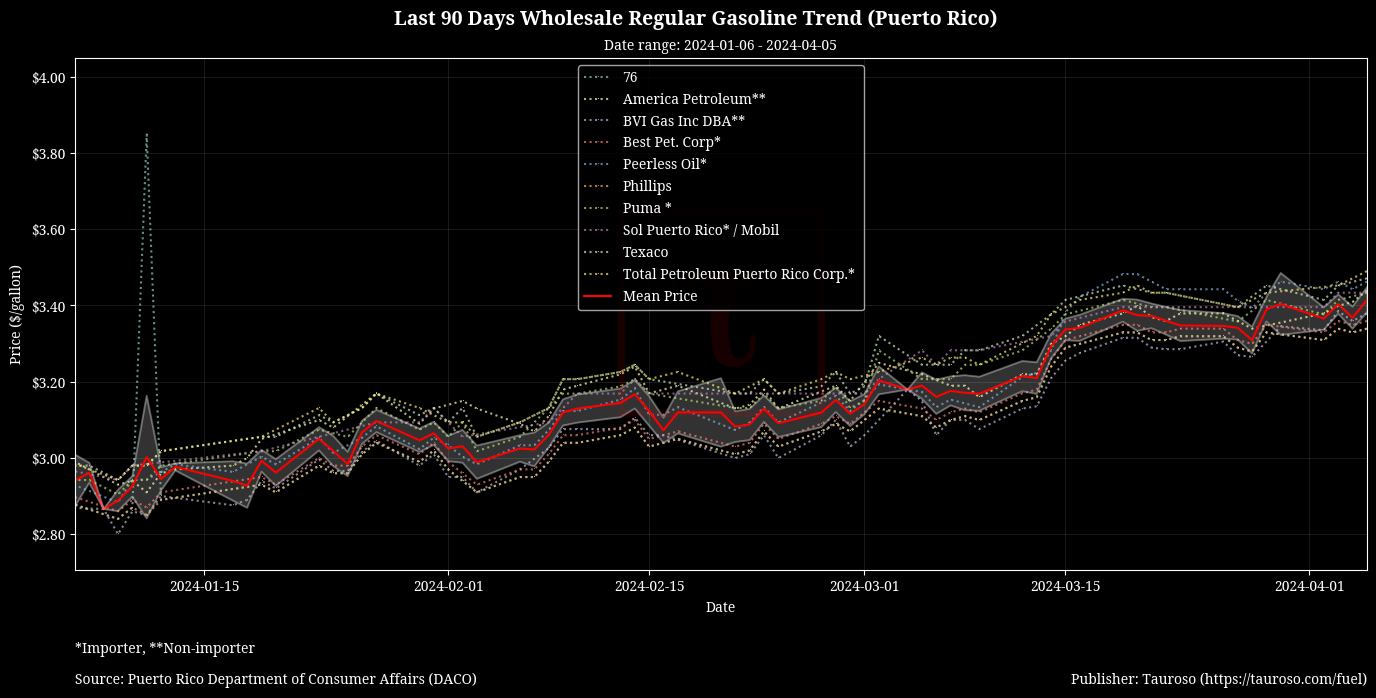

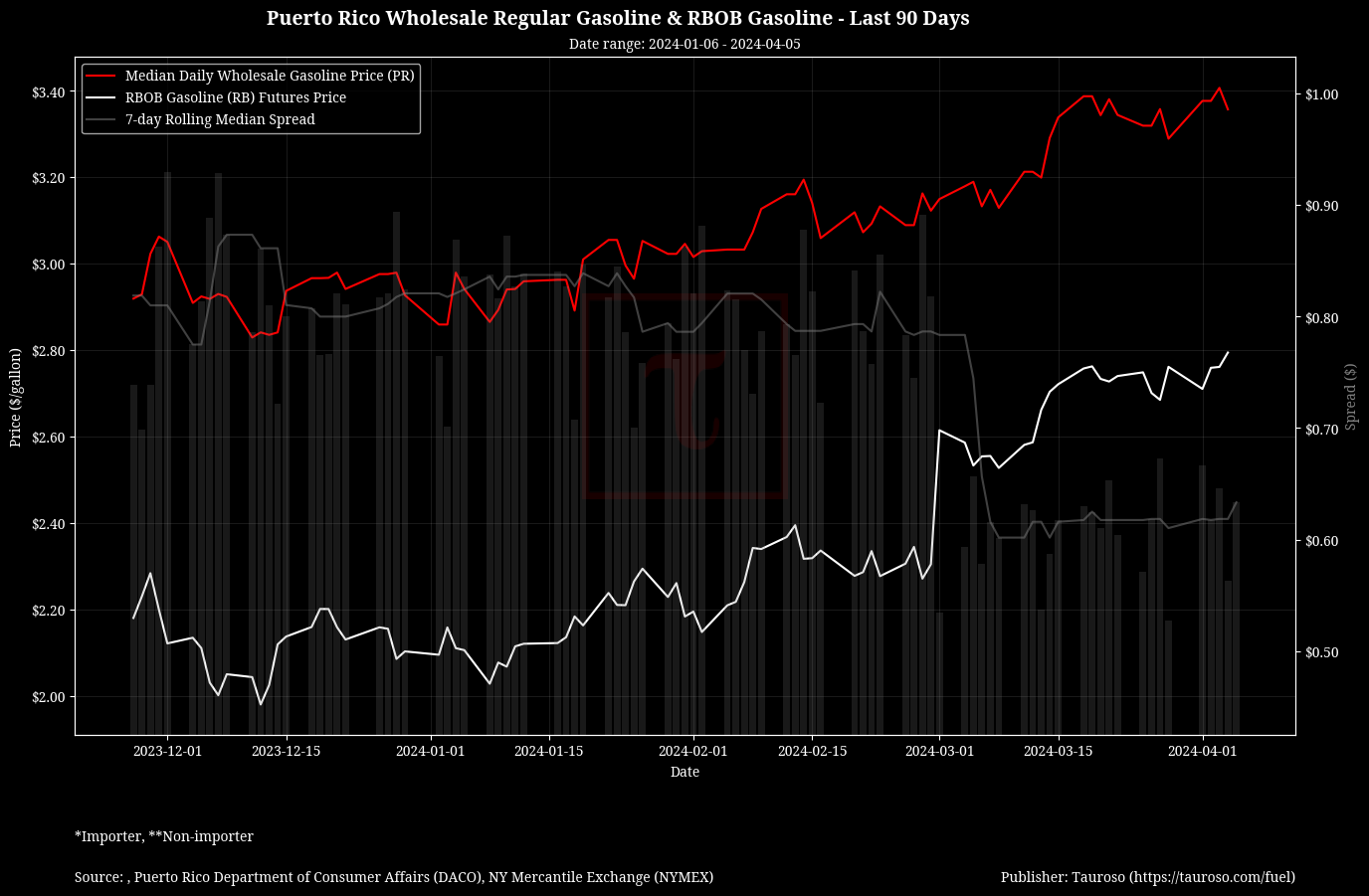

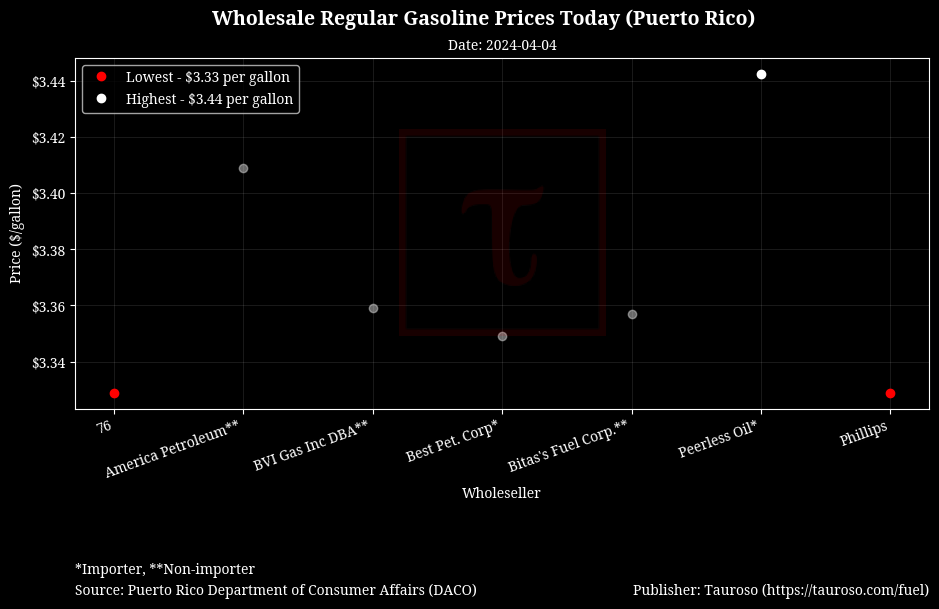

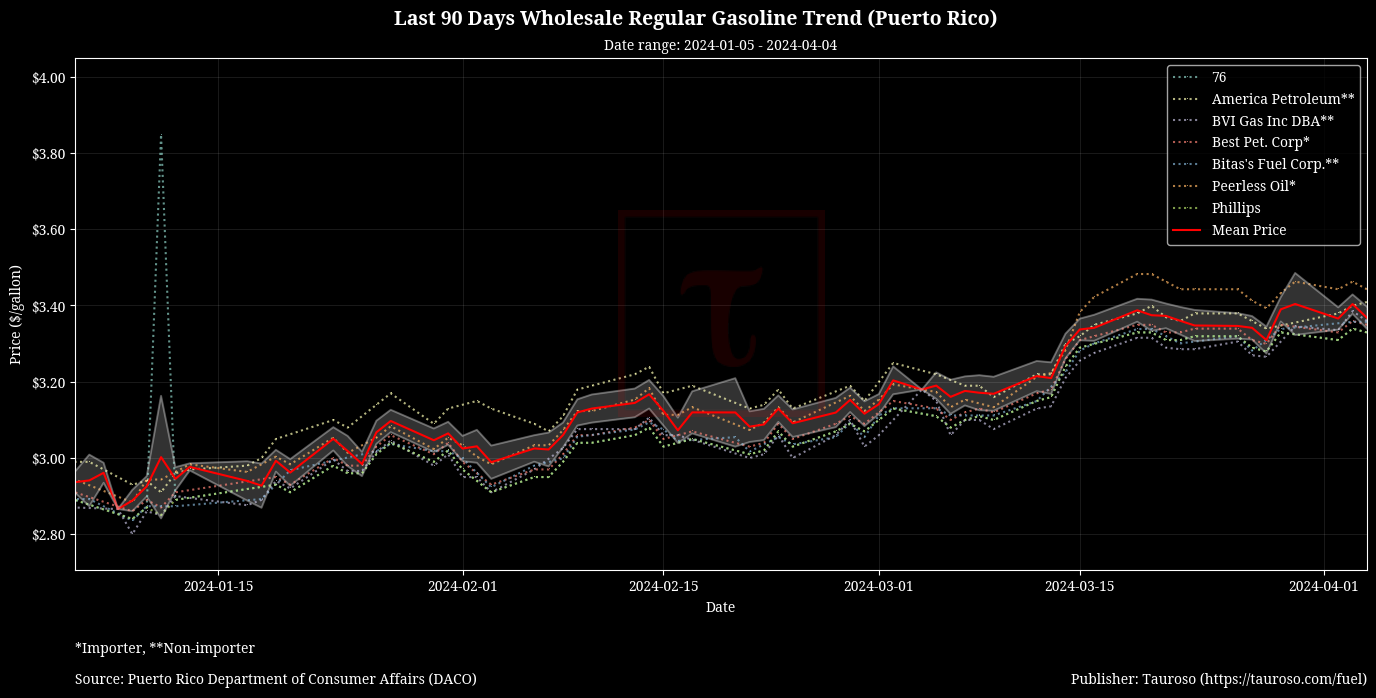

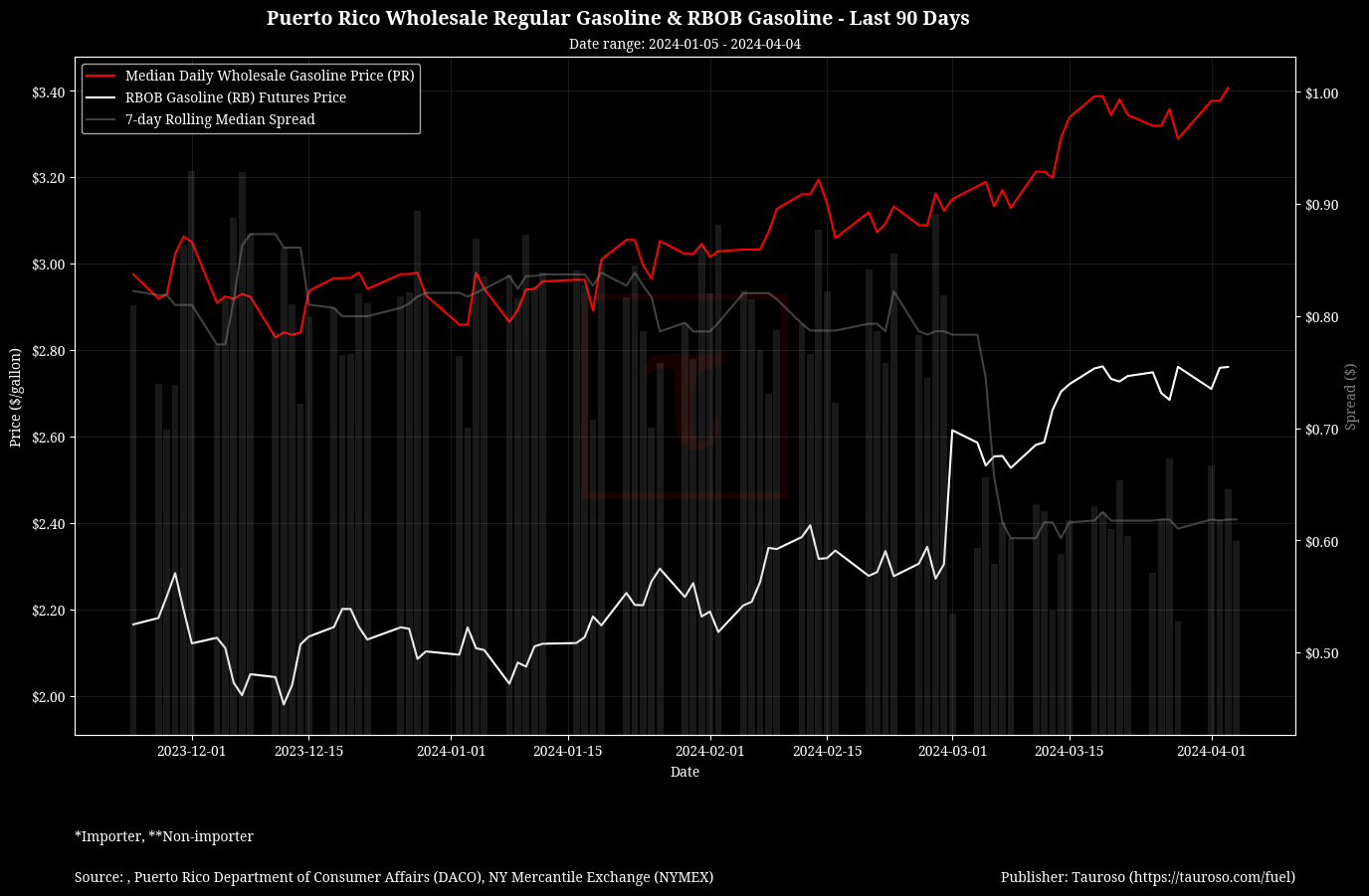

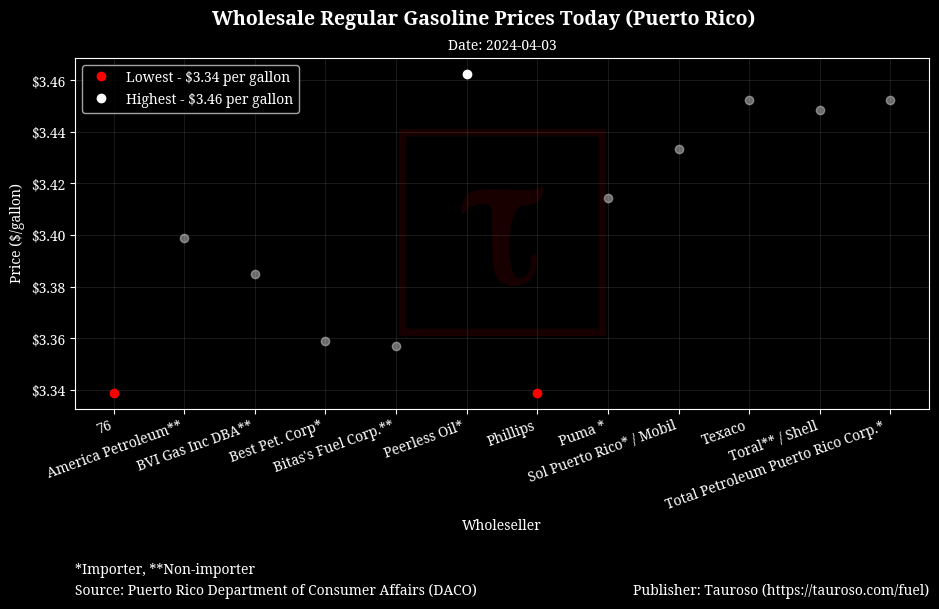

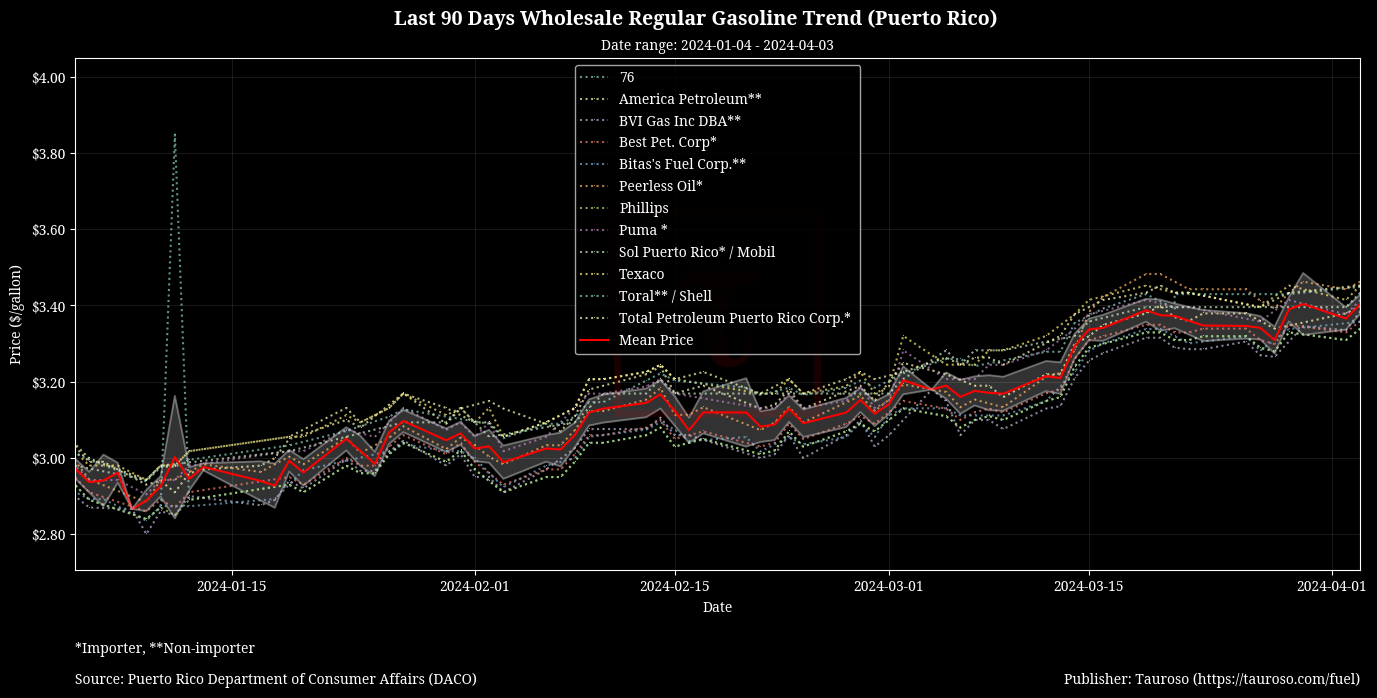

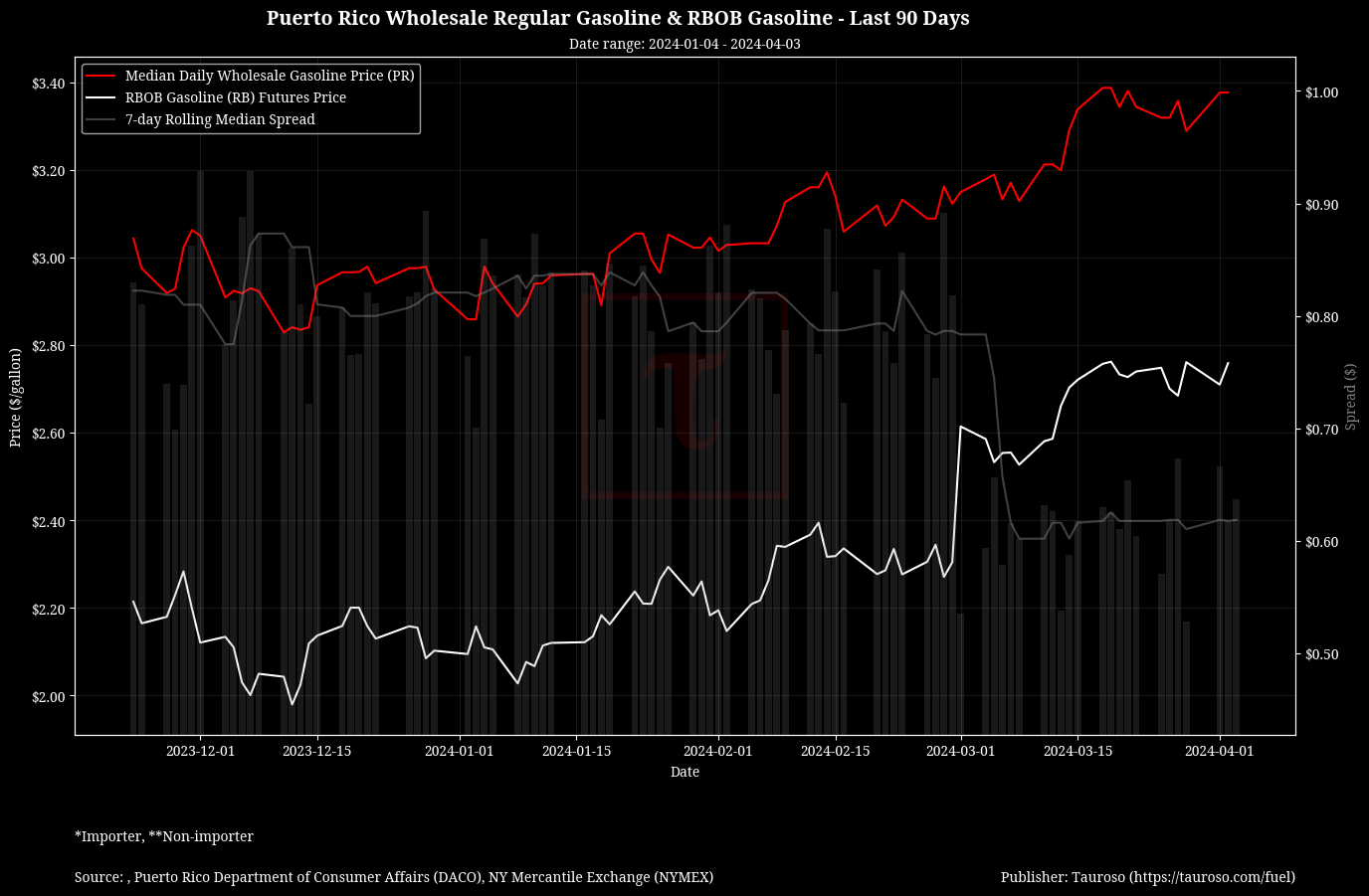

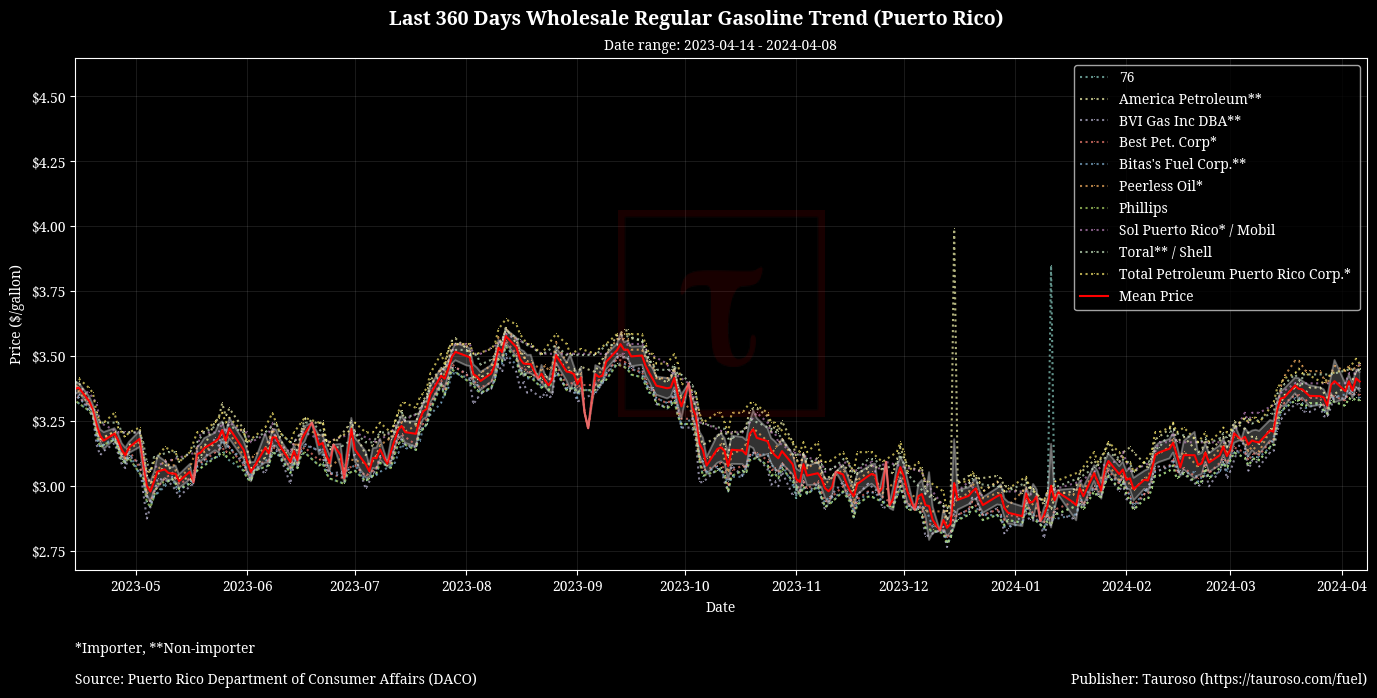

We continue to expect higher wholesale gasoline prices given summer month demand in the US. Expectations are for wholesale regular gasoline to reach up to $3.50 per gallon.

"We're getting into summer driving season. We expect gasoline demand to continue to grow. That will drive prices up in the short term," Regina Mayor, KPMG global head of clients and markets

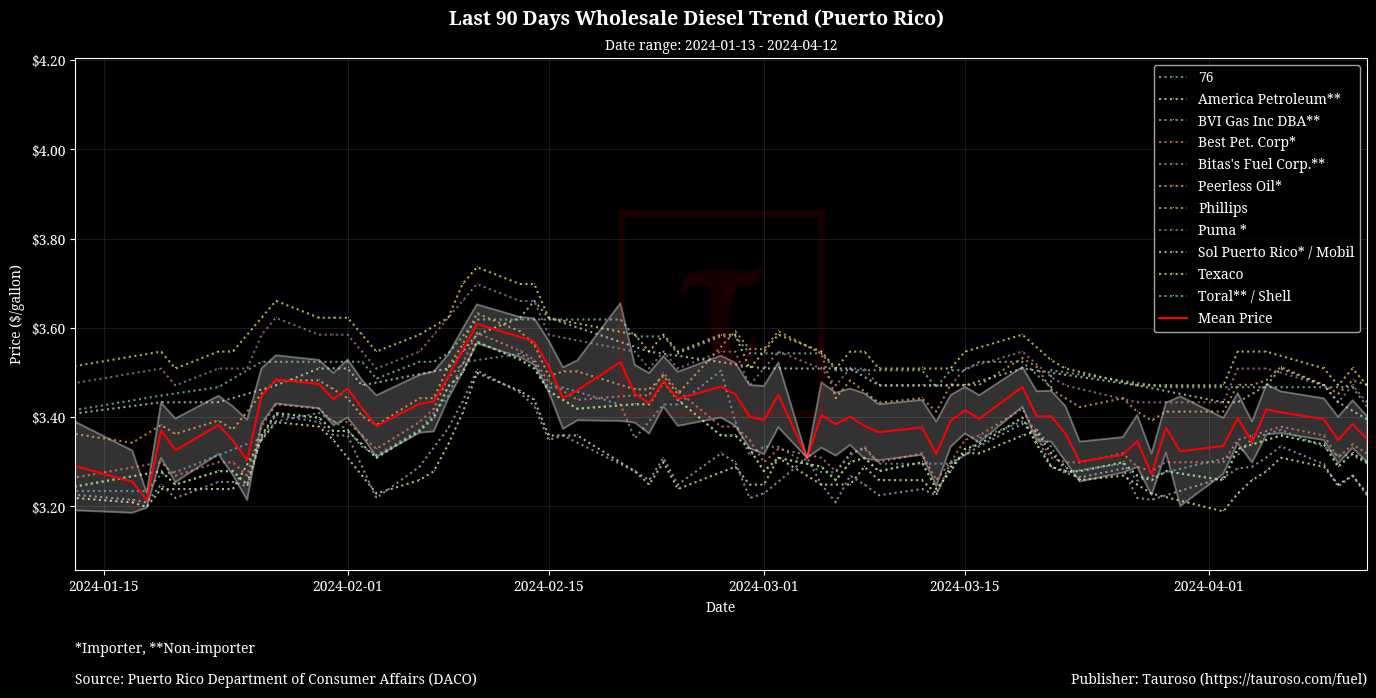

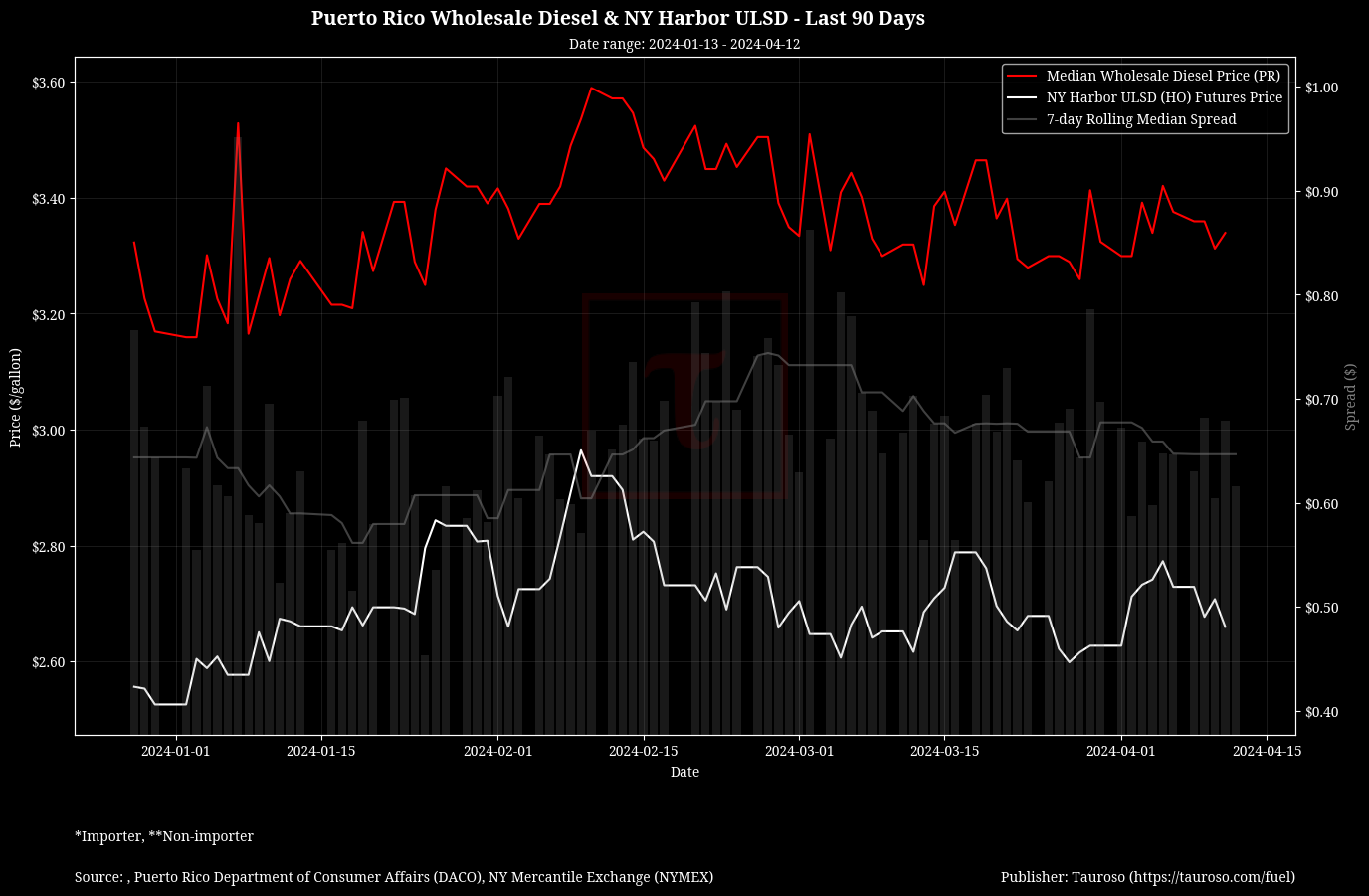

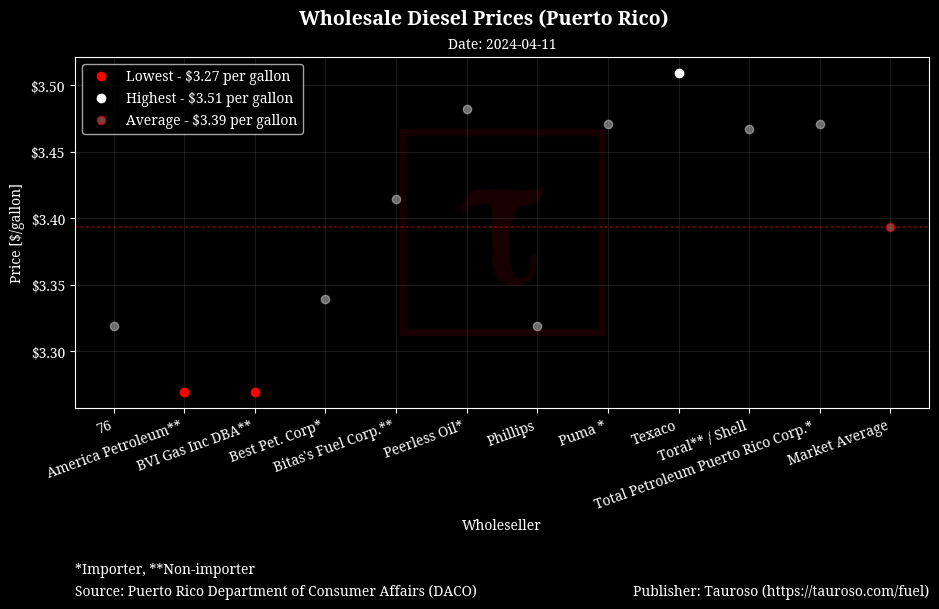

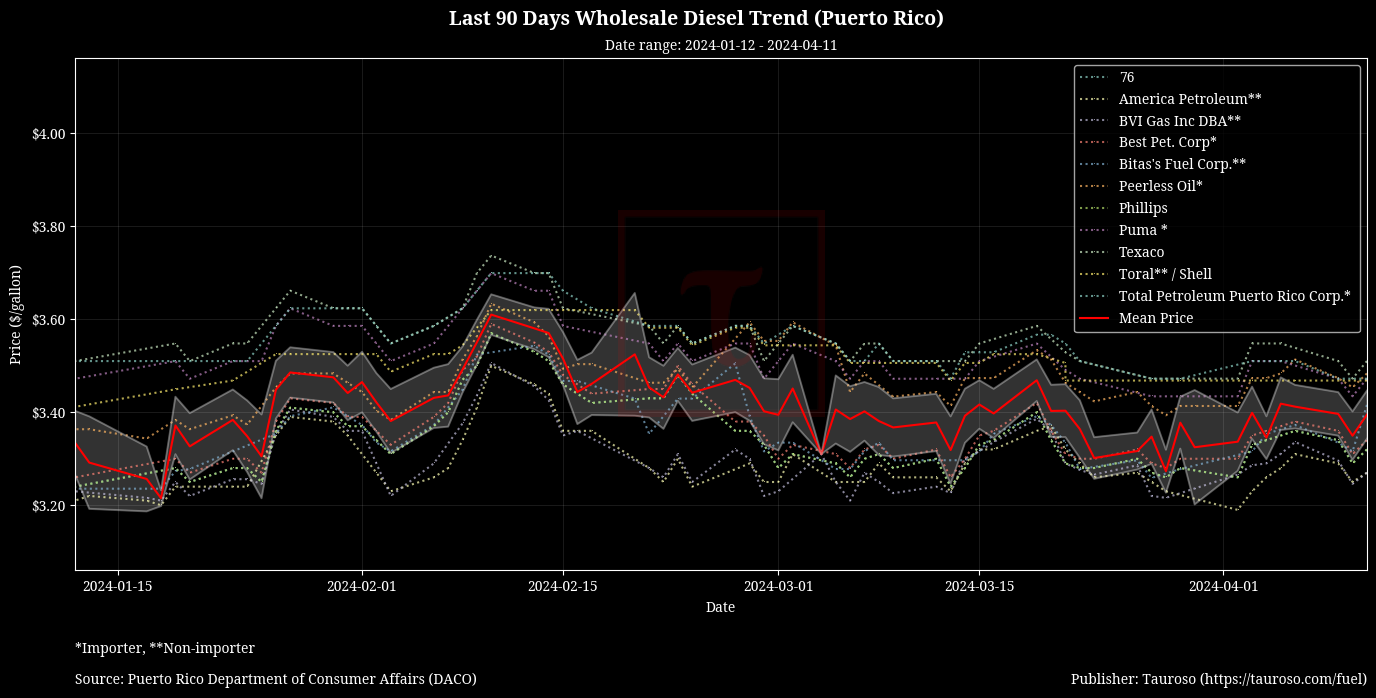

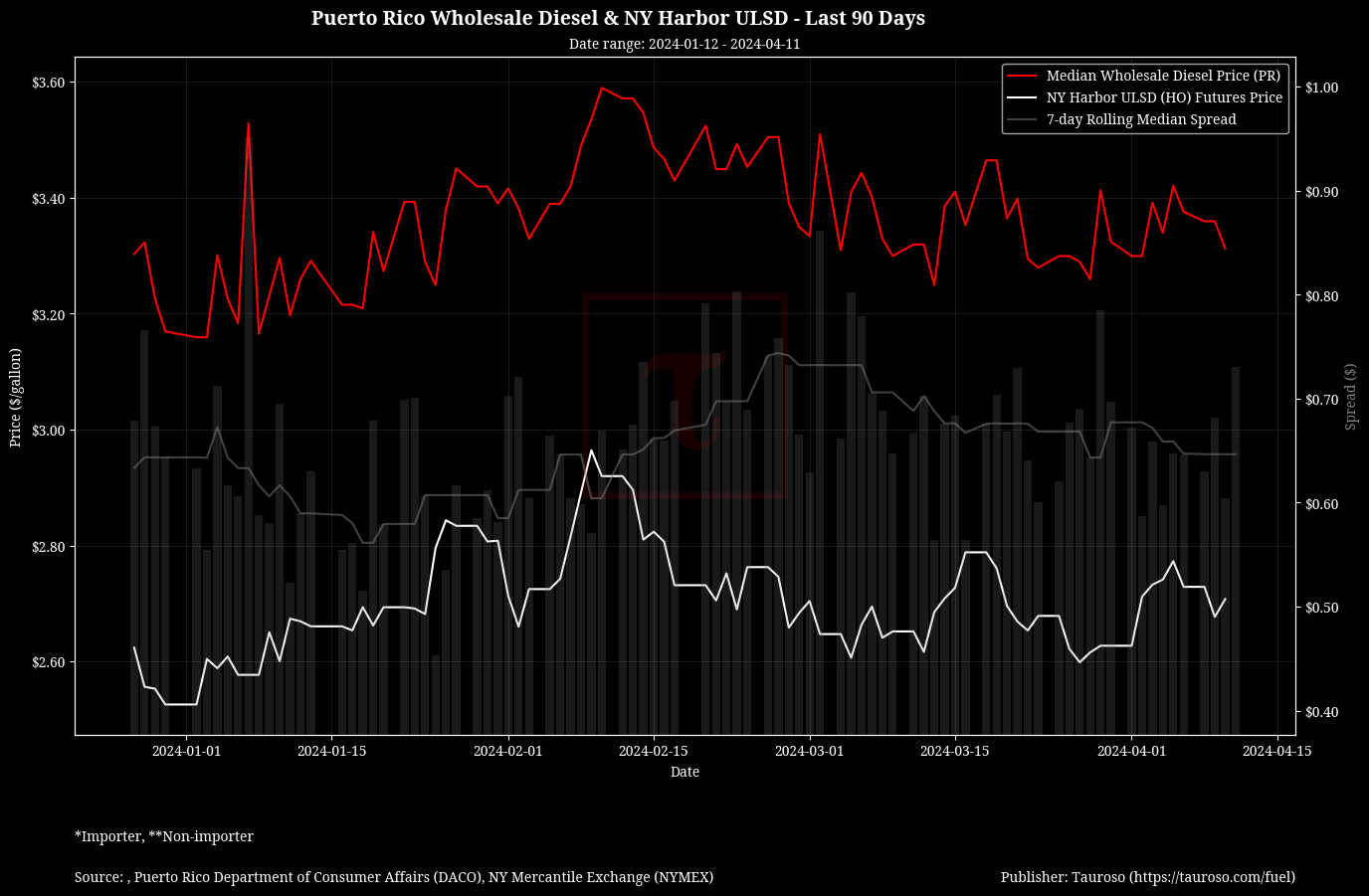

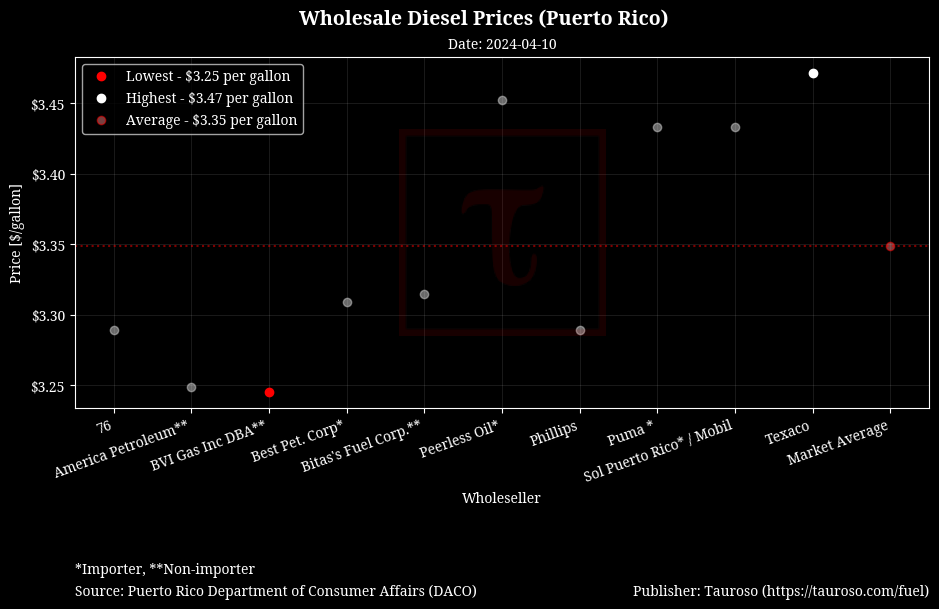

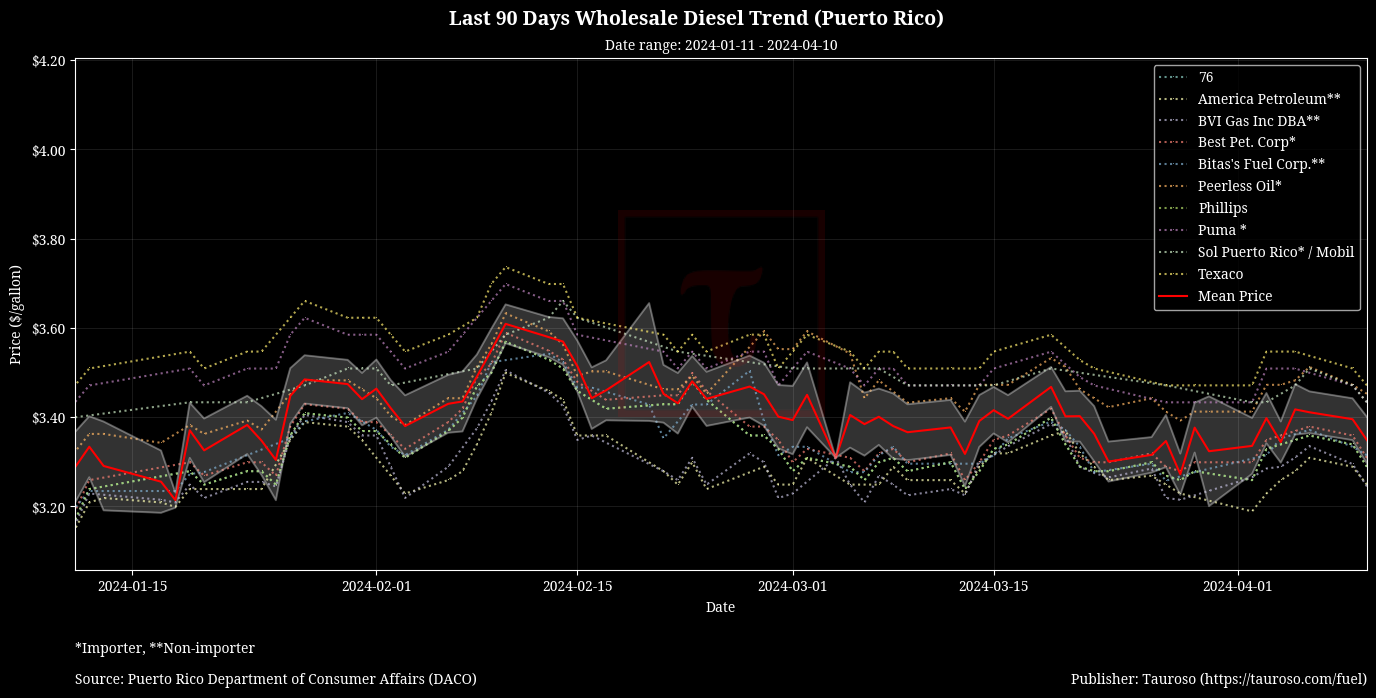

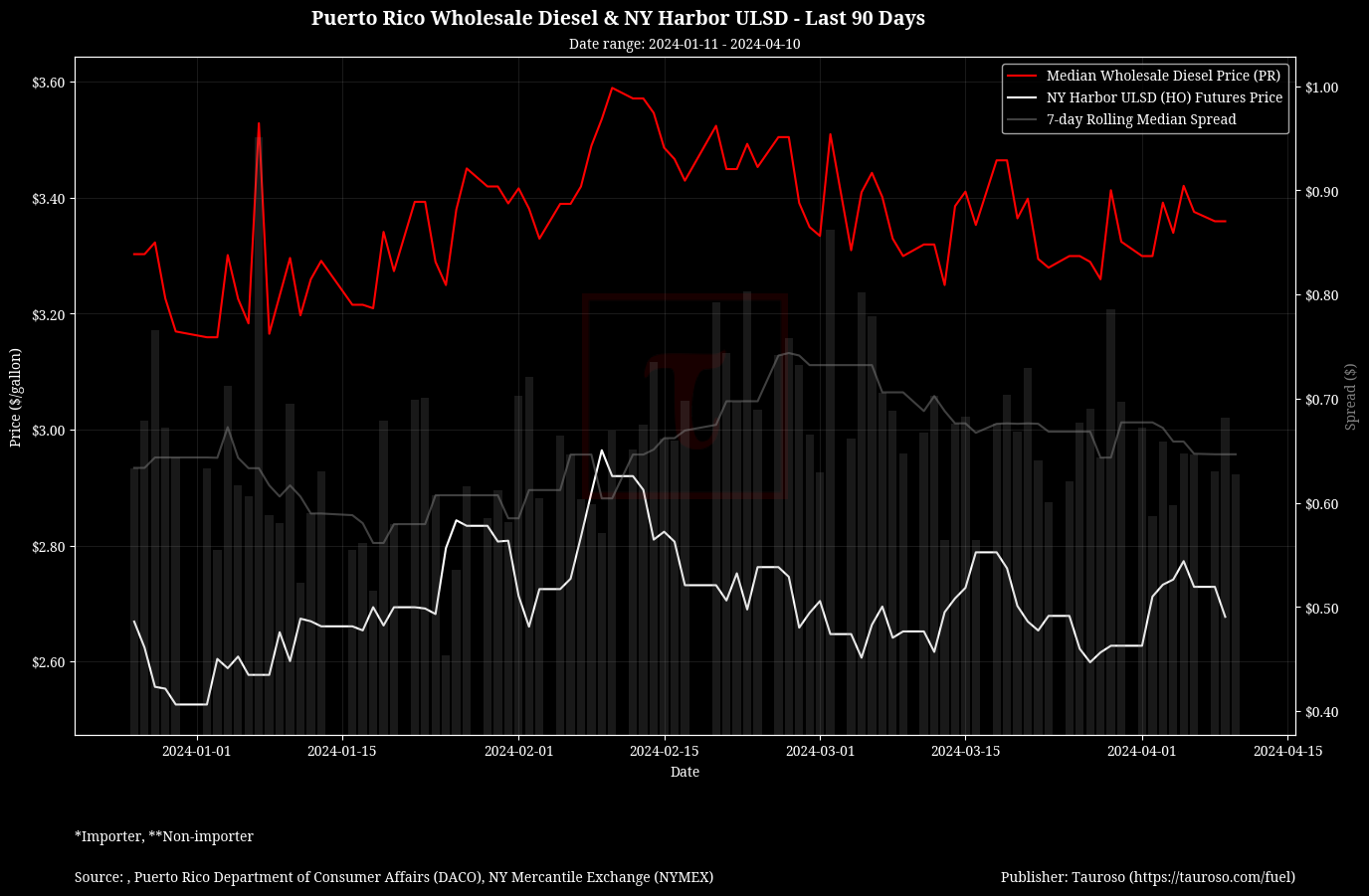

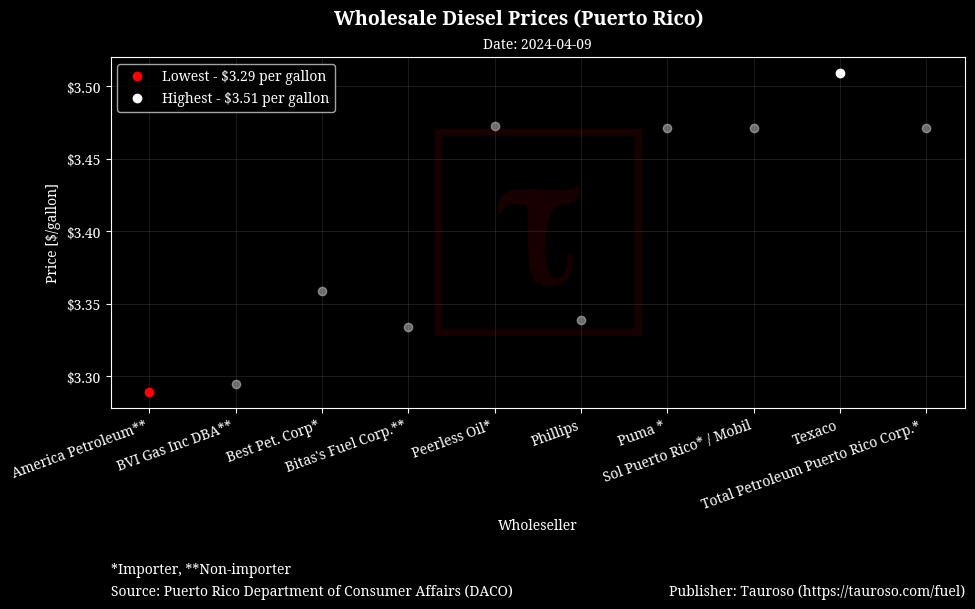

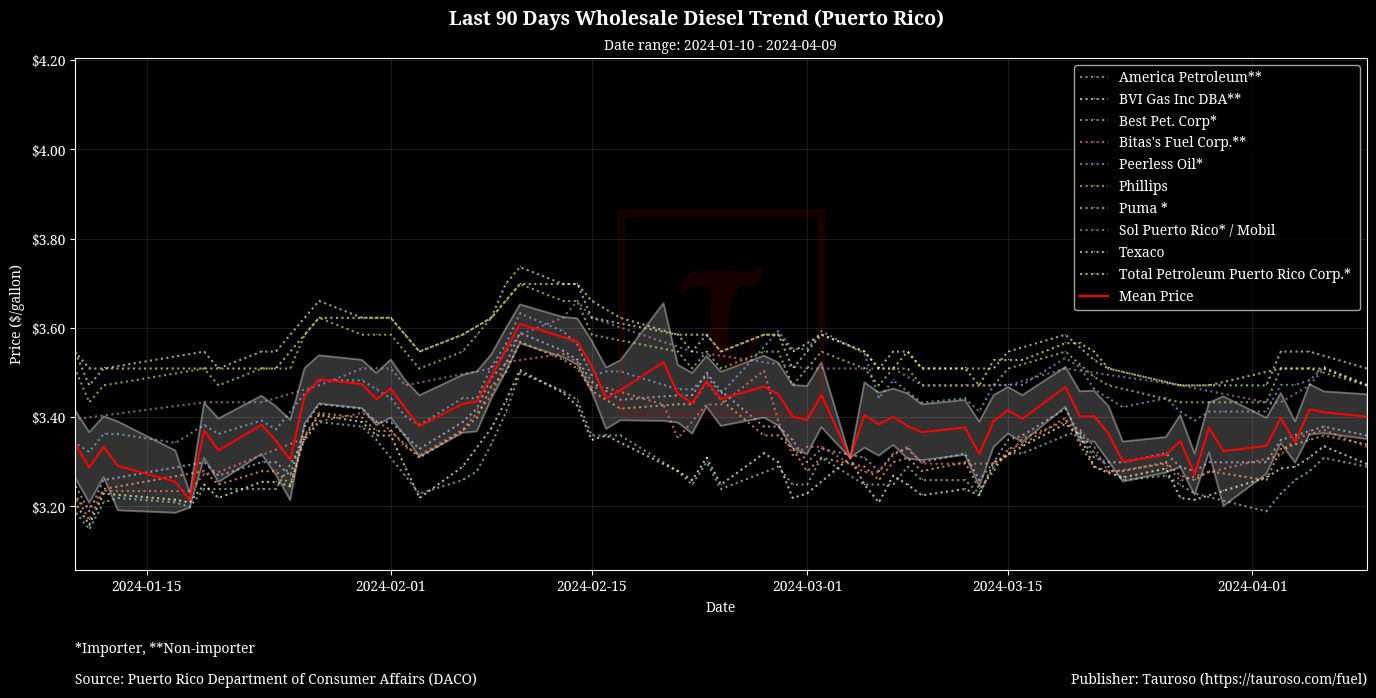

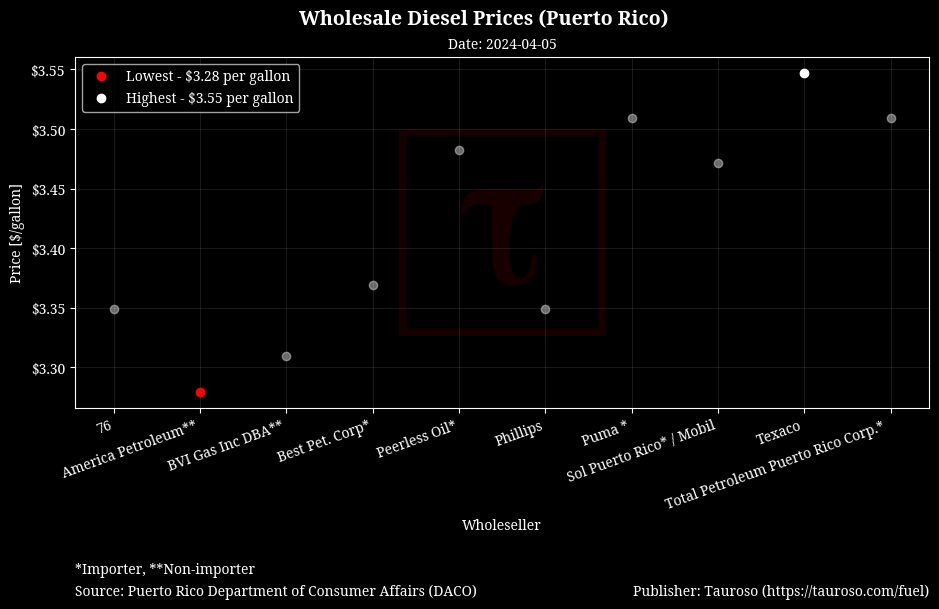

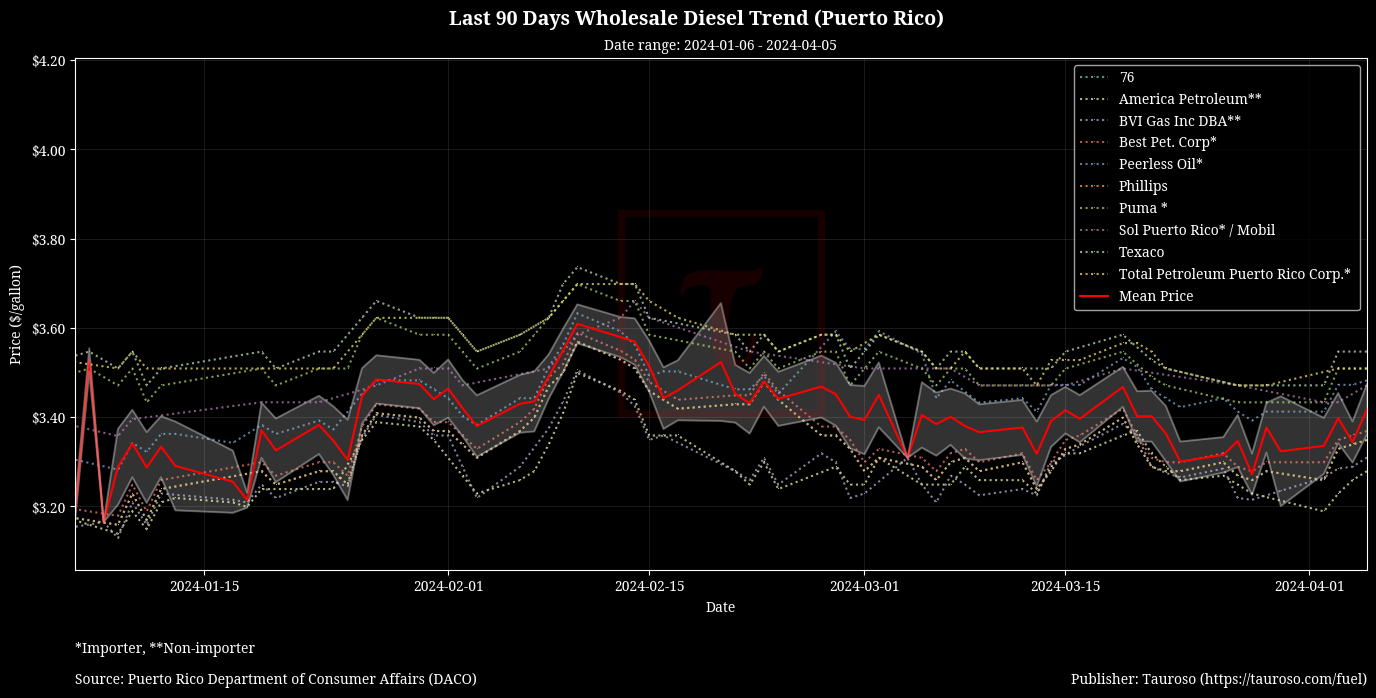

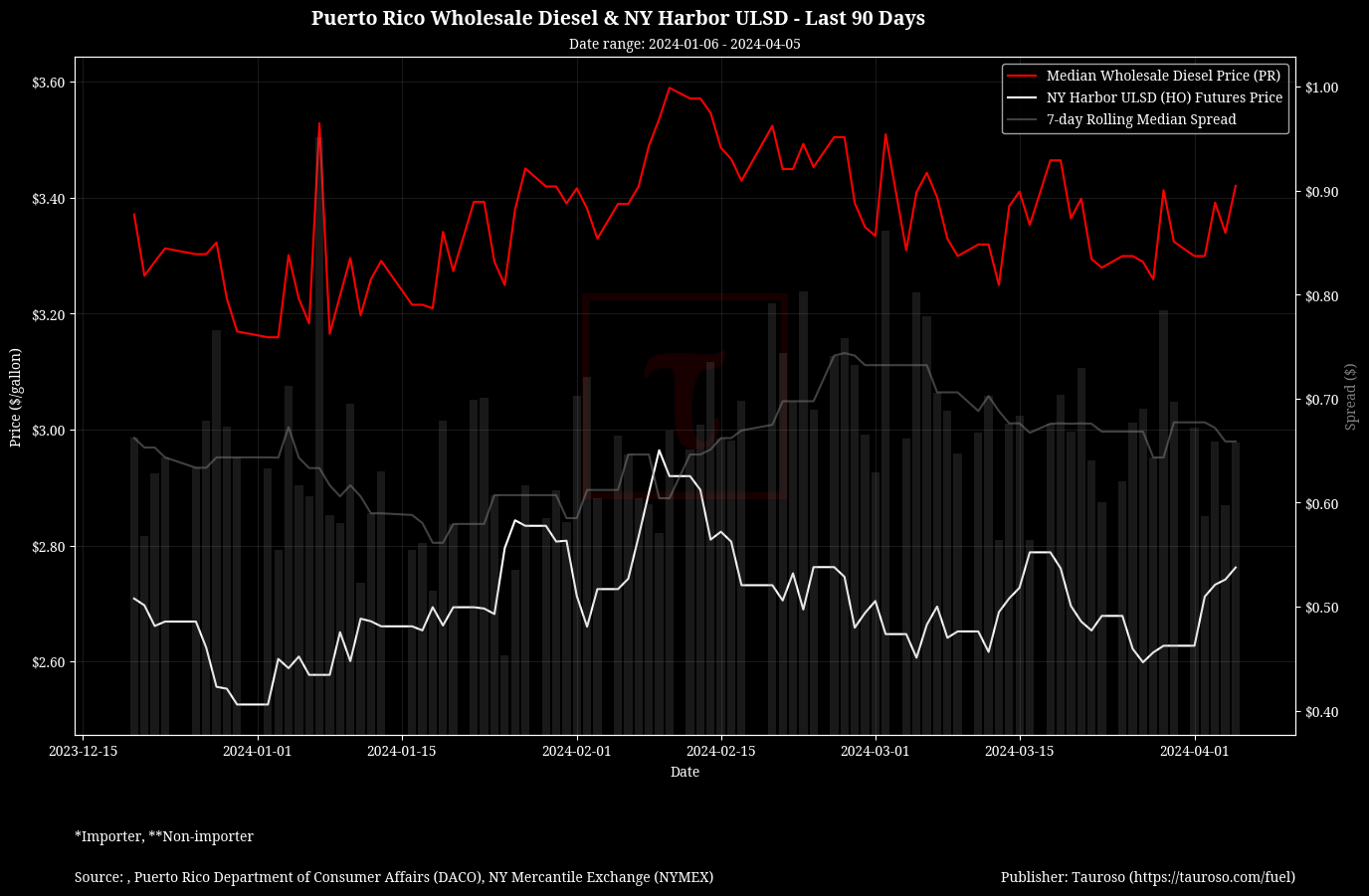

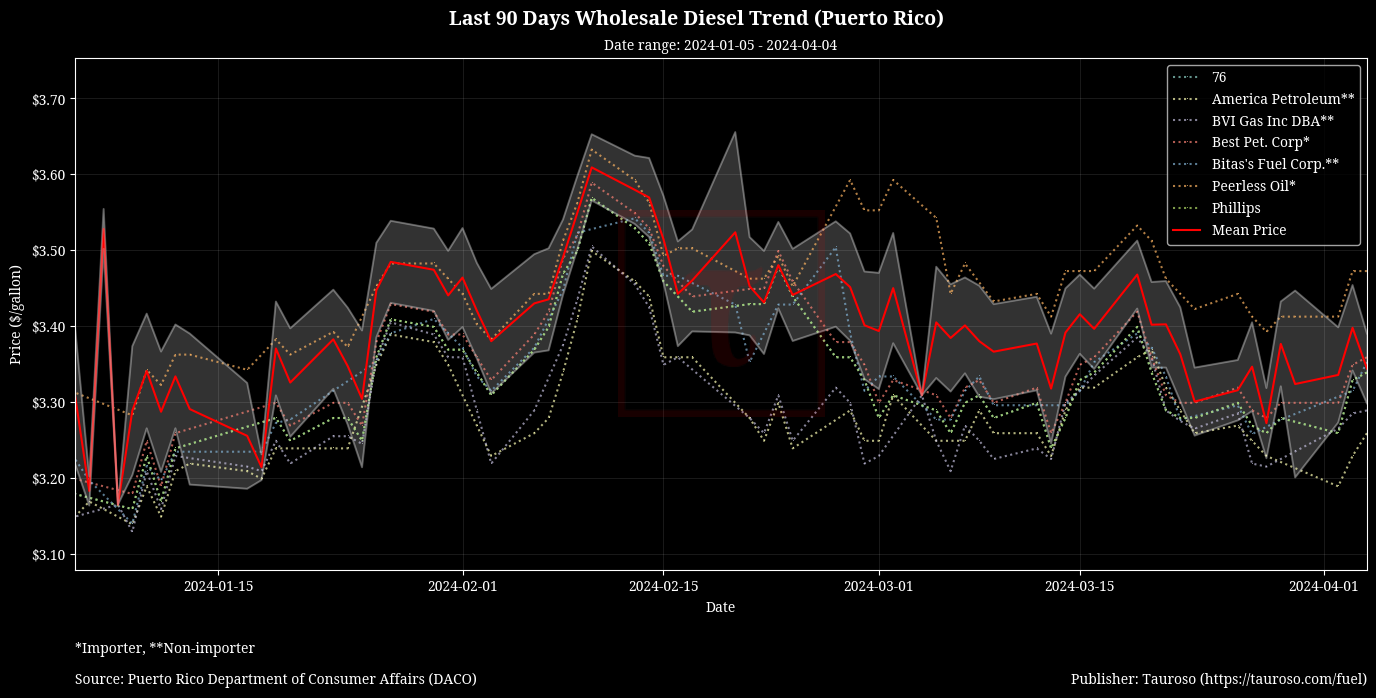

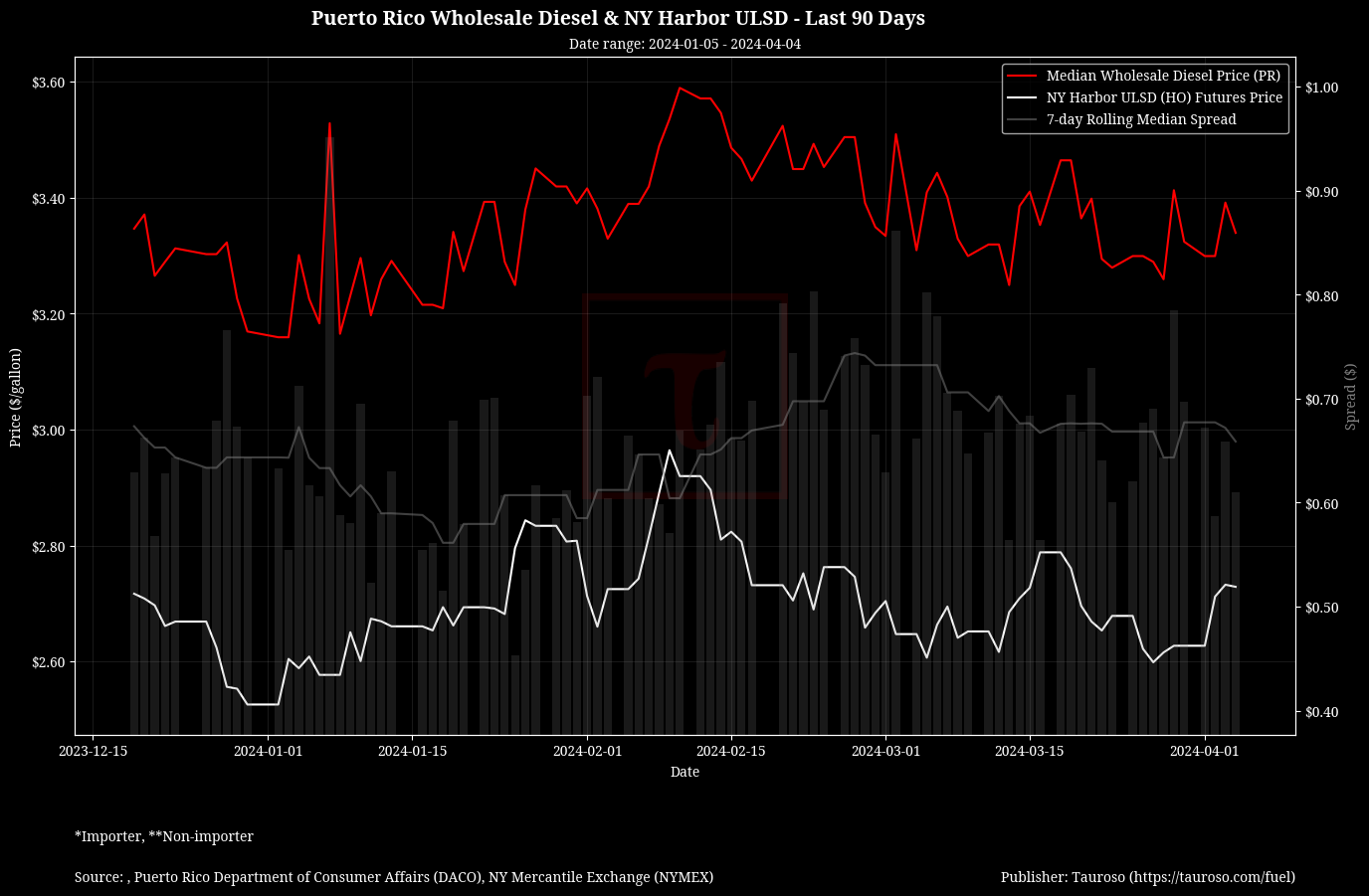

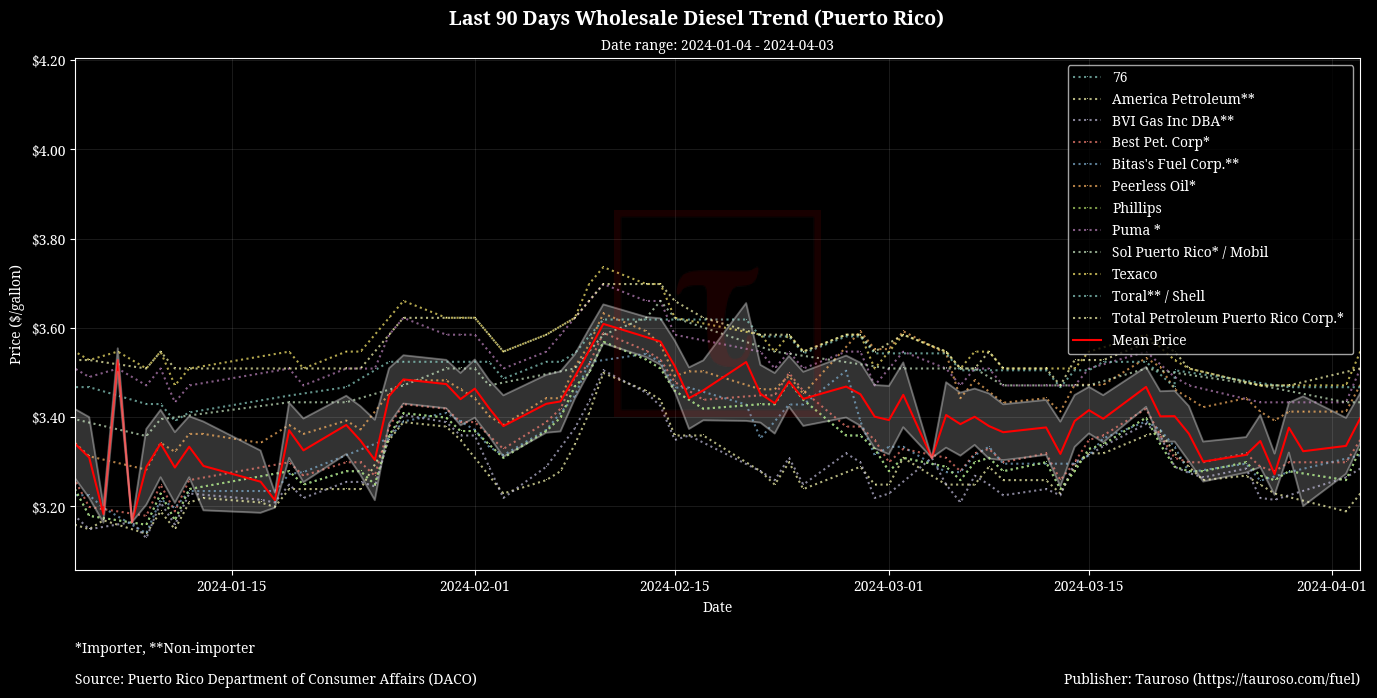

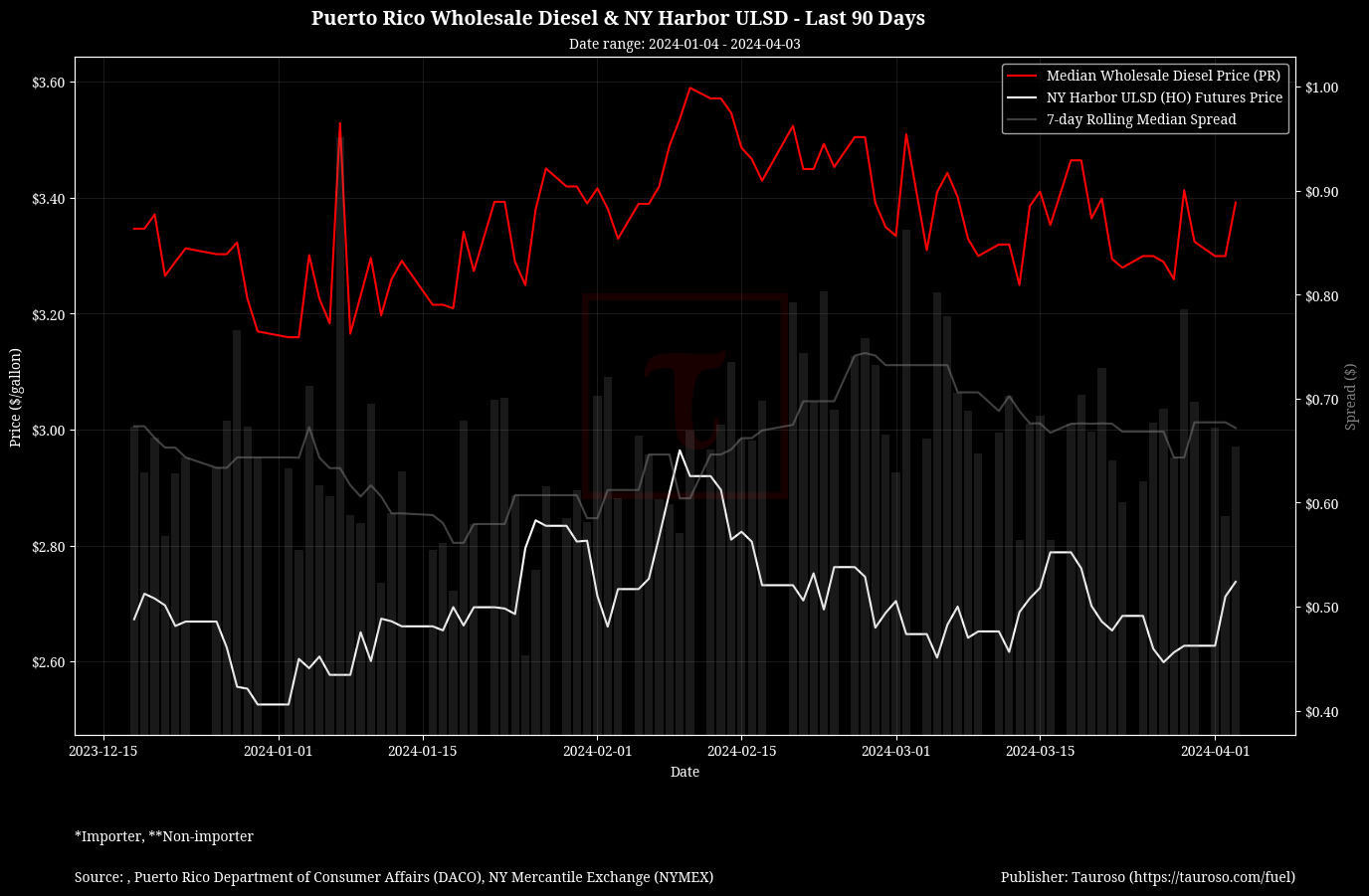

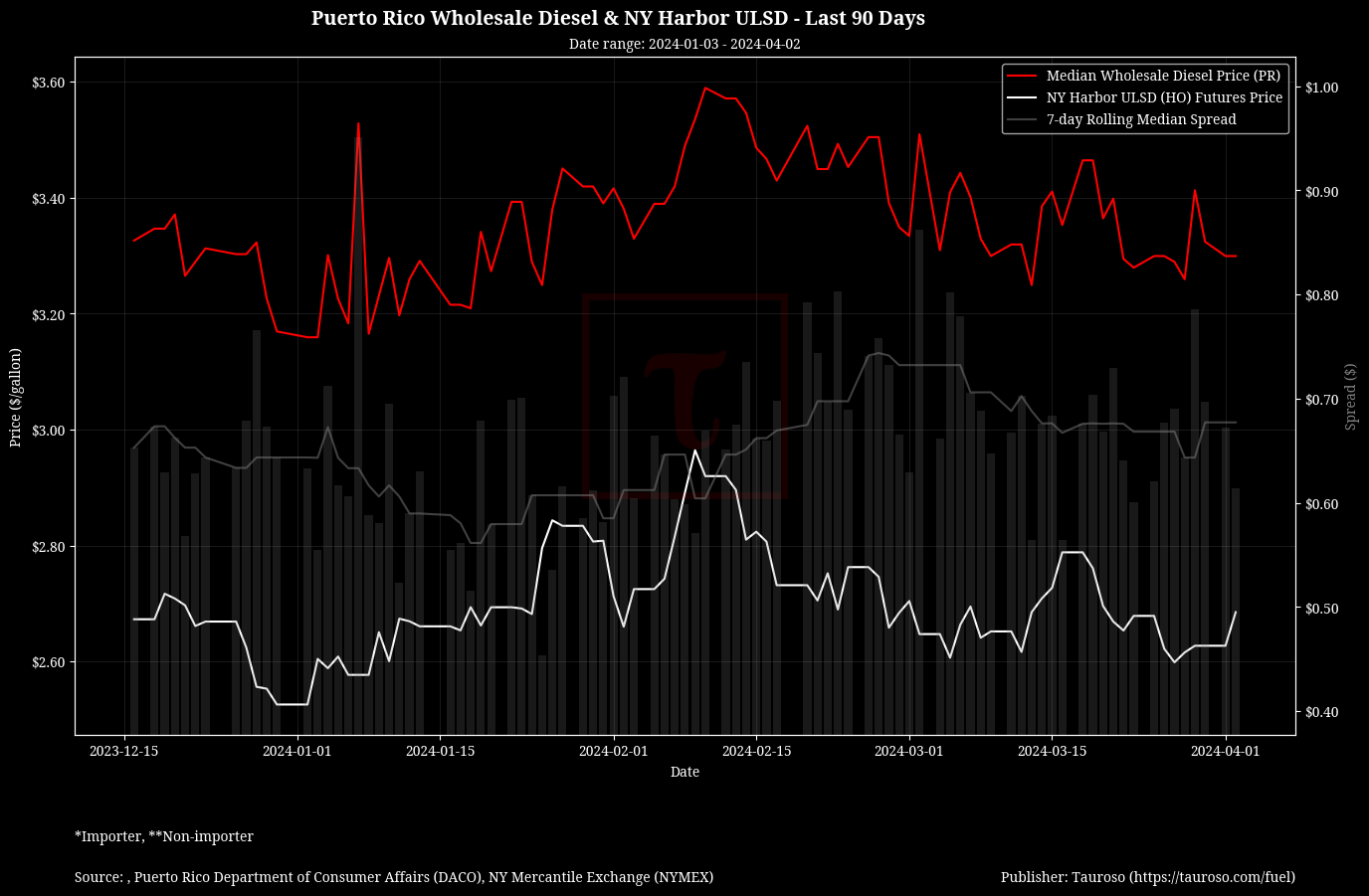

For diesel, we could see slighly higher prices this week given the rise in crude oil but we expect diesel to remain steady with its current trend and price levels for the next weeks.

Highlights

- Trend expectations for crude oil in the coming months: Tensions in the Middle East and the Russia-Ukraine war could see higher crude oil prices in the coming months

"At face value, and assuming no policy, supply or demand response, Russia's actions could push Brent oil price to $90 already in April, reach mid-$90 by May and close to $100 by September." - Natasha Kaneva, JPMorgan analyst

- California's $5 per gallon of gasoline problem: According to AAA, the average price at the pump in California last Friday was $5.27 compared to the national US average of $3.54 per gallon. In contrast, EnLaBombaPR reports an average of $3.62 per gallon for at the pump for retail customers in Puerto Rico.

"Refinery challenges points as the main culprit for California's surging prices, including an important Phillips 66 refiner in the Bay Area halting gasoline production in favor of renewable diesel." - Tom Kloza, global head of energy analysis at OPIS

- Russian-Ukraine war could be the catalyst to drive crude to $100 per barrel: Russia, a large oil producer, could provide a hole large enough in supply to drive crude oil prices in the triple digits.

"Continued production cuts from oil alliance OPEC+ and Ukrainian drone attacks on Russian refineries as the major catalysts pushing prices toward $100 in the next few months. Russia is a major oil producer. So the moment you have potentially 500,000, [or] a million barrels a day temporarily impacted — this is when you can see oil prices notch up potentially another $5, $10, and then you are in triple digits" - Claudio Galimberti, senior vice president at Rystad Energy

Crude Oil Benchmarks

References