What to expect

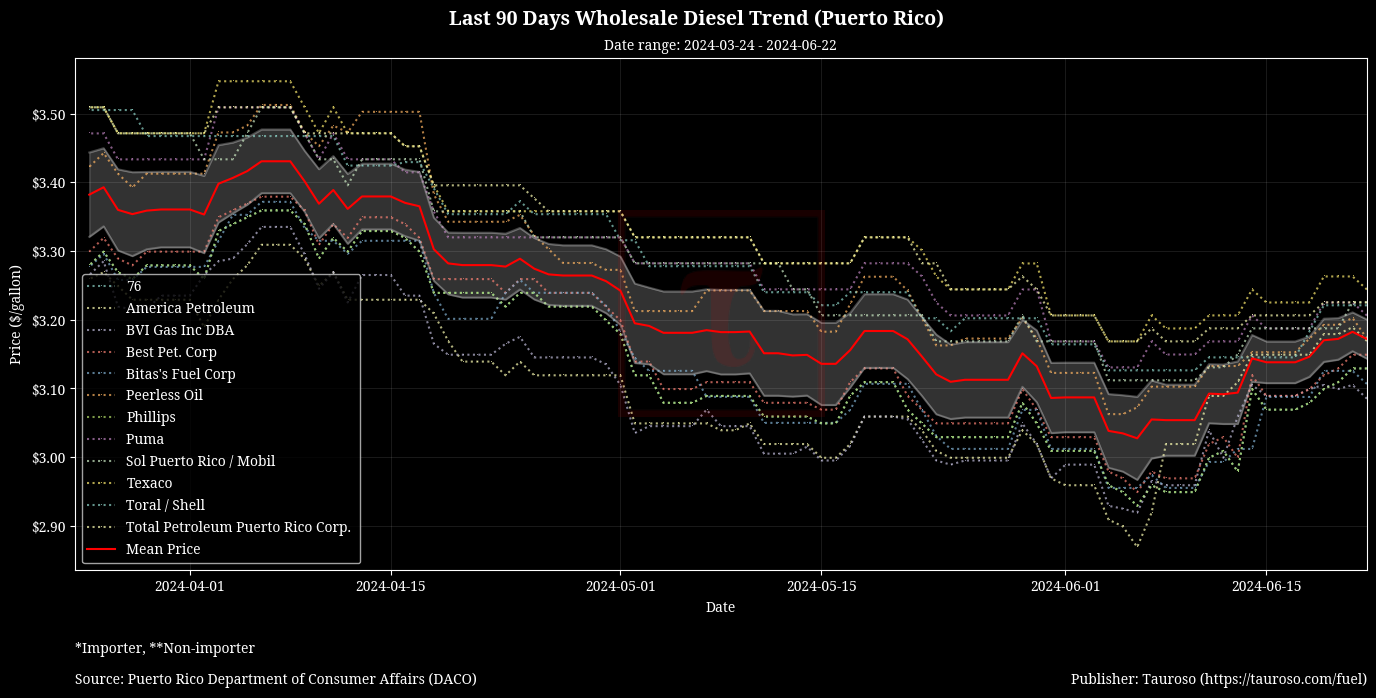

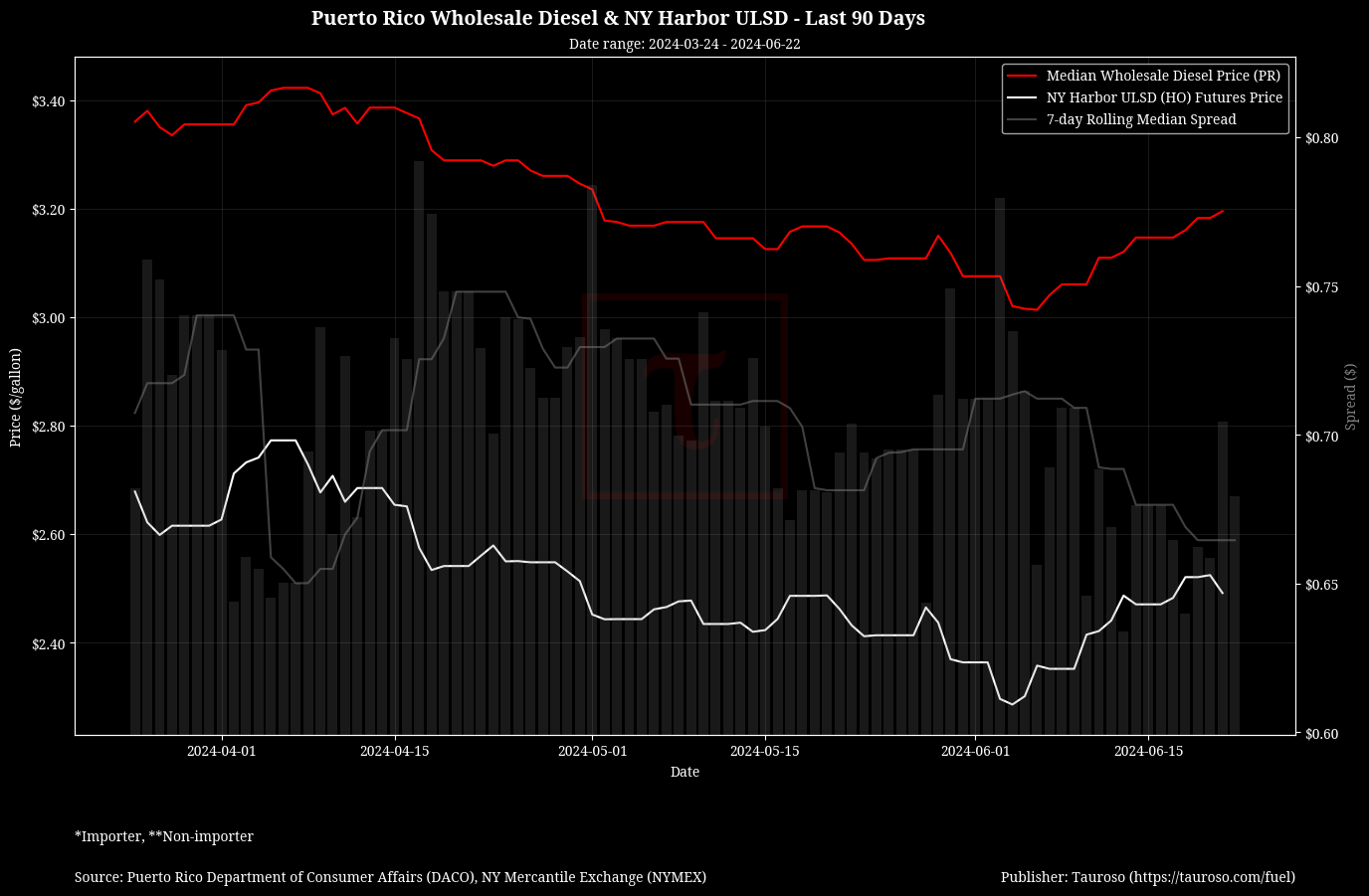

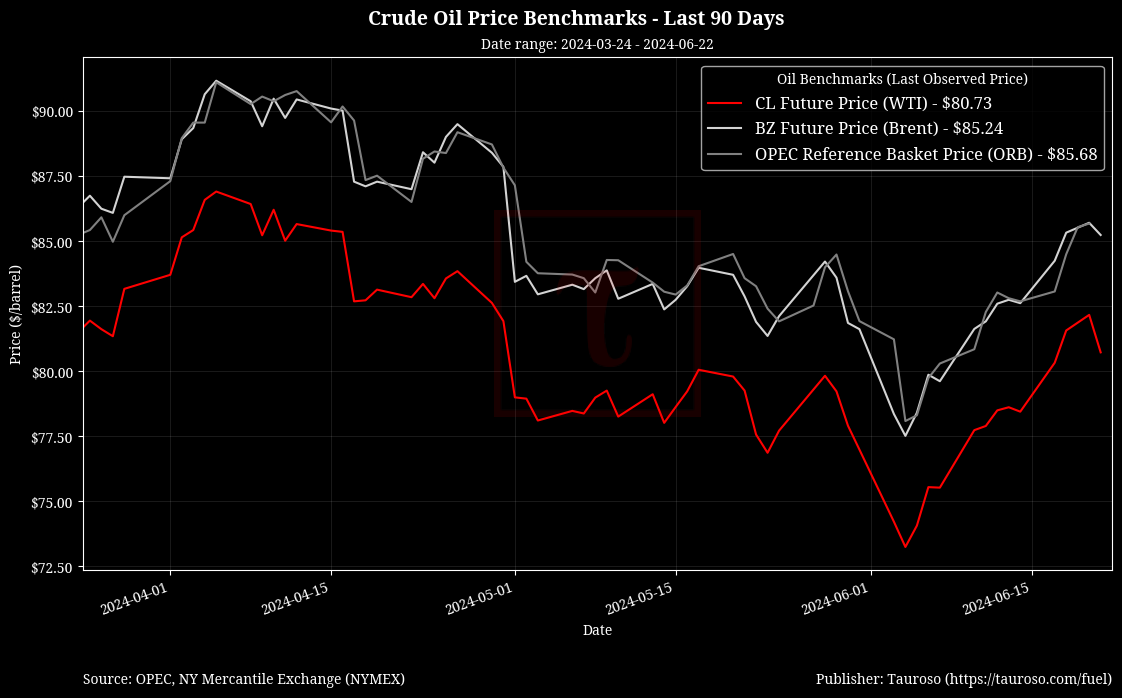

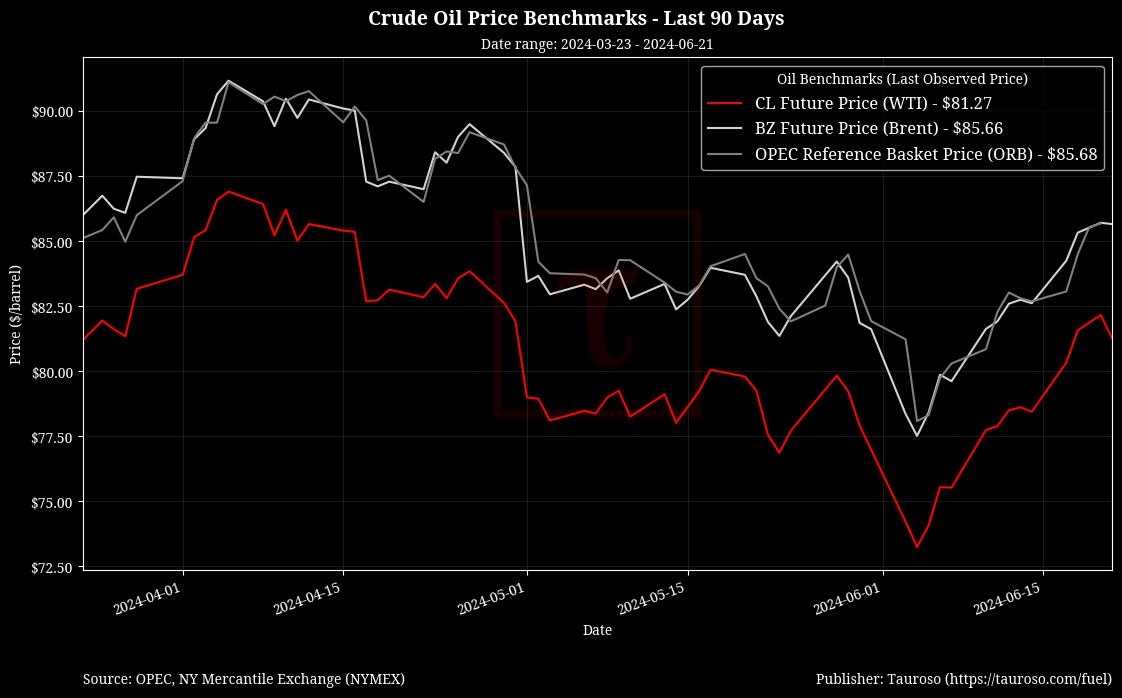

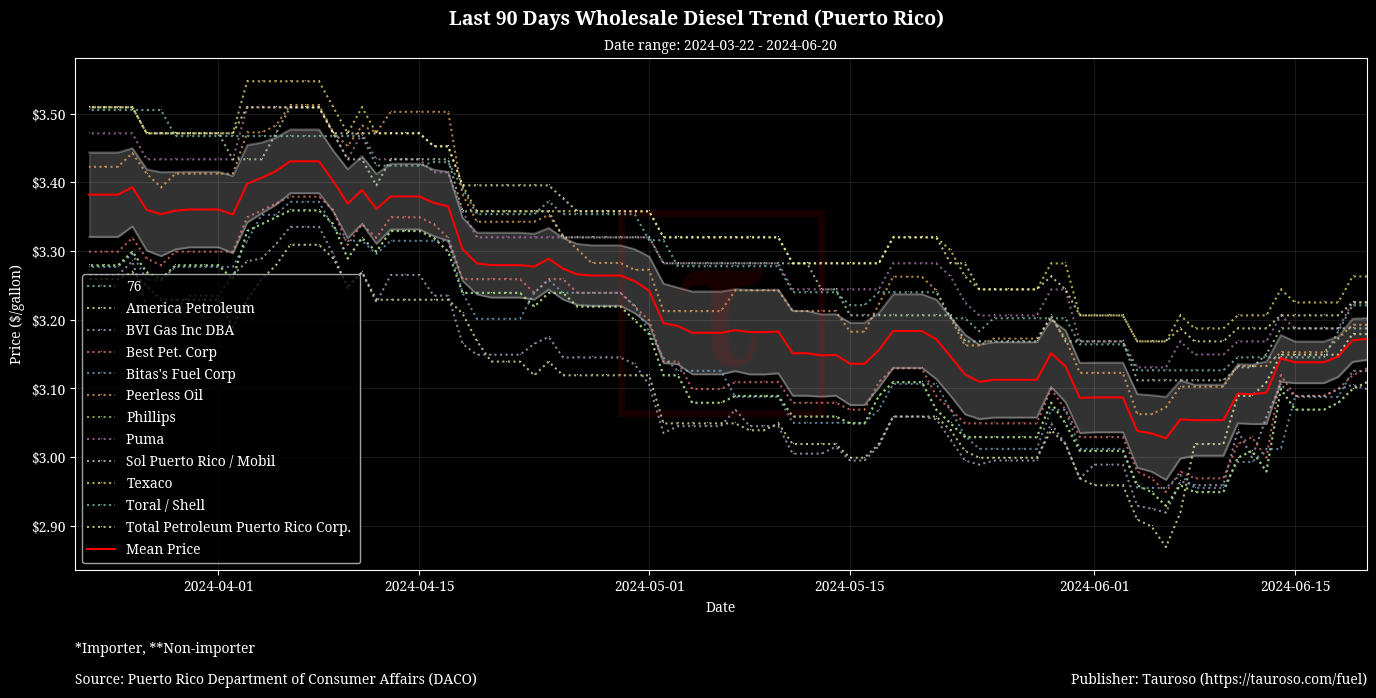

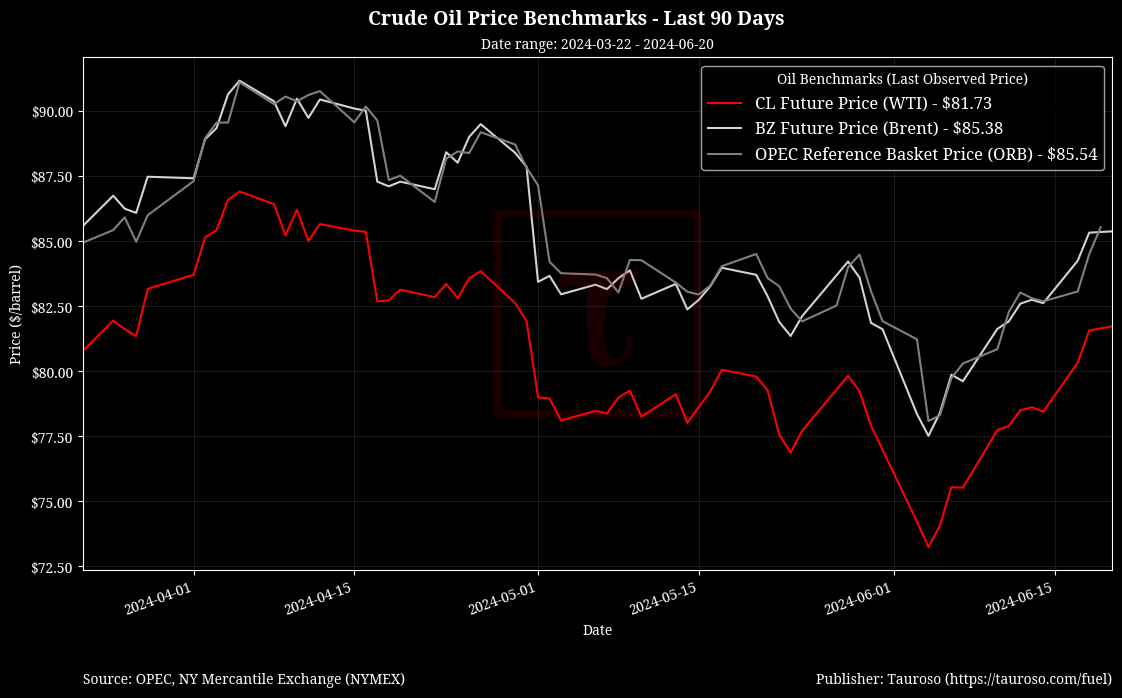

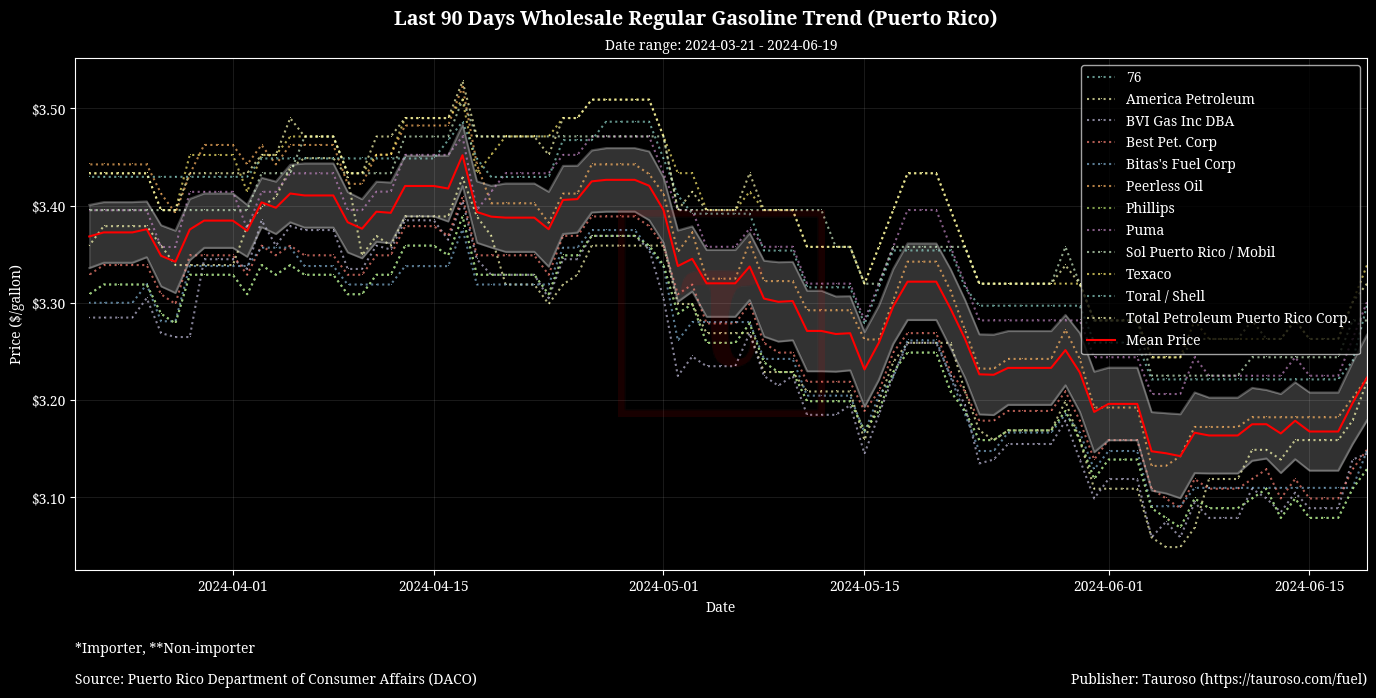

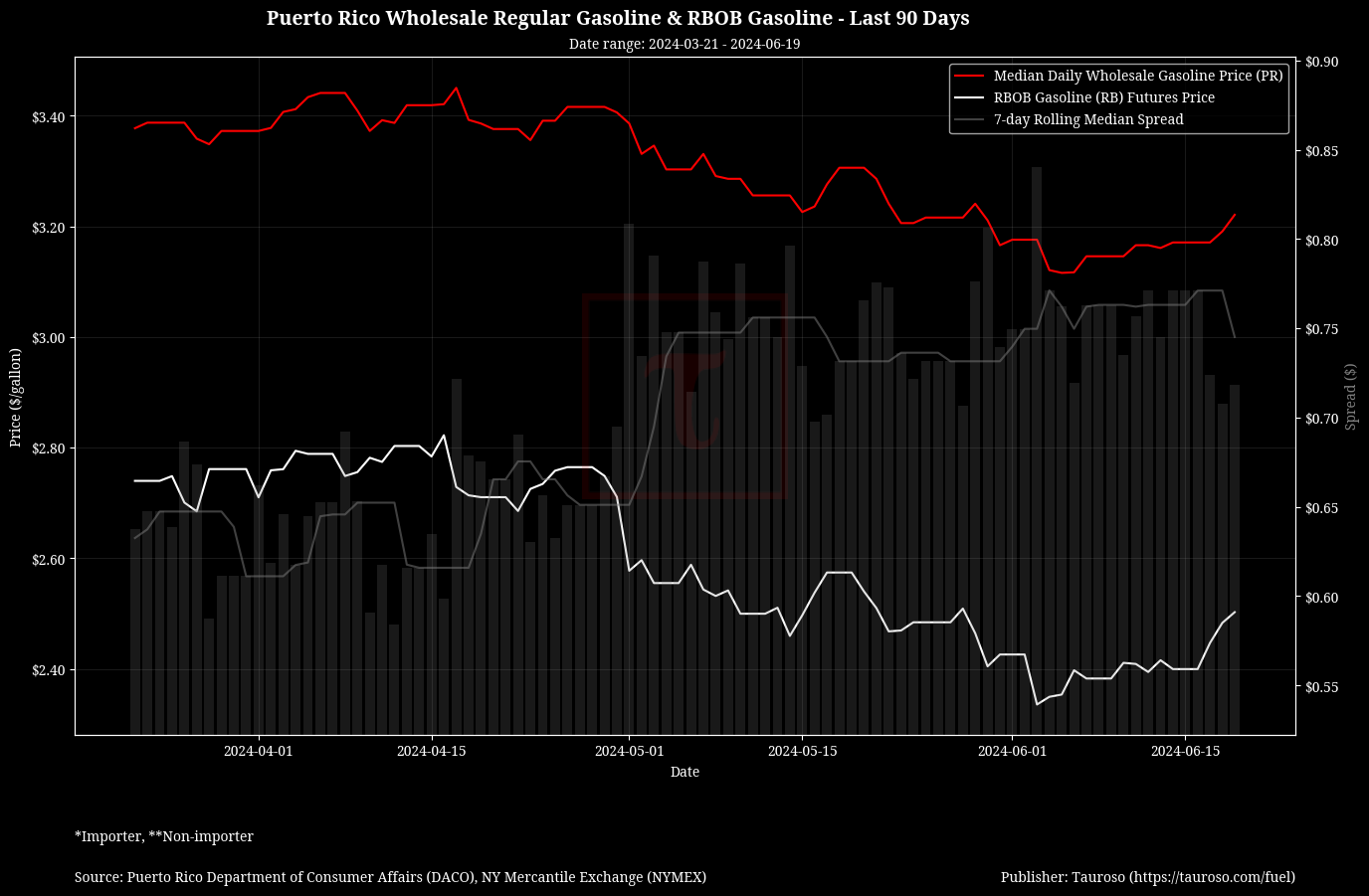

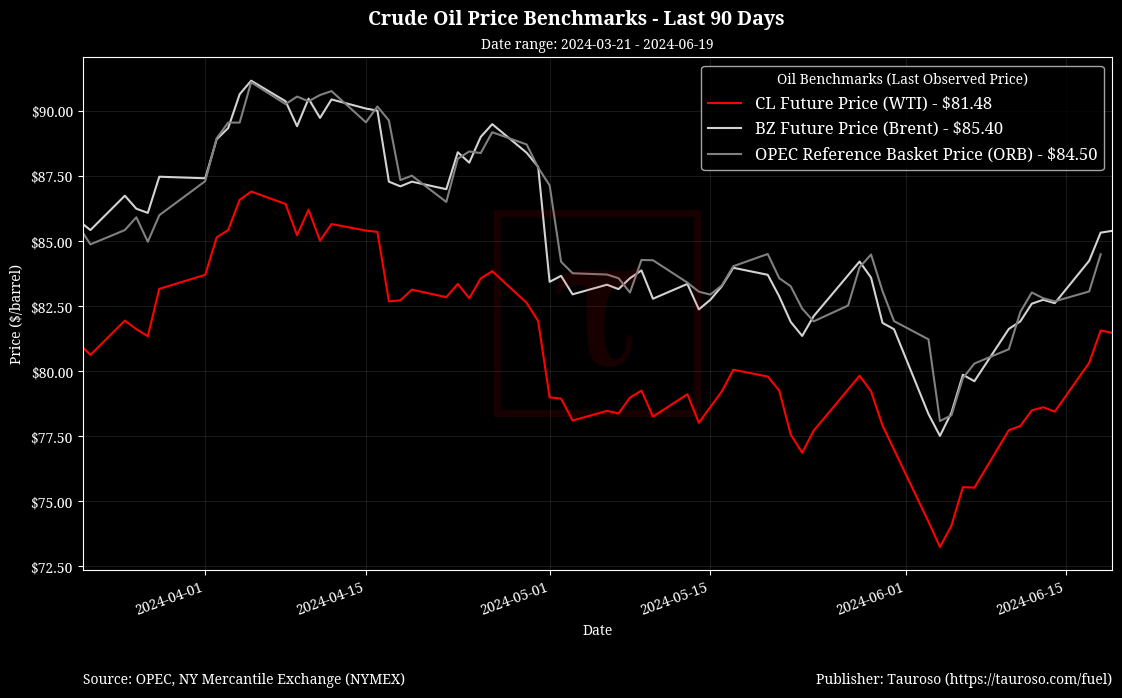

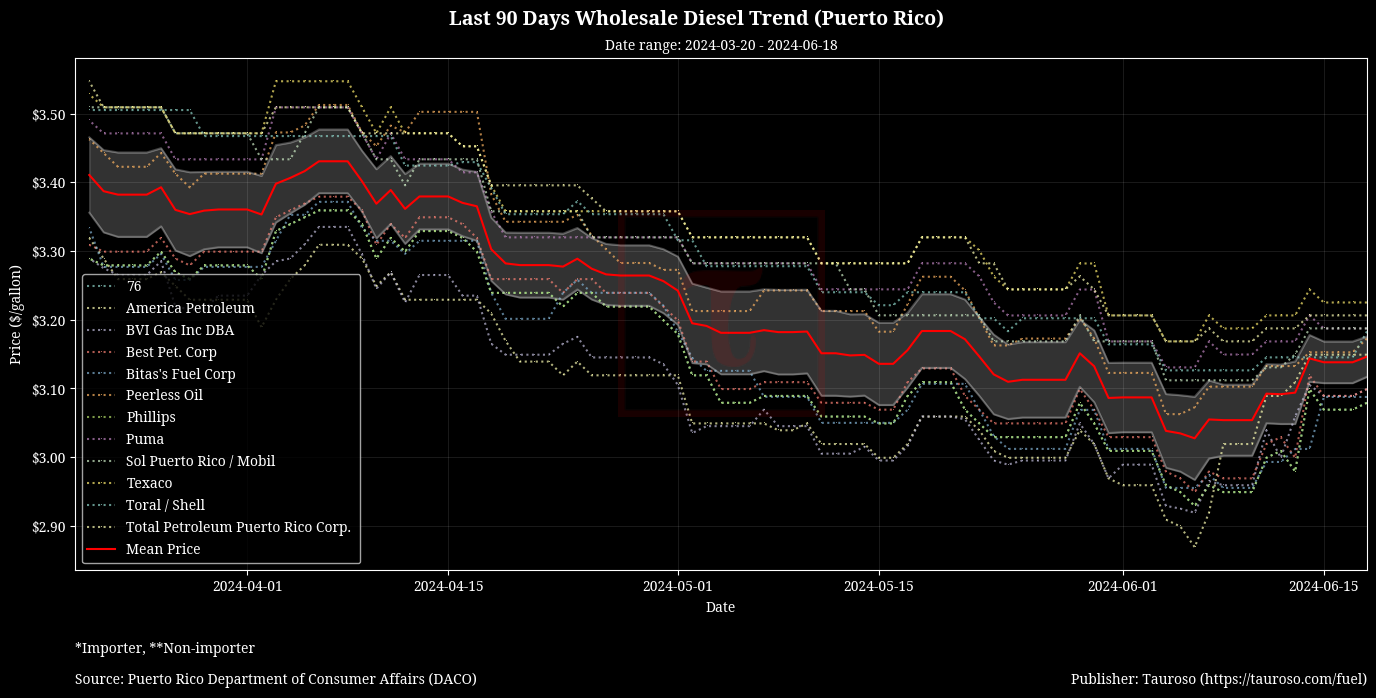

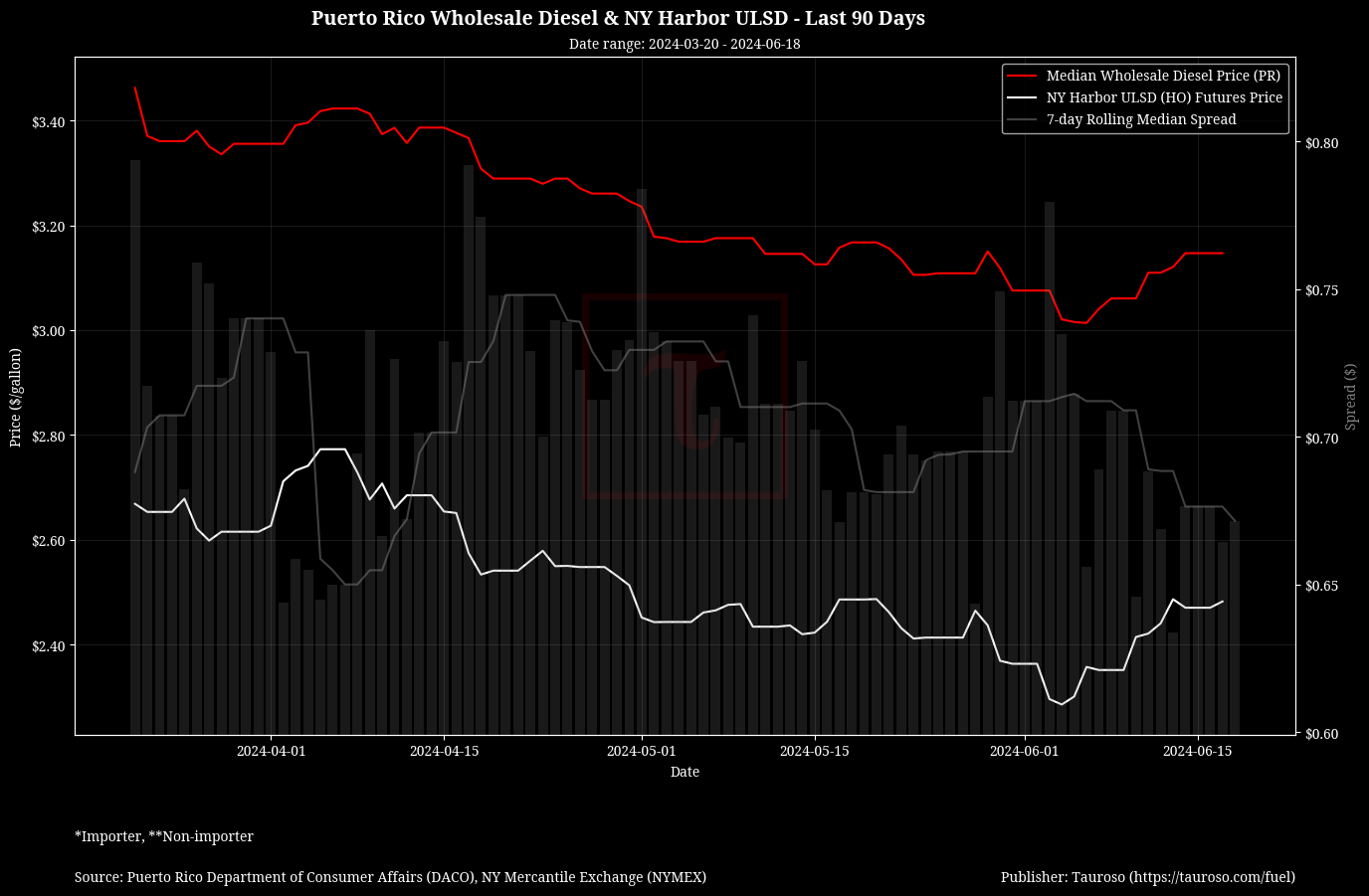

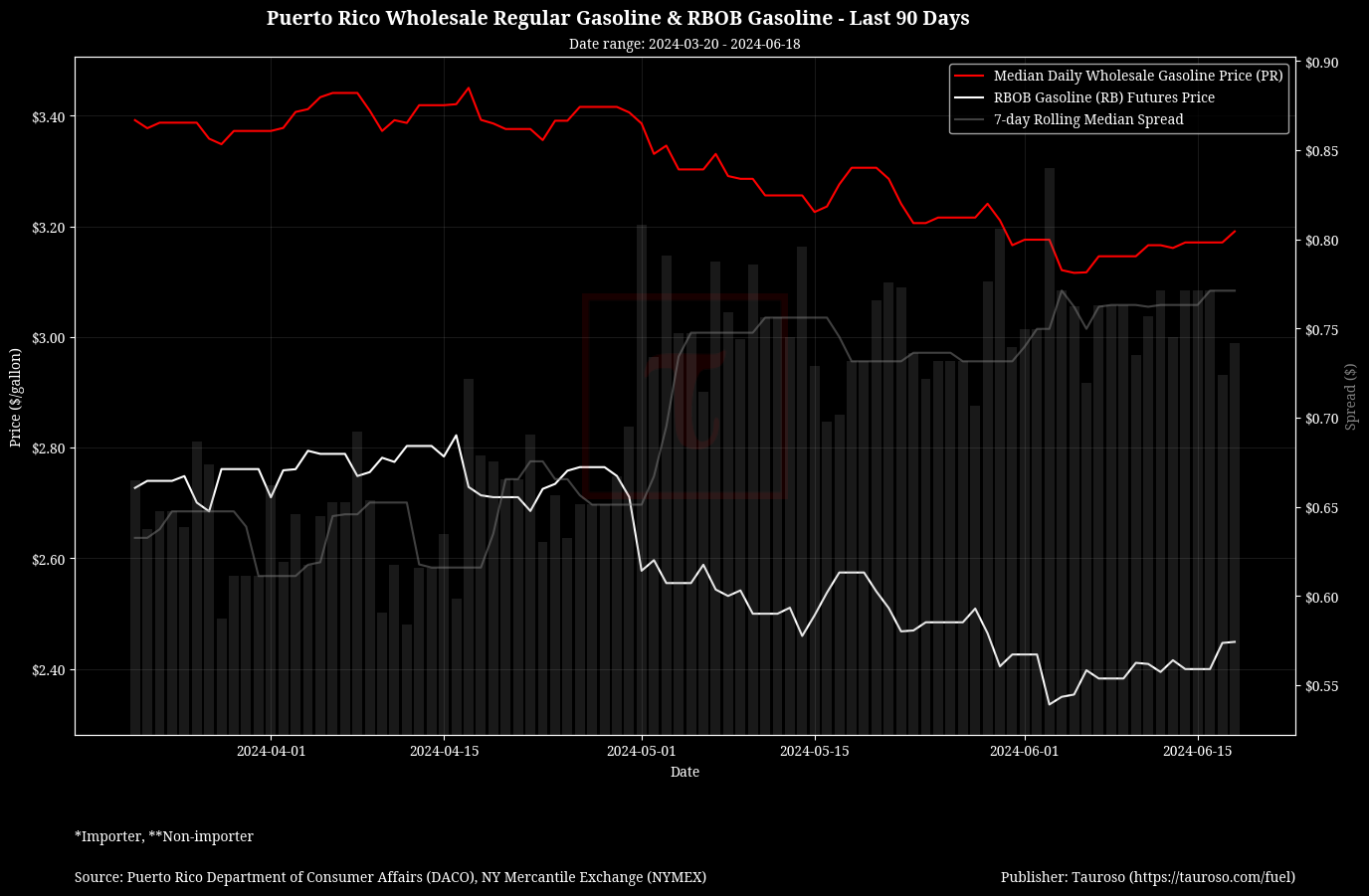

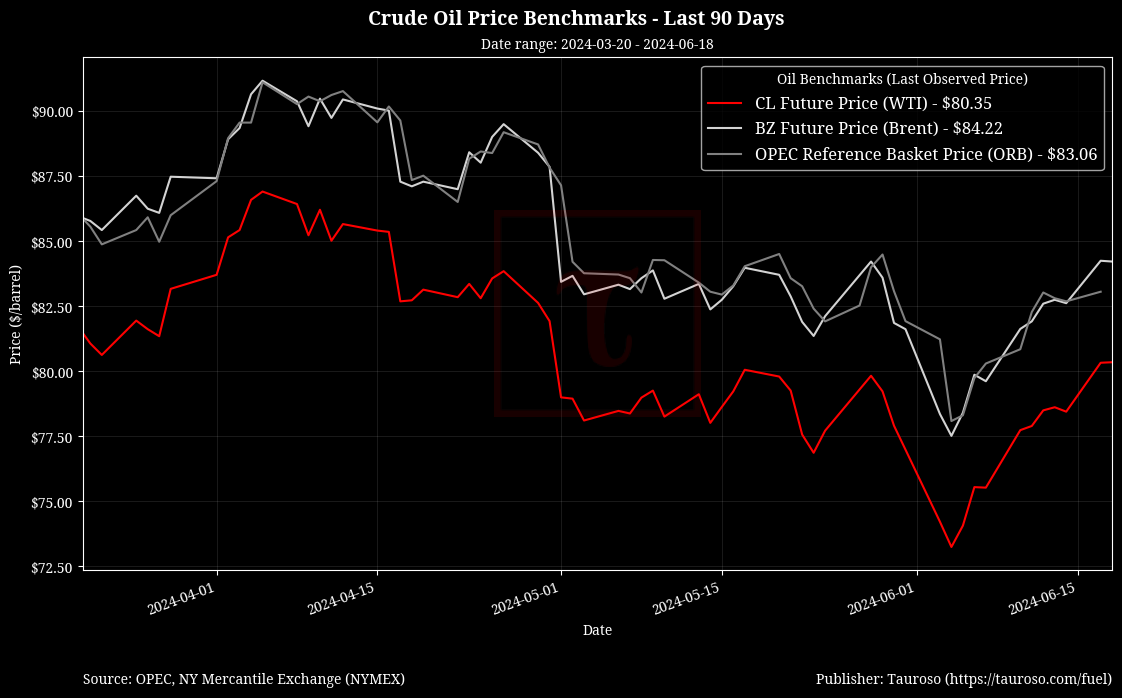

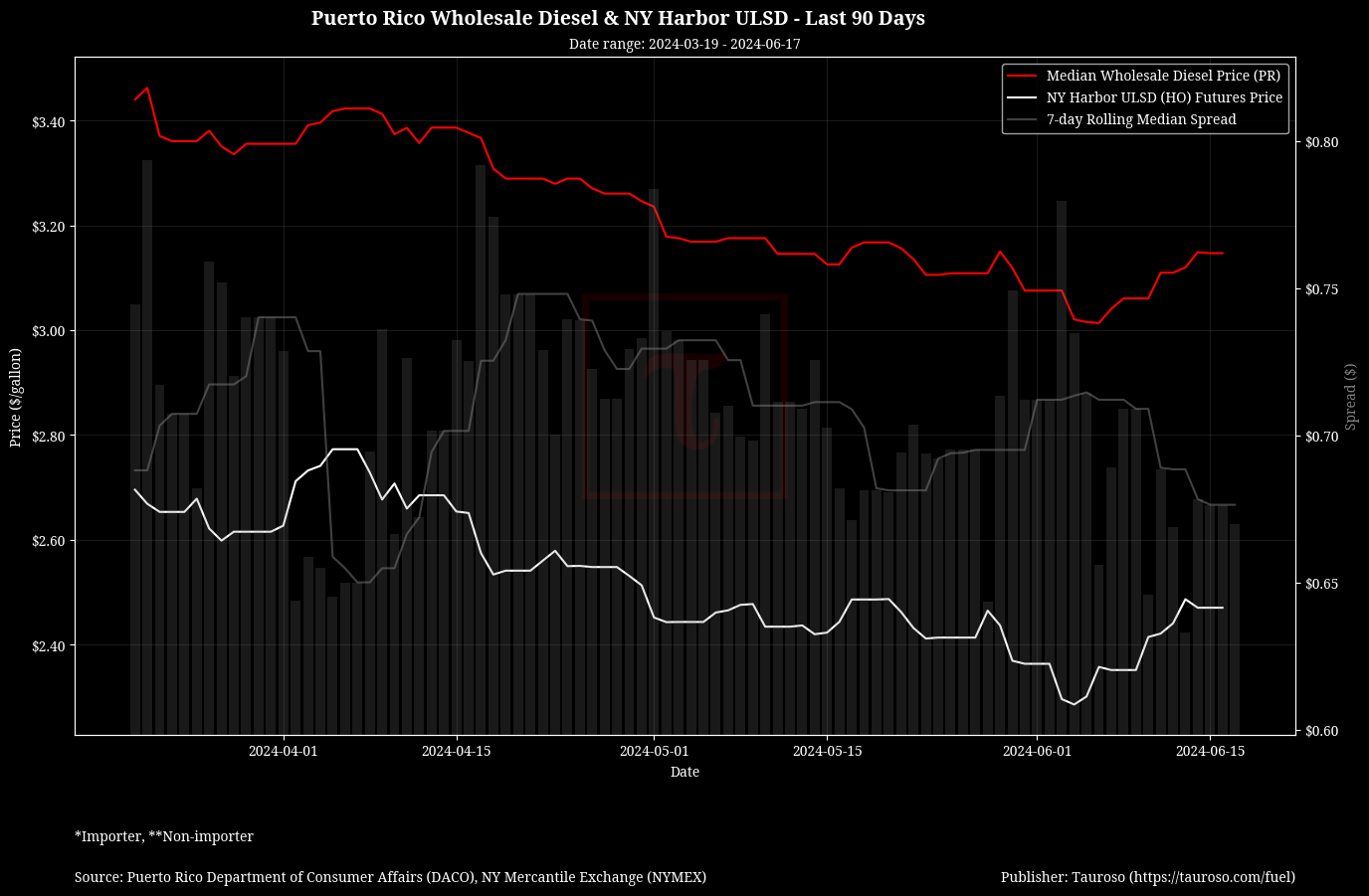

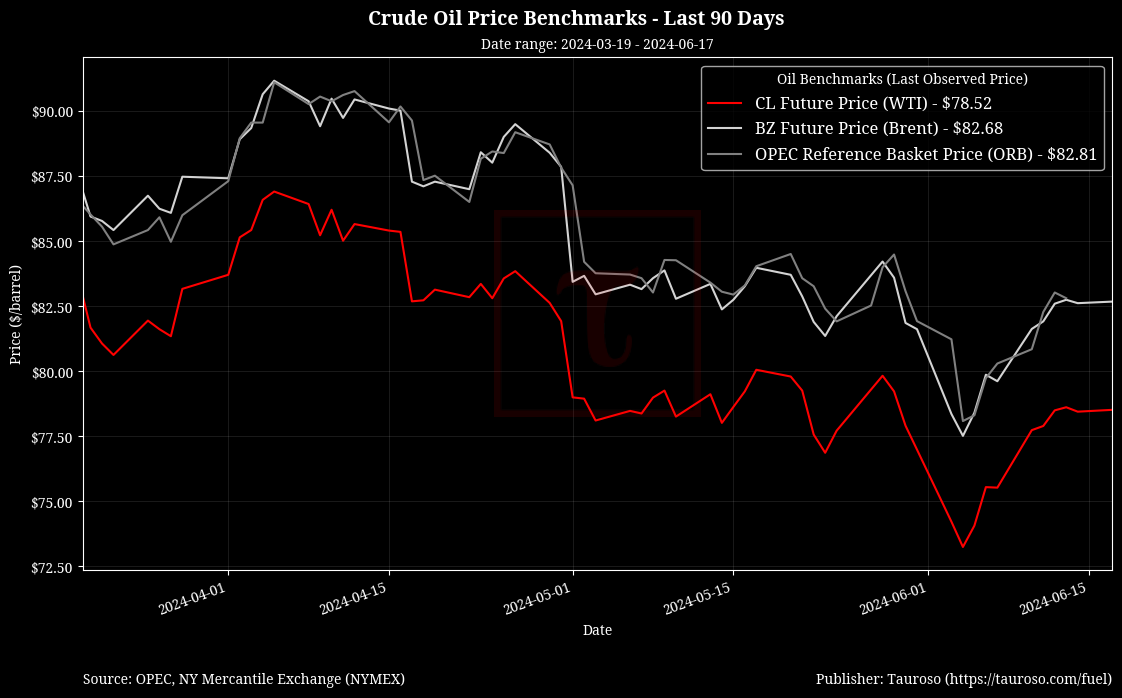

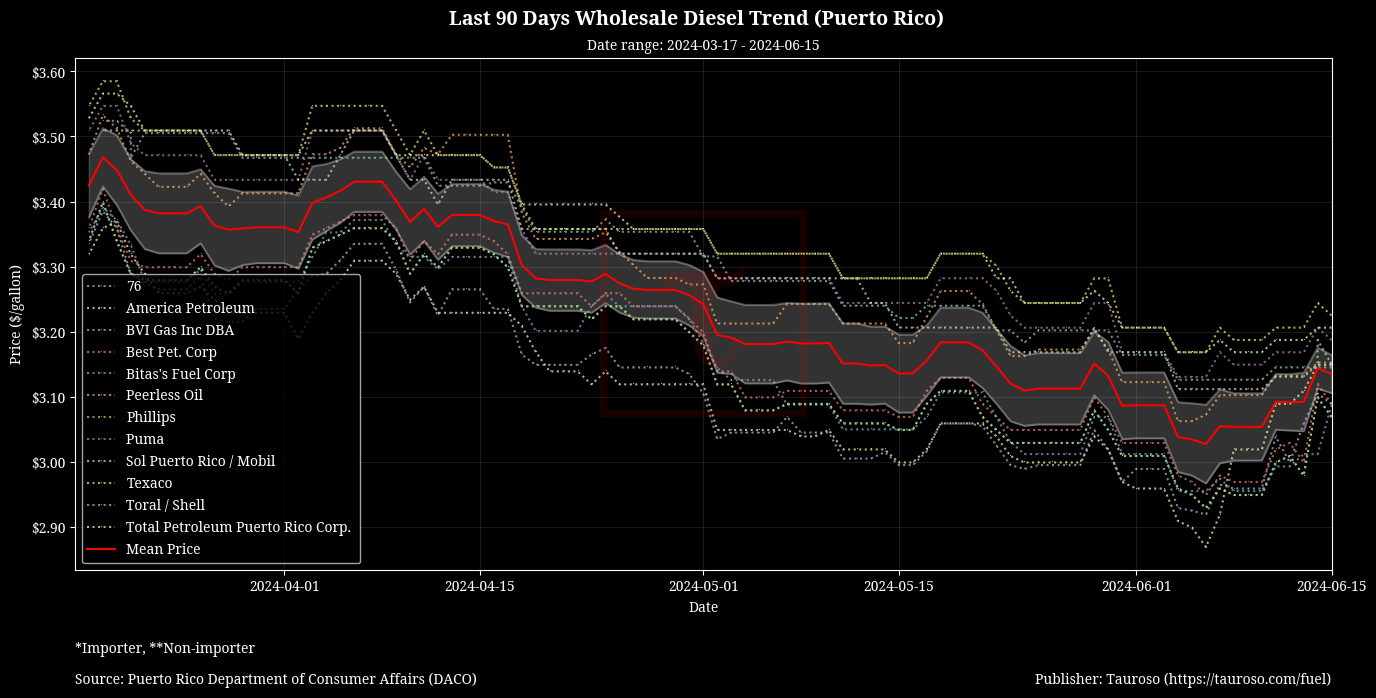

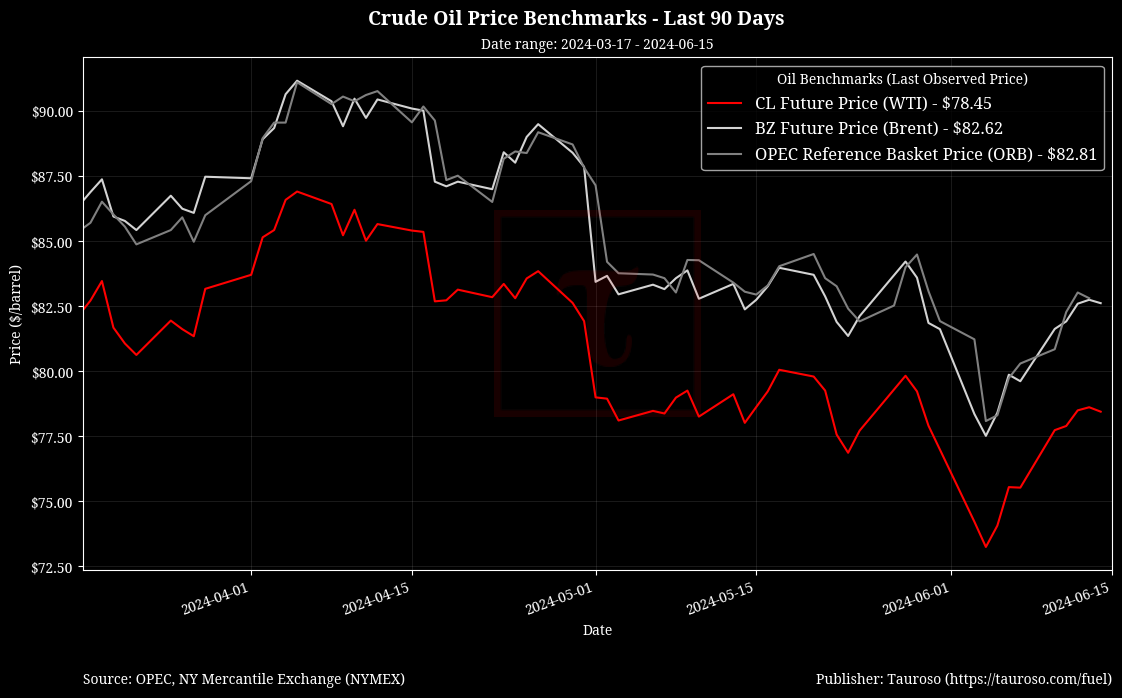

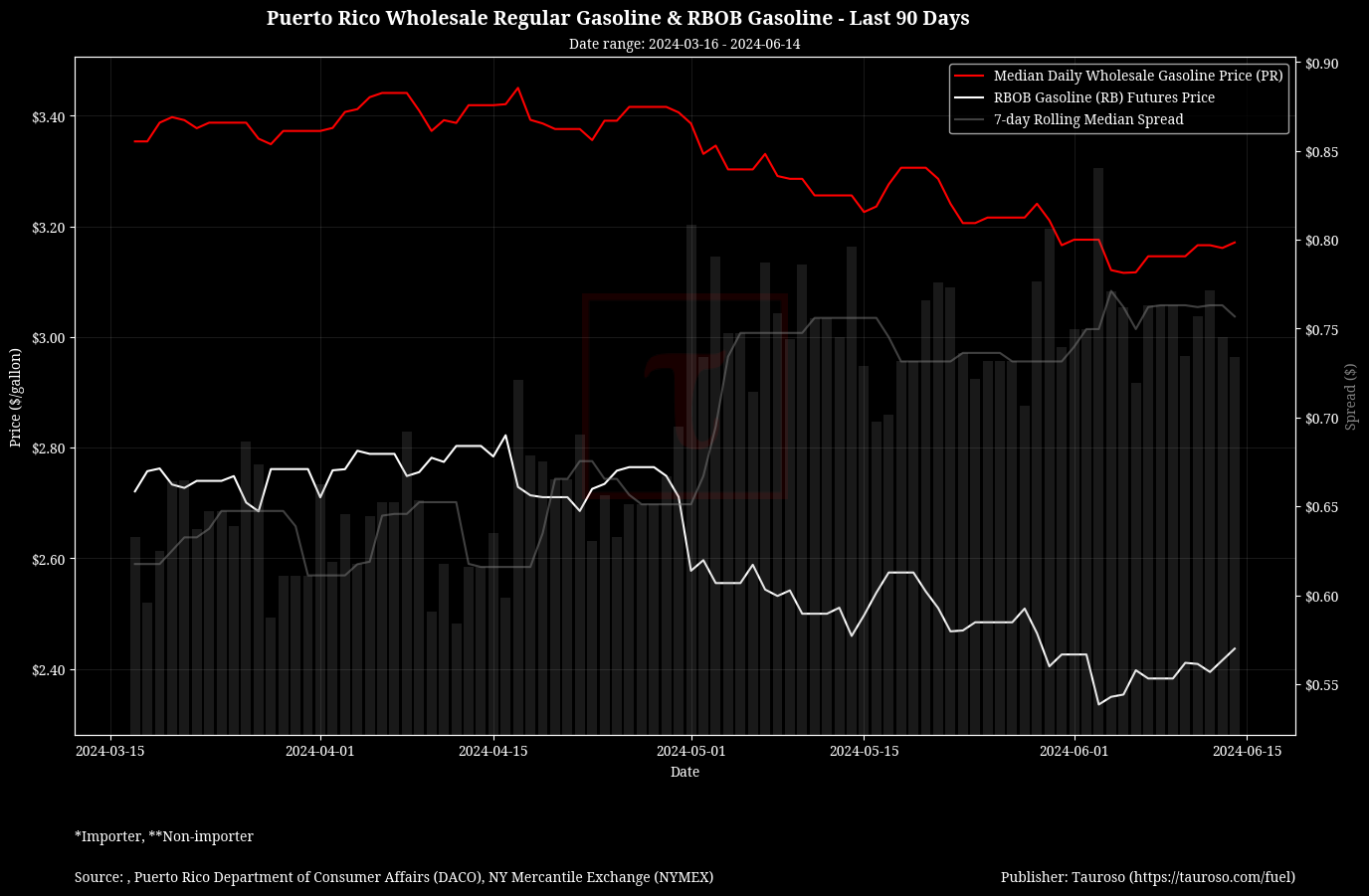

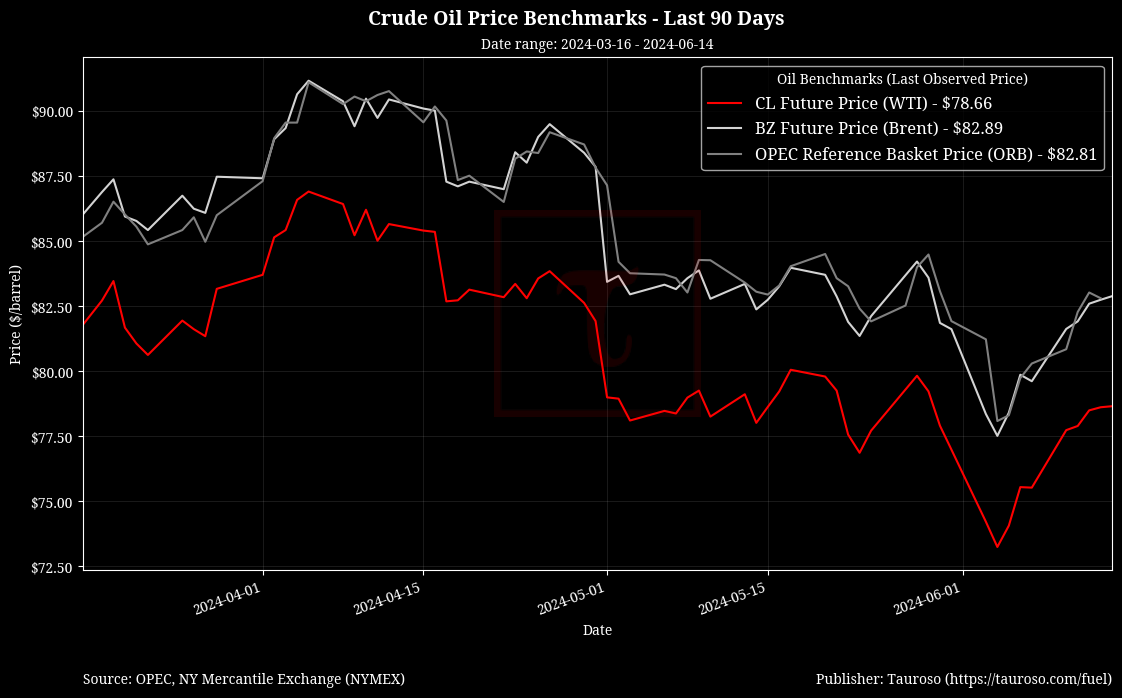

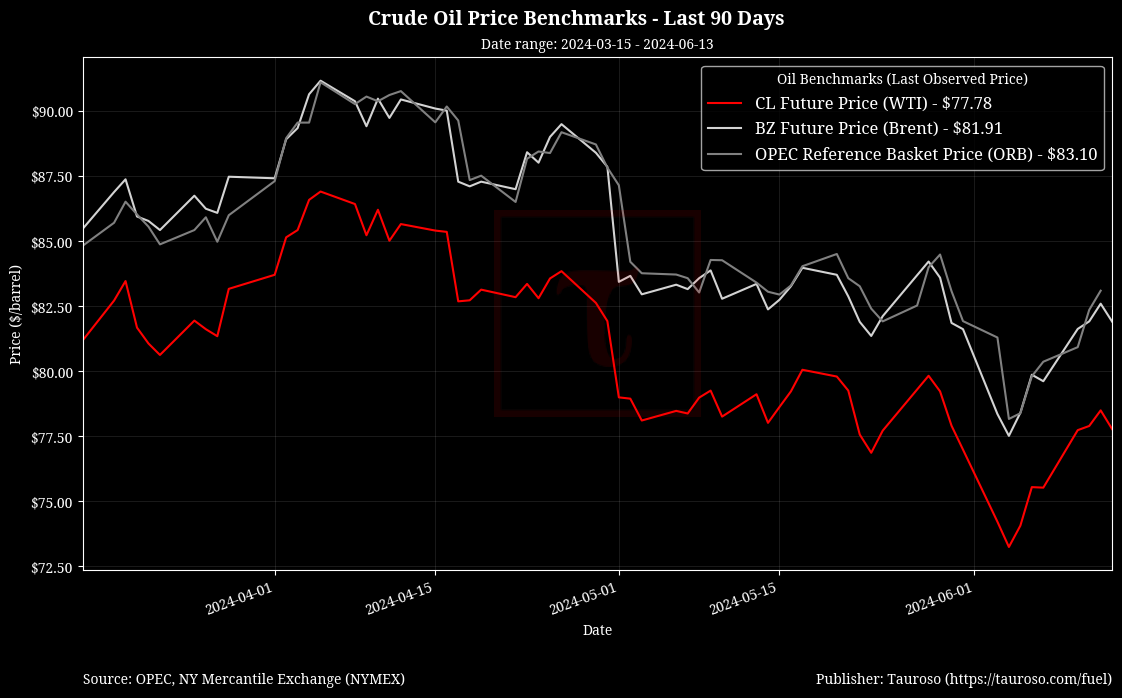

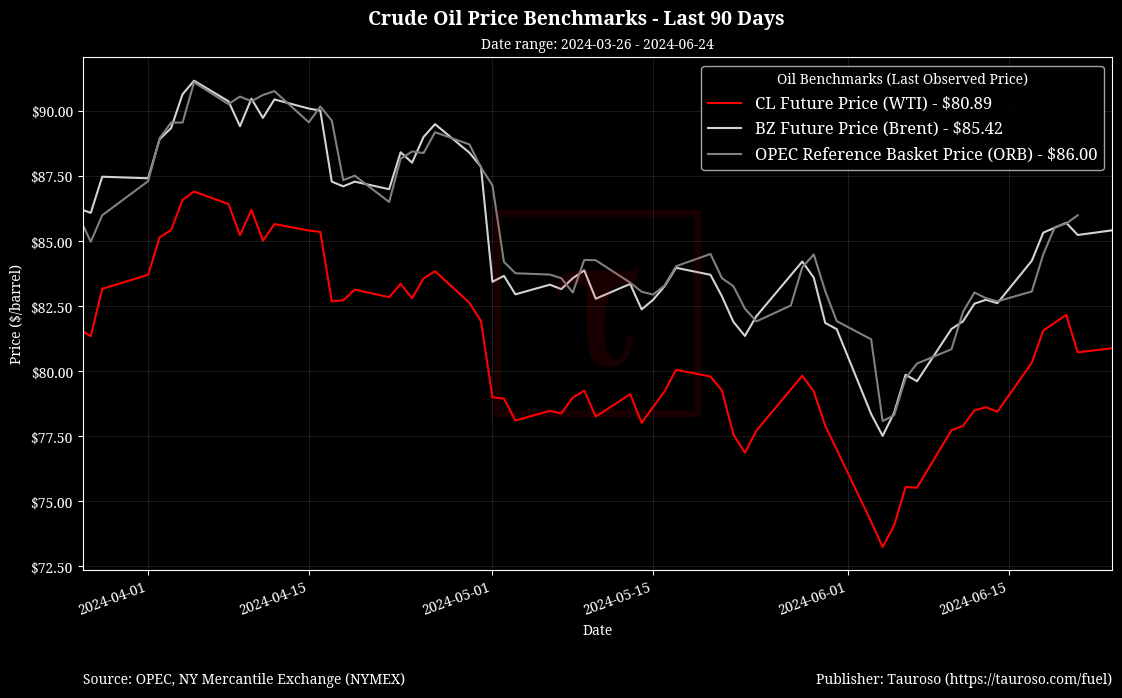

We seem to have reached a low for fuel prices and have started witnessing a renewed uptick as we get deeper into the summer season. We expect to continue to see crude oil in the US and across benckmarks to remain stable in their current levels (~$80 per barrel).

Highlights

- Crude expected to remain at $80 per barrel: Oil prices are holding above $80 per barrel due to a combination of supply constraints and market dynamics. Key factors include ongoing production cuts by major oil-producing countries and increased summer energy demand. Additionally, market uncertainty about future demand, influenced by global economic conditions and geopolitical tensions, is contributing to price stability at this level.

"Summer inventory draws should be enough to get Brent back into the high $80s-$90 range by September" - Natasha Kaneva, JPMorgan's head of global commodities strategy

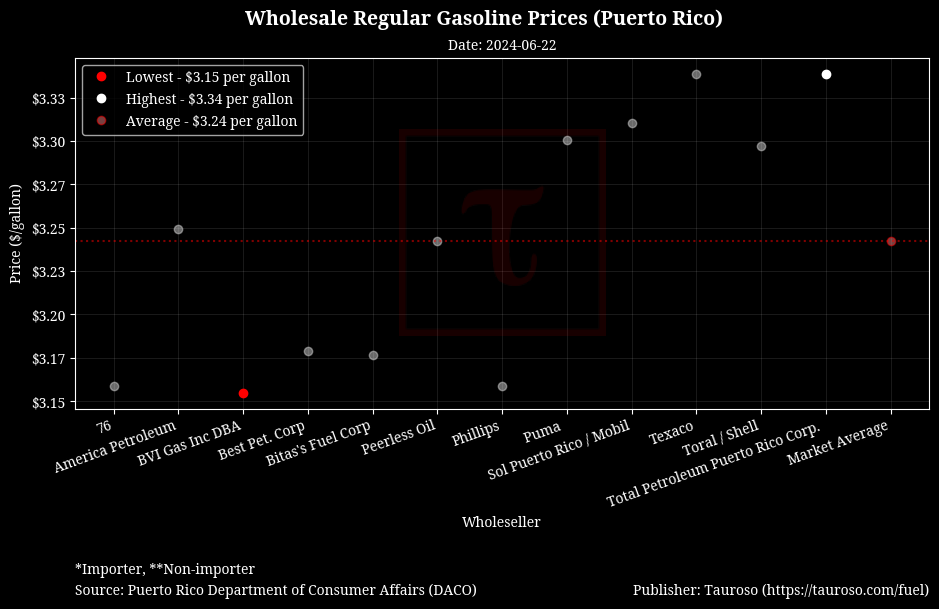

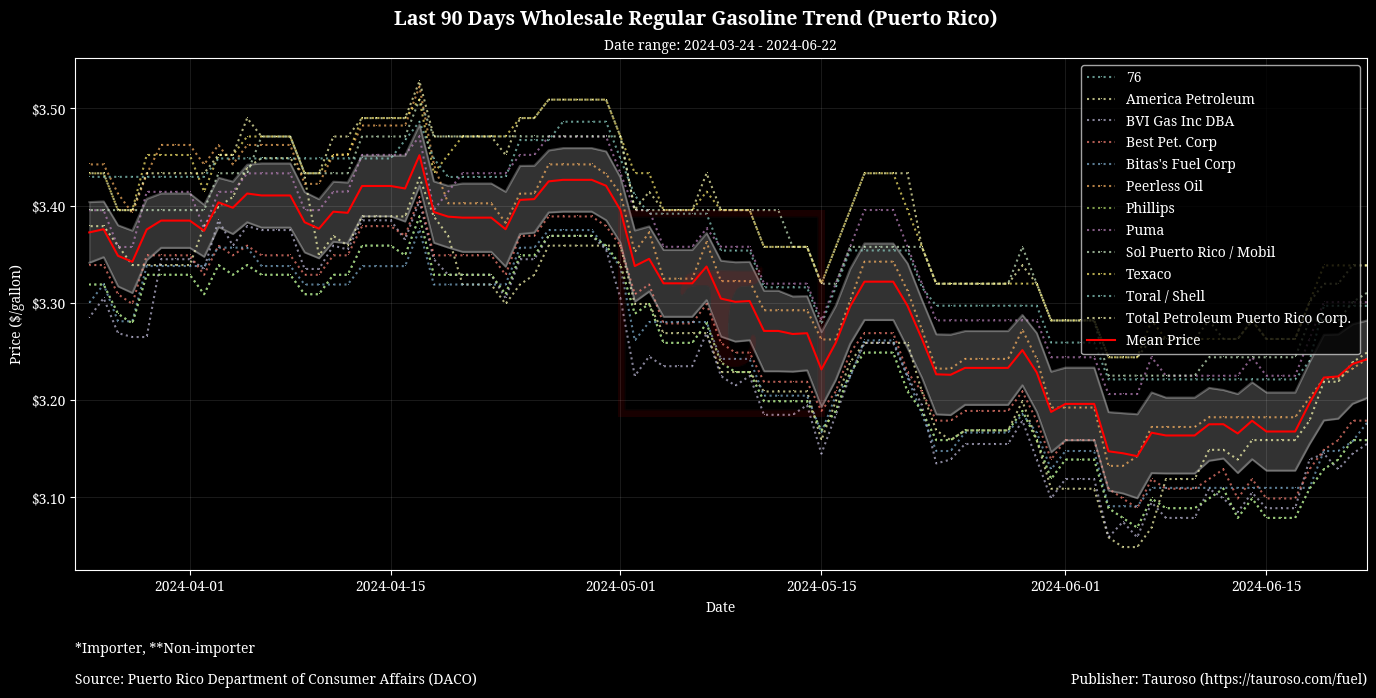

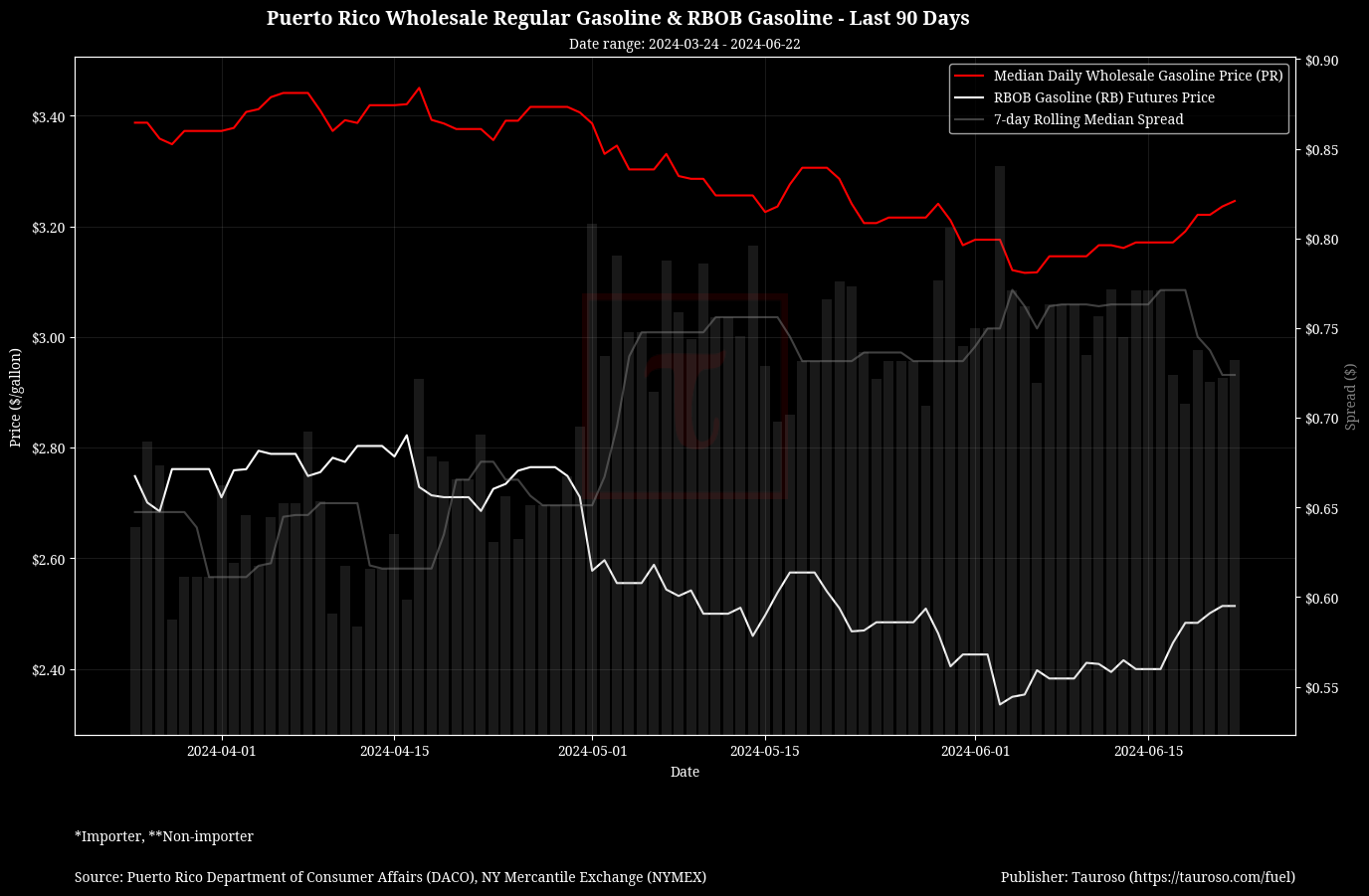

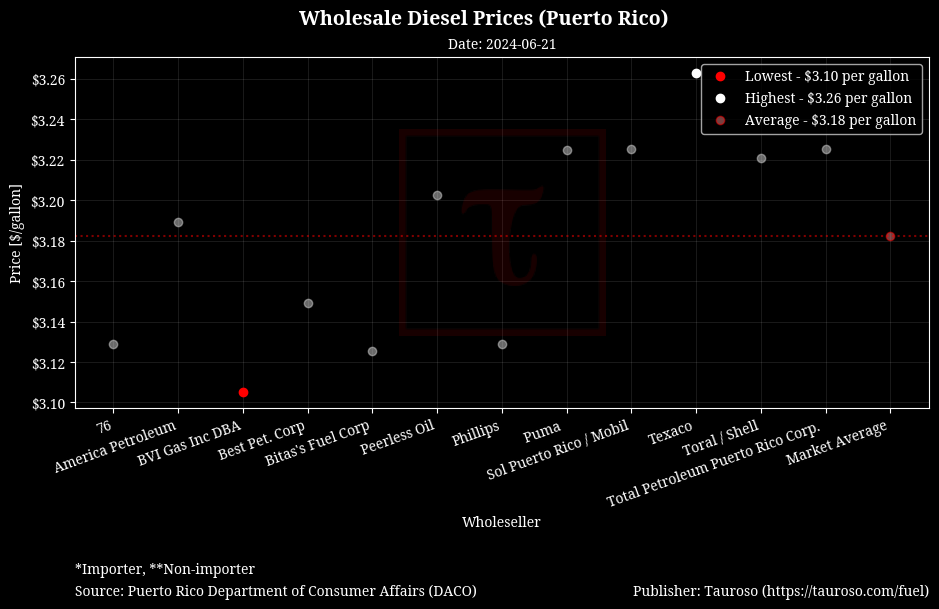

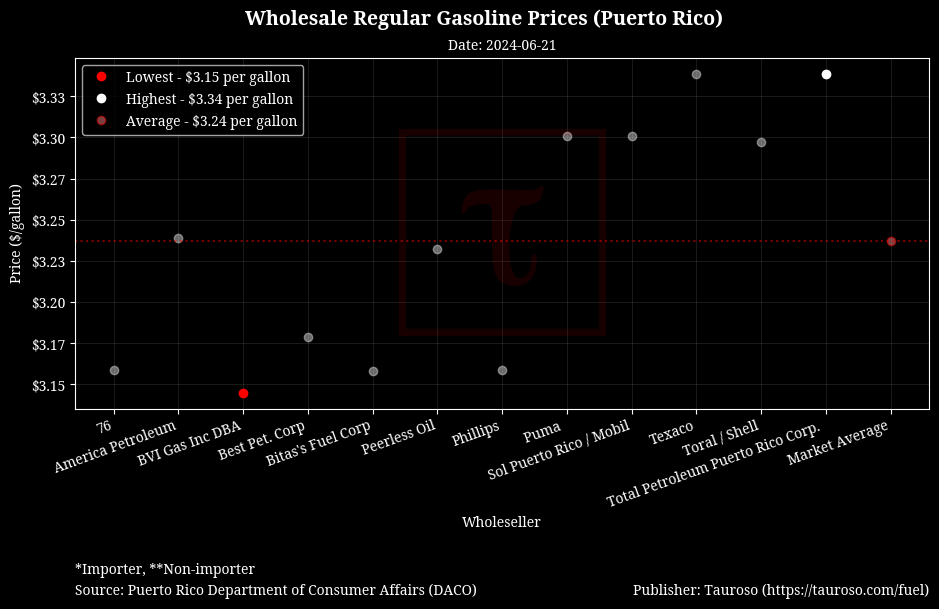

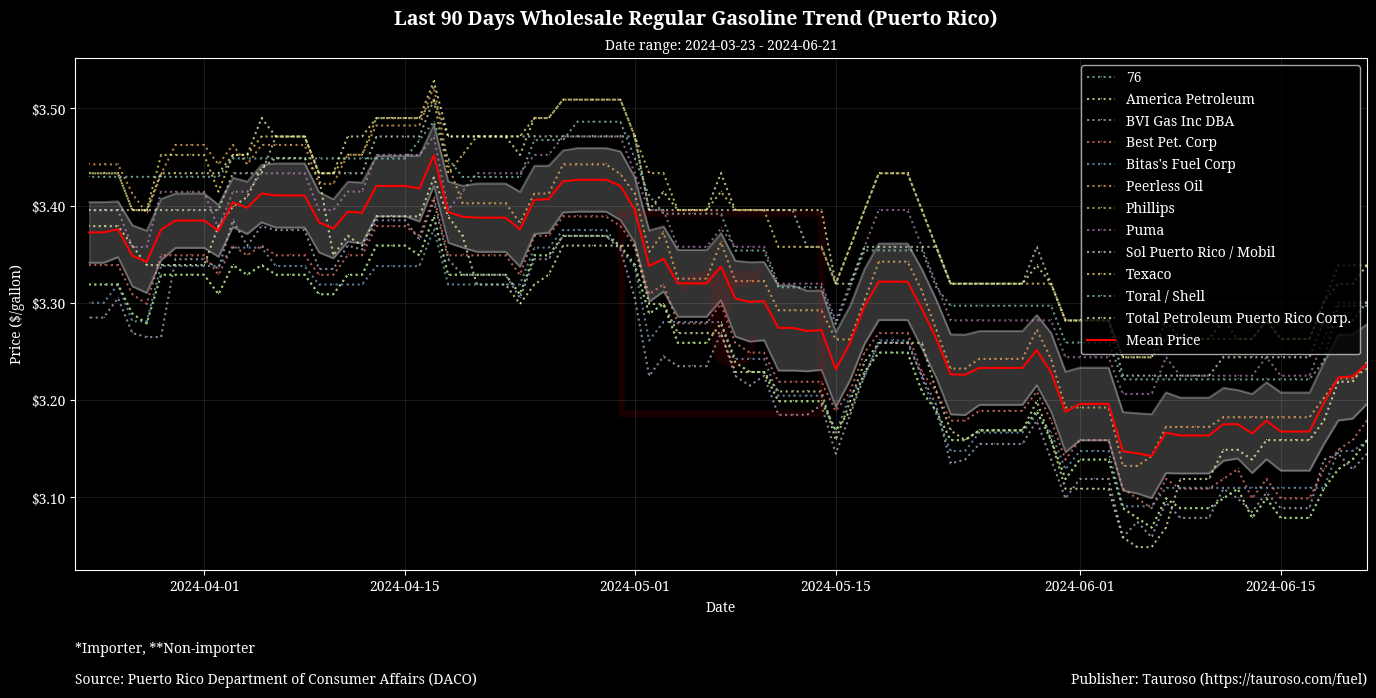

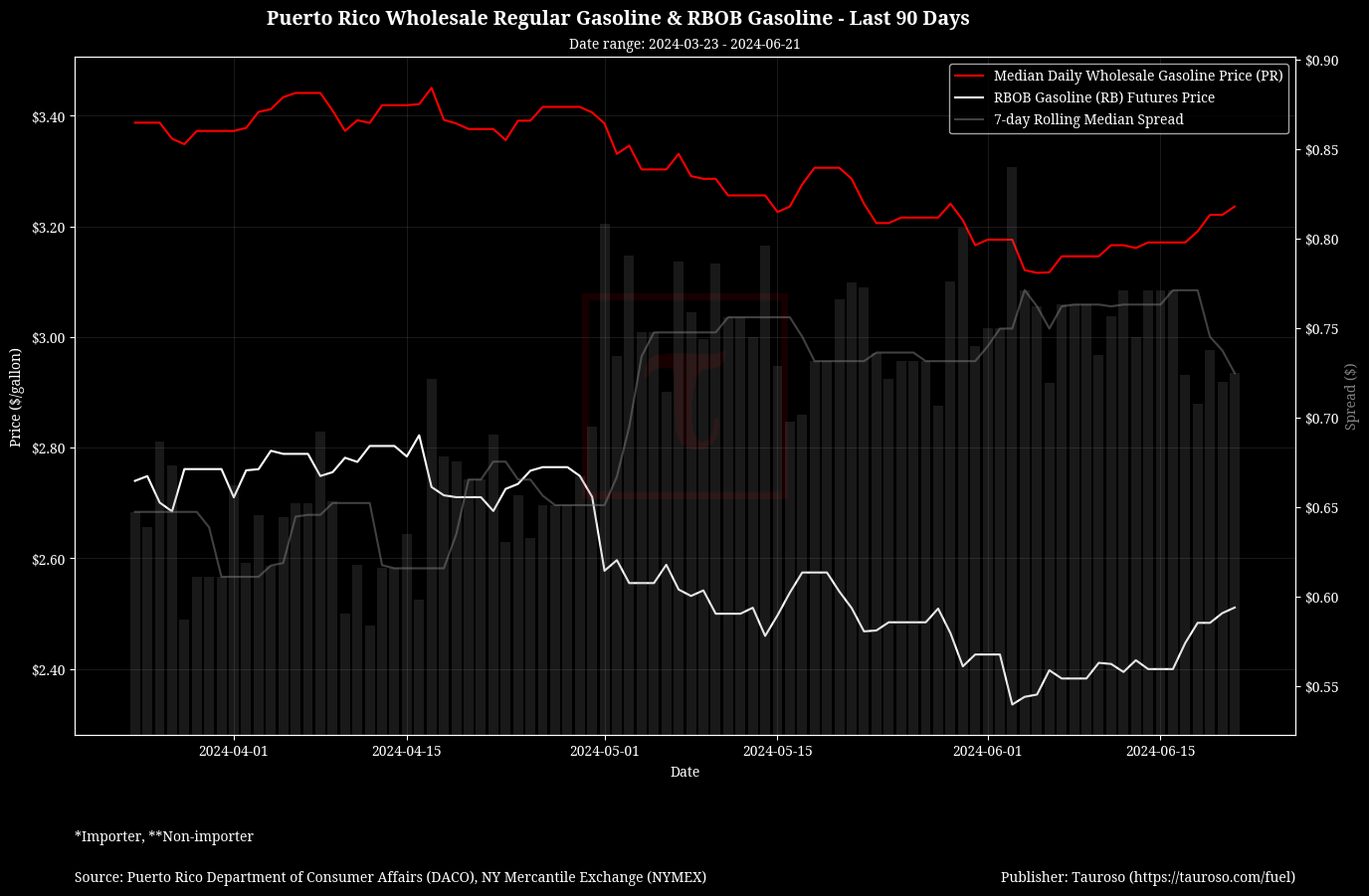

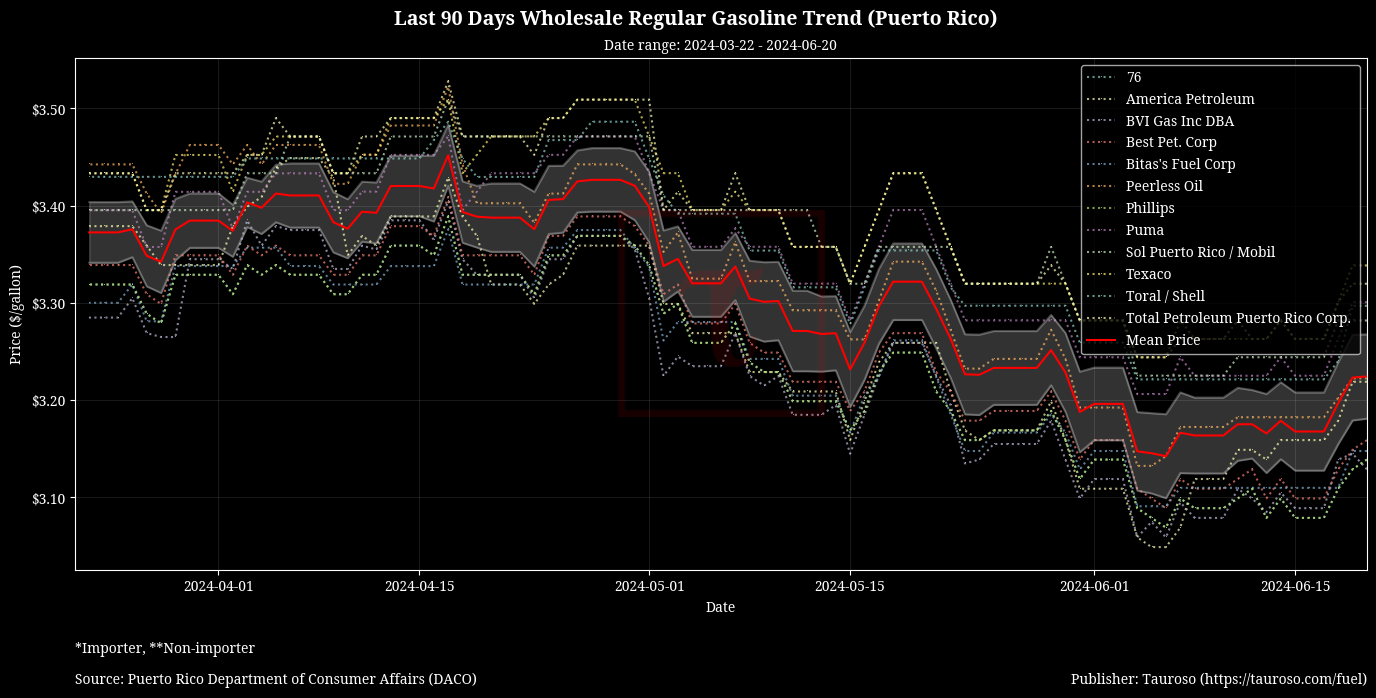

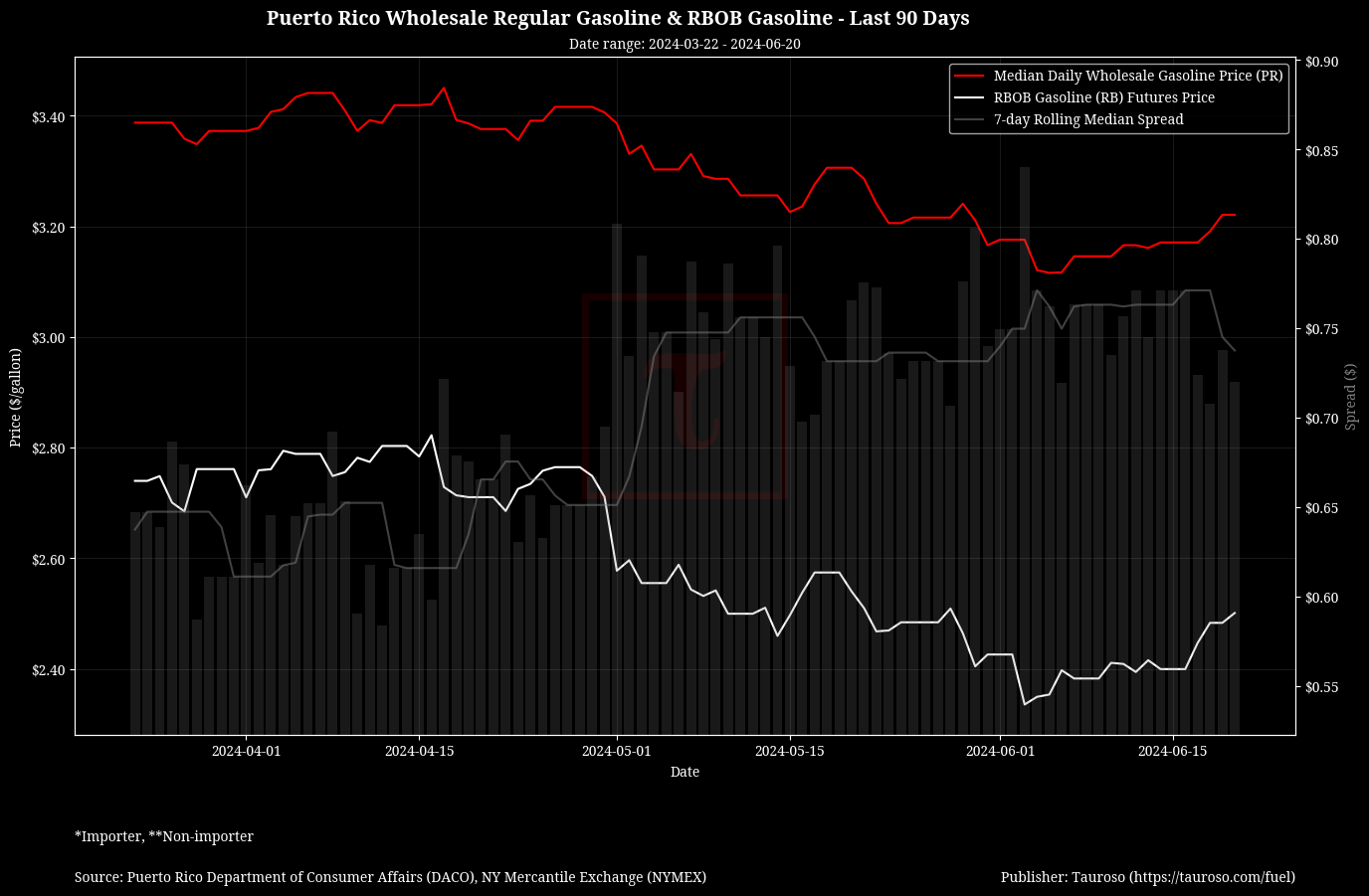

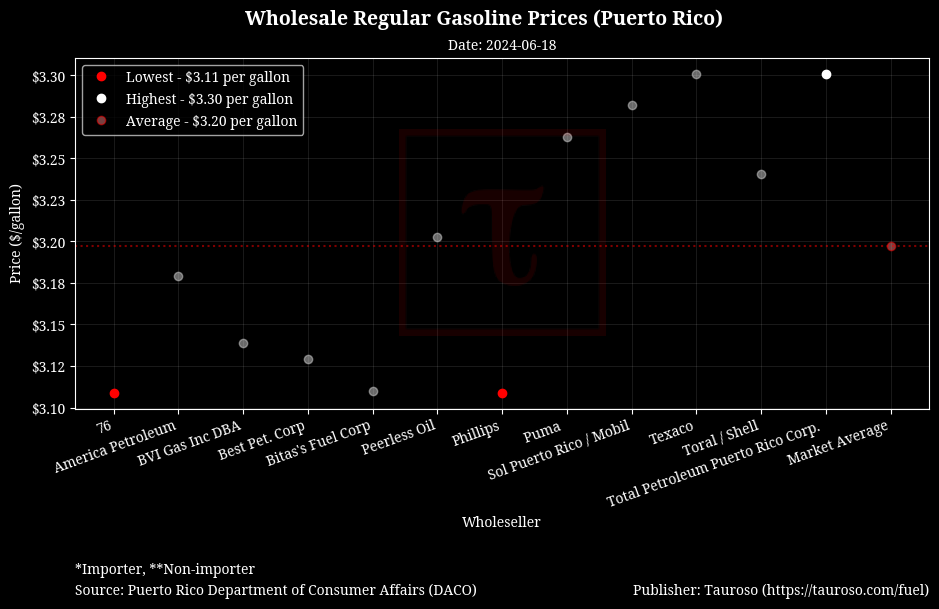

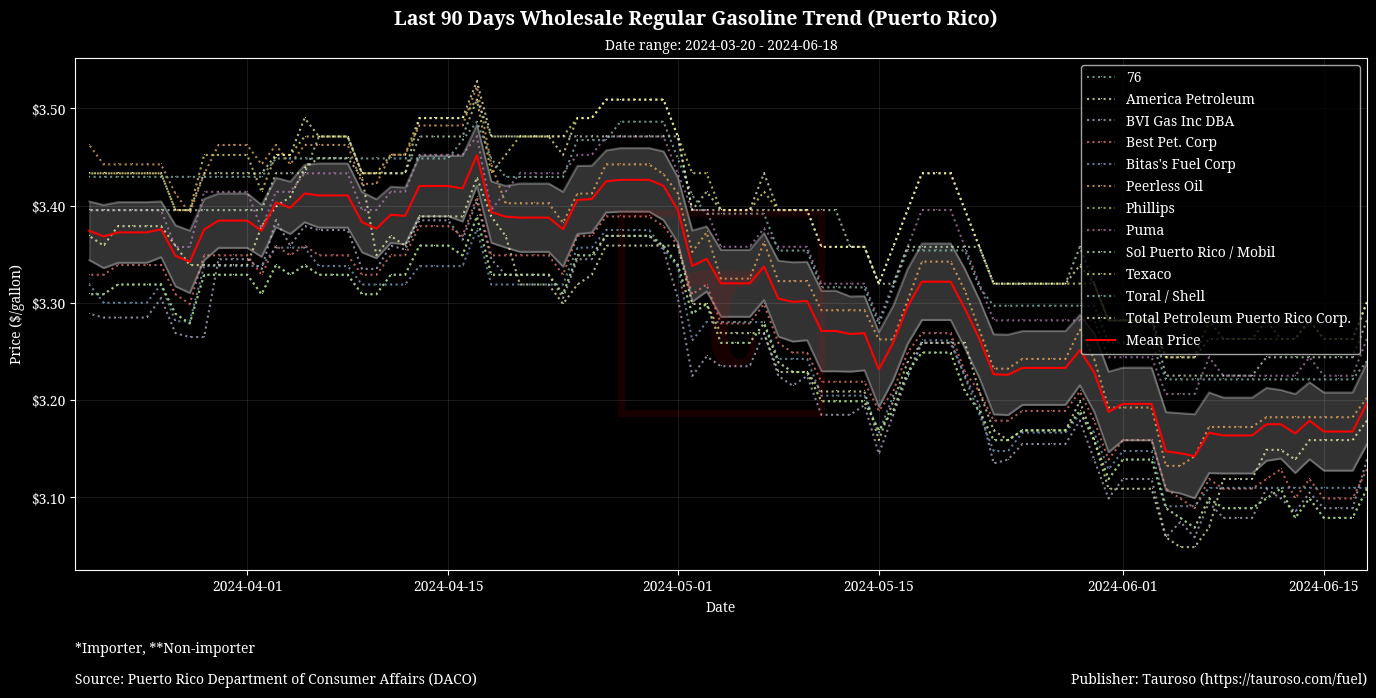

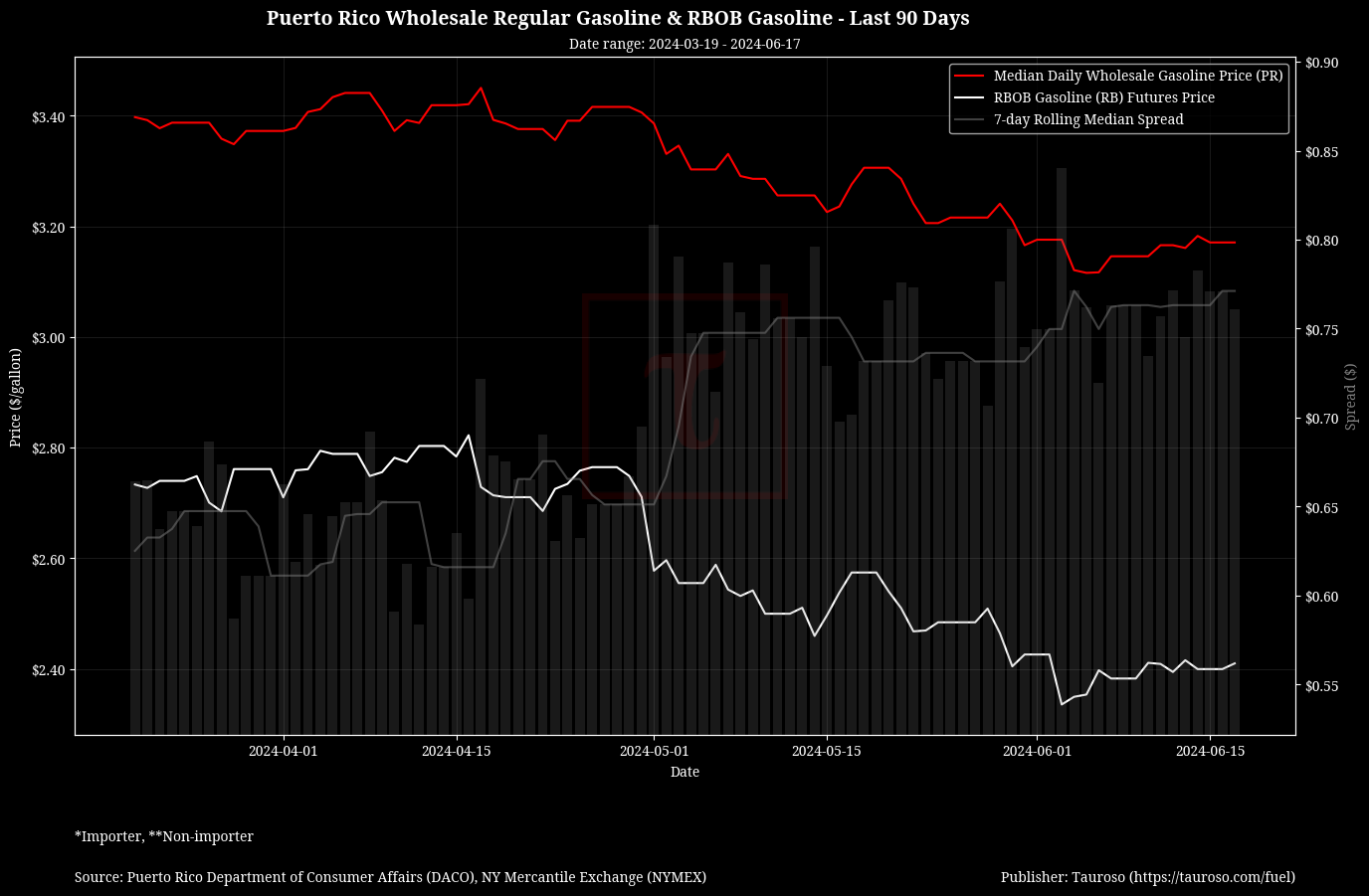

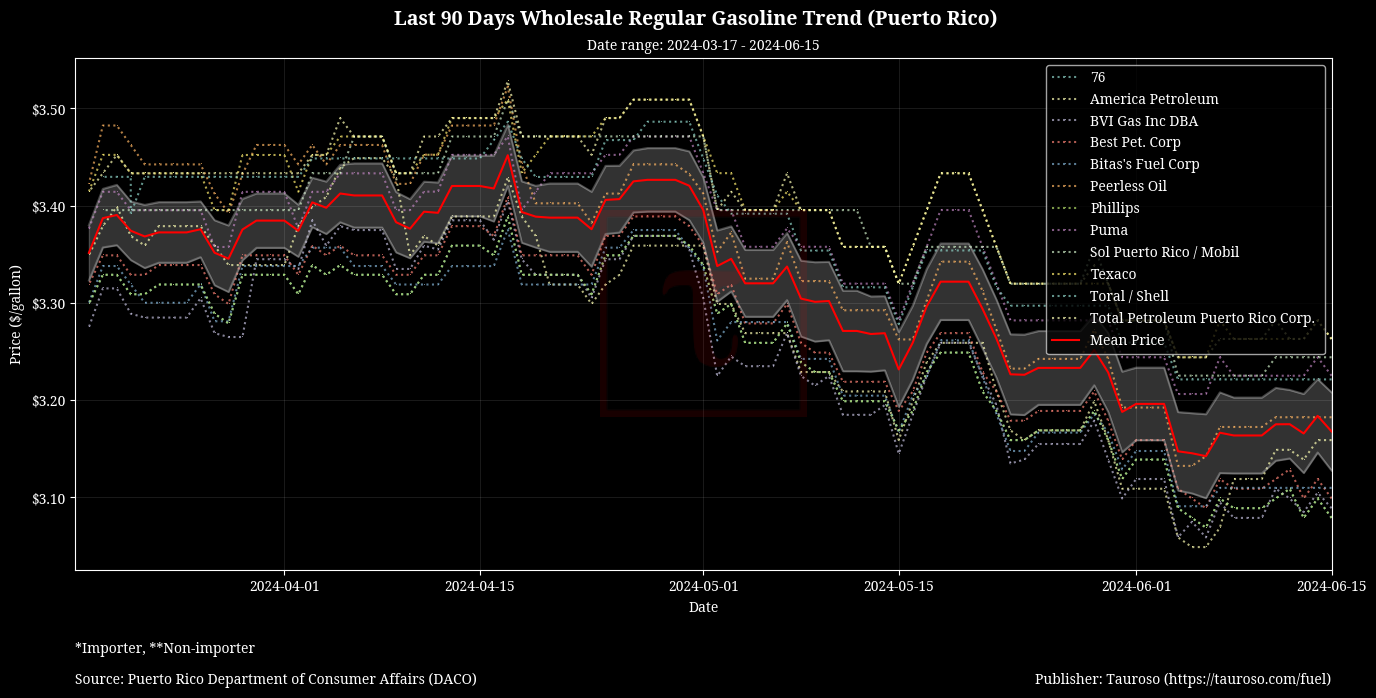

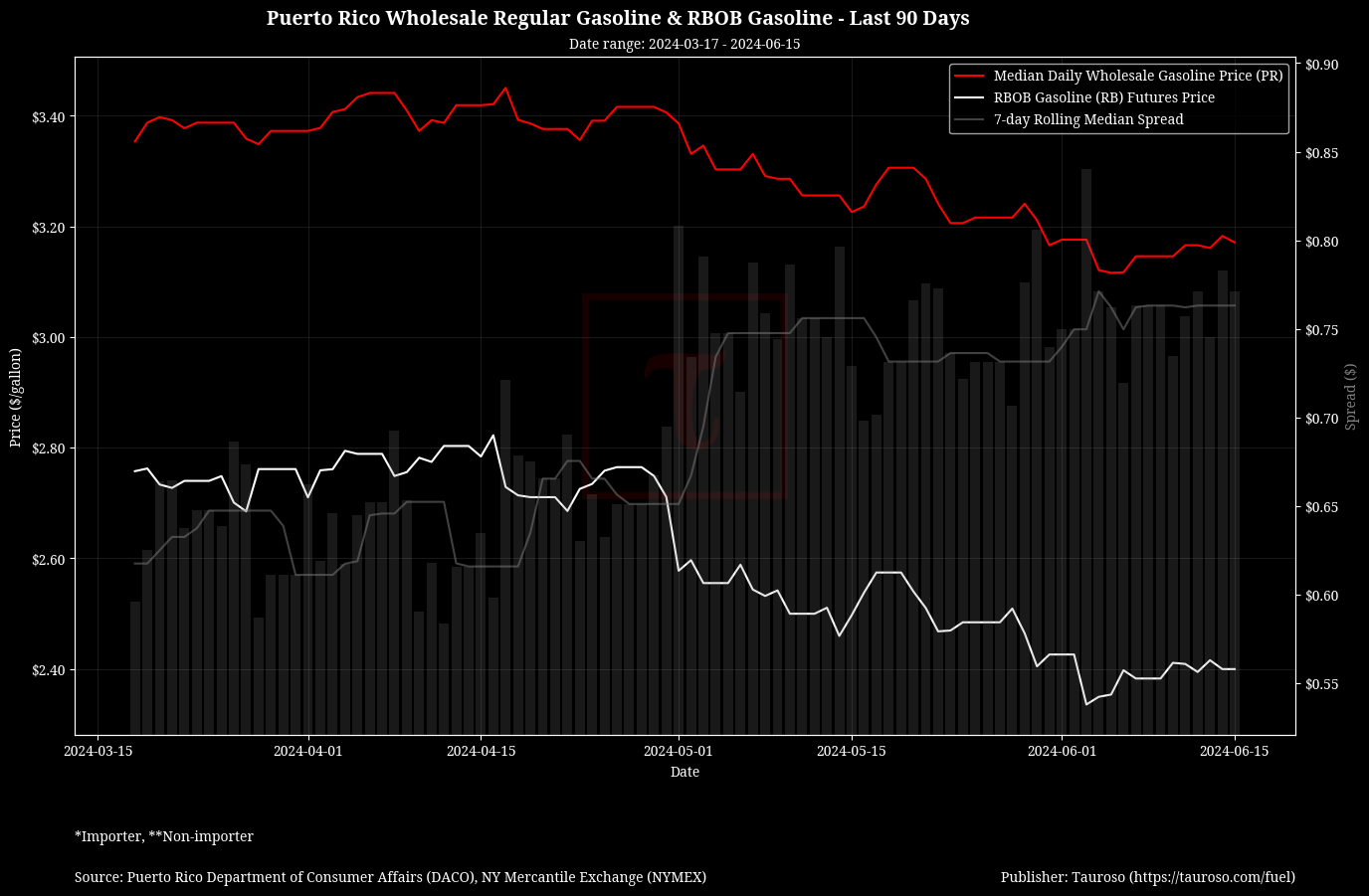

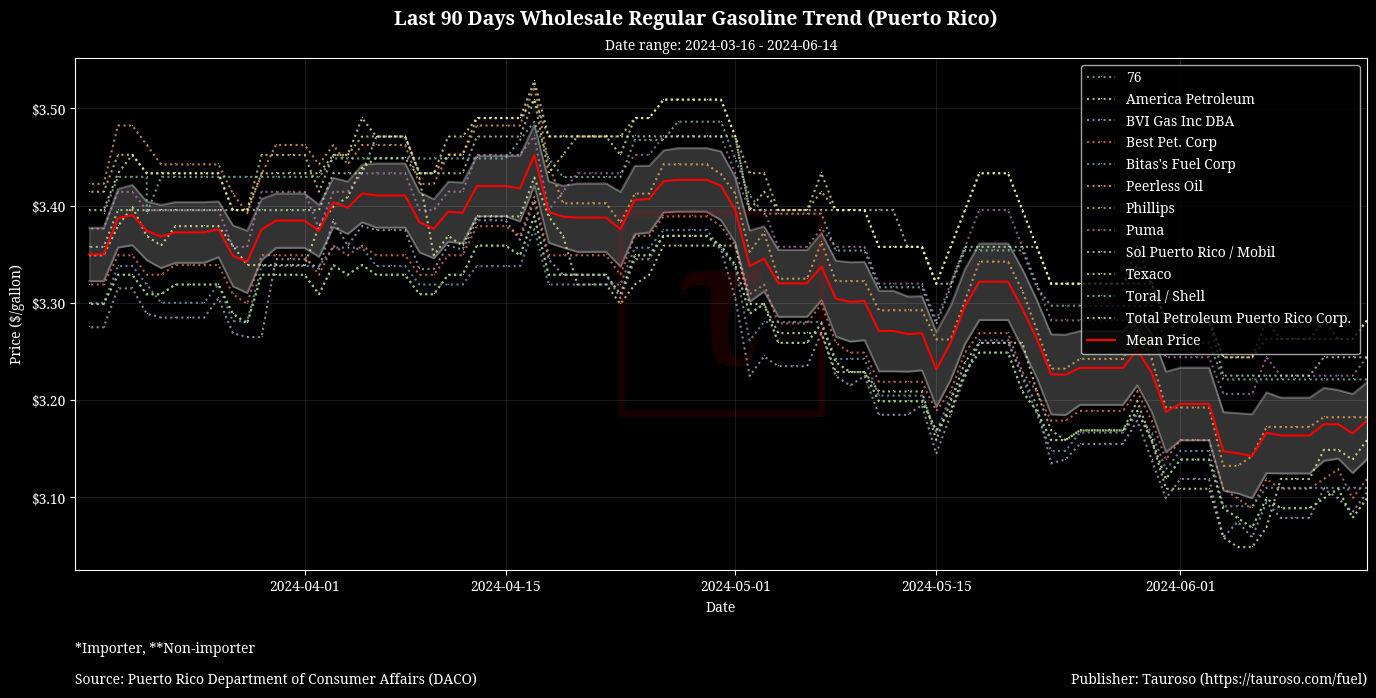

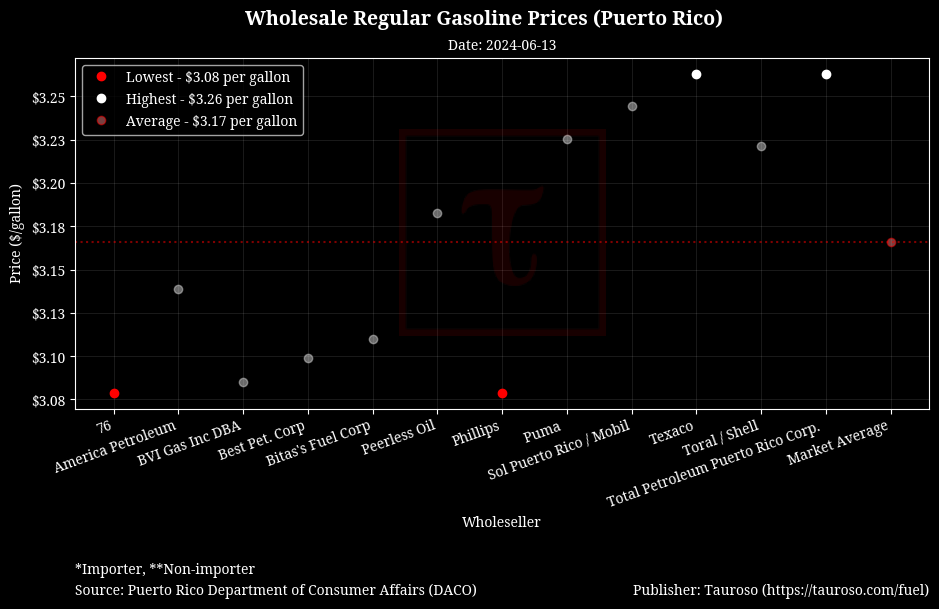

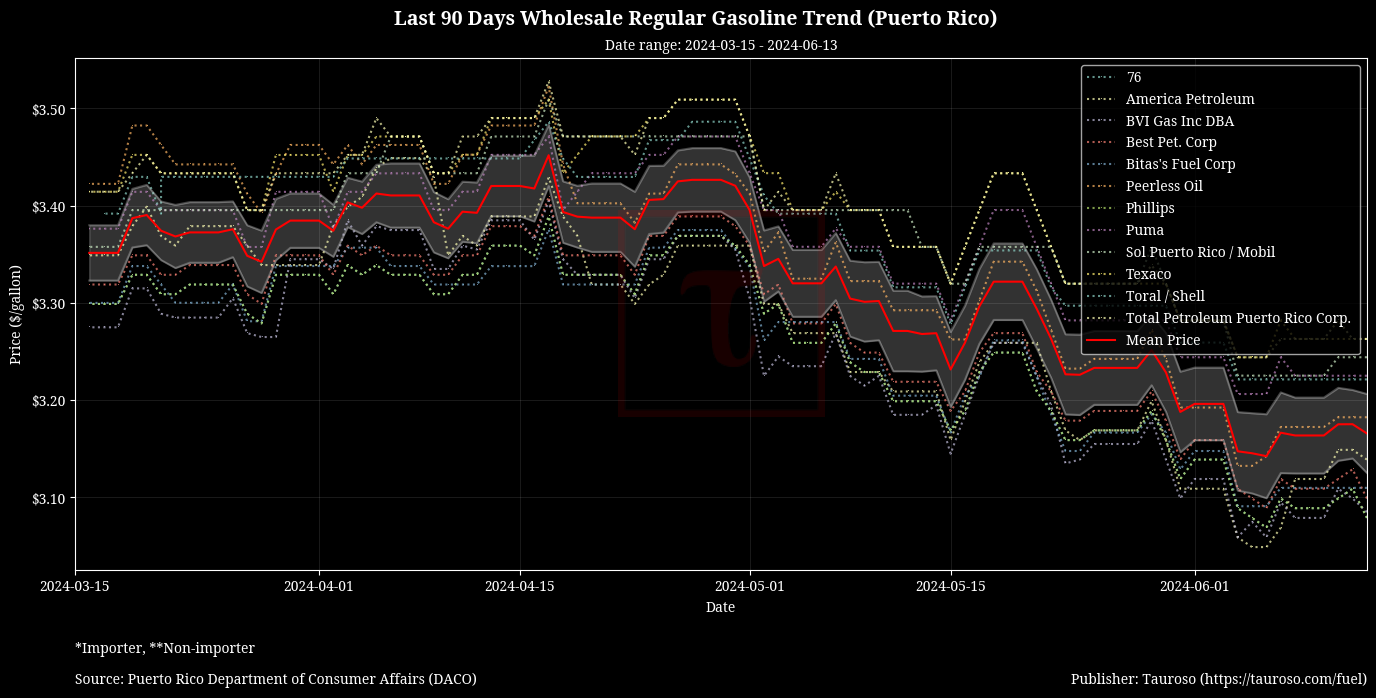

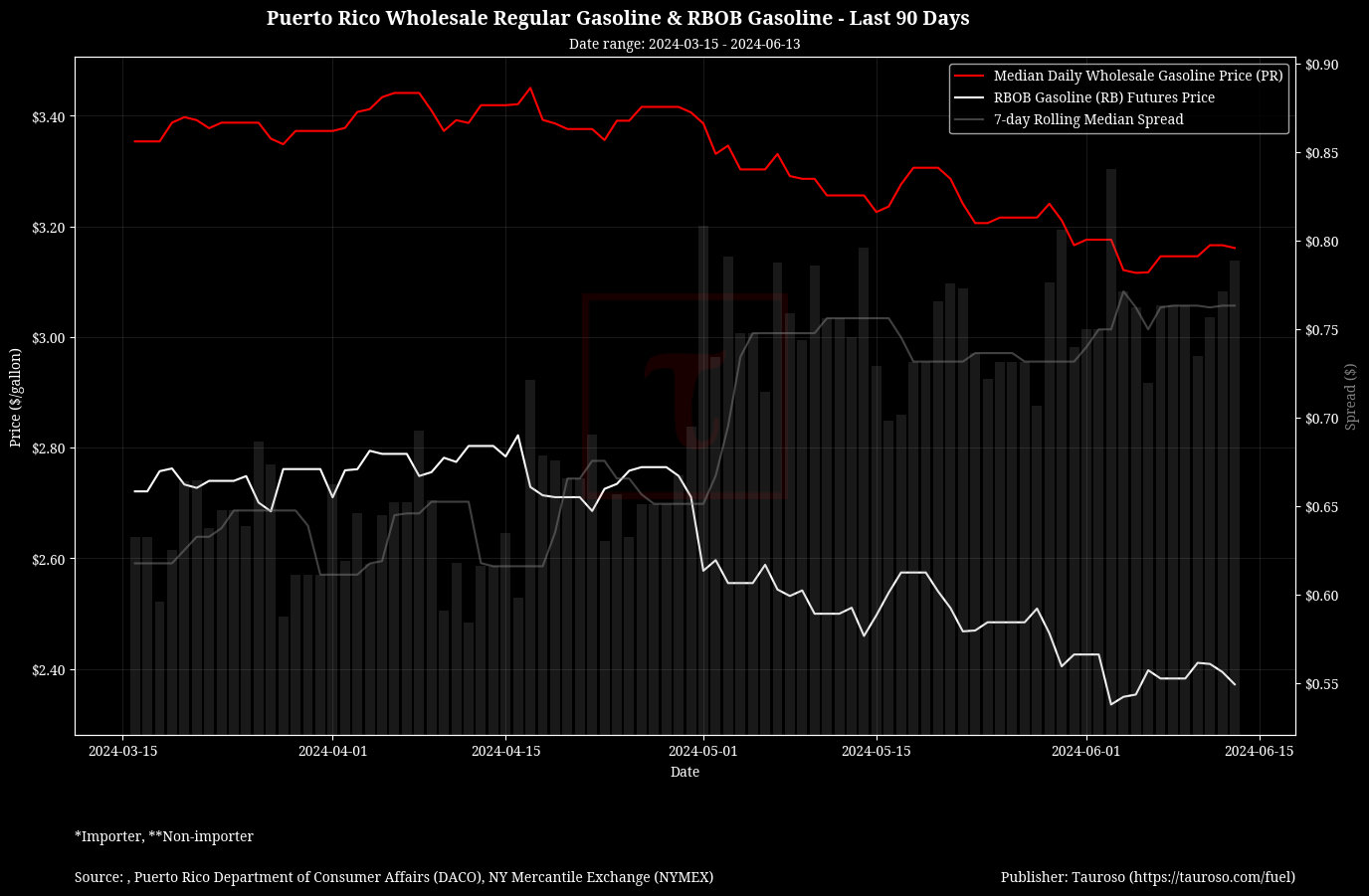

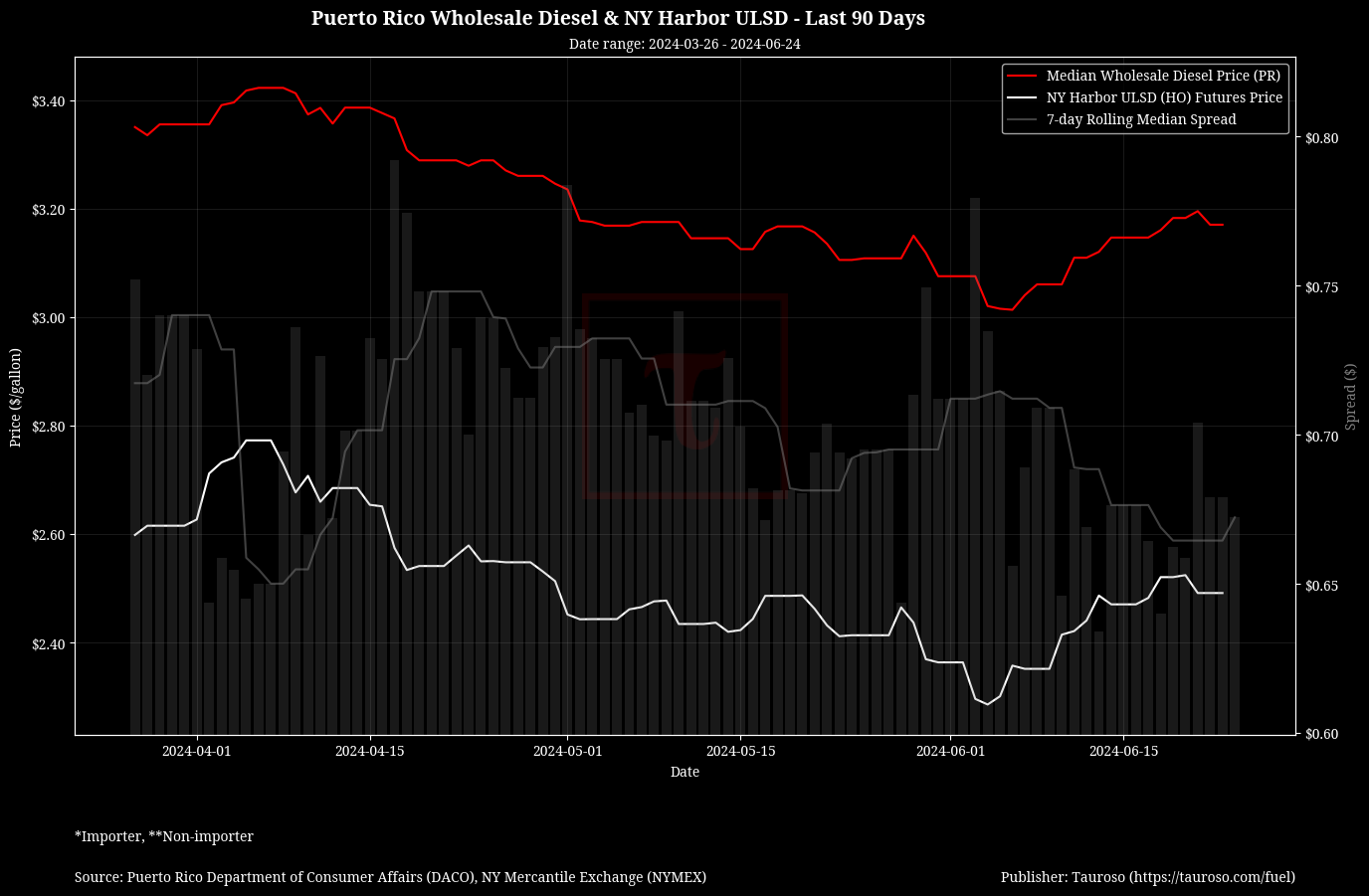

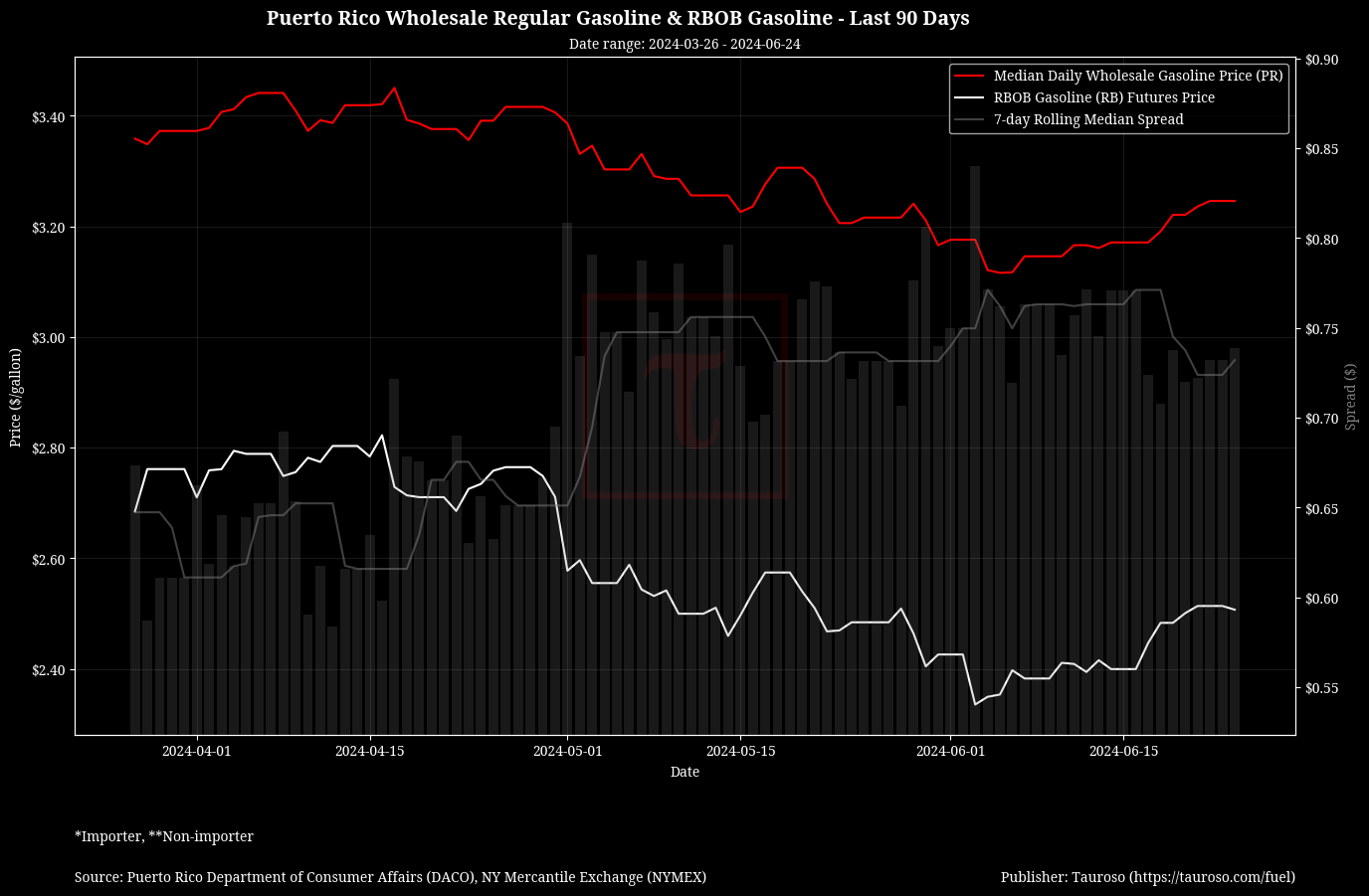

- Gasoline prices headed for a summer squeeze: The driving season and higher energy consumption for cooling are major factors behind the anticipated price rise. This demand is expected to create a market deficit, pushing prices upward.

"We expect that healthy consumers and solid summer demand for transportation and cooling will push the market in a sizable Q3 deficit," - Daan Struyven, managing director and head of oil research at Goldman Sachs

- Gasoline in the US up after 3 week decline: U.S. gasoline prices have risen to a three-week high, driven primarily by increases in the Great Lakes region. The national average price at the pump increased by 1 cent from the previous week, halting a gradual decline. This rise in prices comes despite a backdrop of fluctuating oil prices and varying regional demand and supply dynamics. The increase highlights the sensitivity of gasoline prices to regional market conditions and broader economic factors

“Since the national average price of gasoline fell to its lowest June level since 2021 last week, we’ve seen the drop in prices take a break, with some states seeing a small rise over the last week. Thankfully, I expect this to be more like a short timeout, with an eventual return to falling gasoline prices in most states,” - Patrick De Haan, head of petroleum analysis at GasBuddy

- Strategic Petroleum Reserve (SPR): The U.S. is in the process of refilling its SPR after significant drawdowns in 2022. The Energy Department has initiated new solicitations to purchase oil at favorable prices to replenish these reserves, aiming to stabilize the market

Crude Oil Benchmarks

References

- https://finance.yahoo.com/quote/CL%3DF

- https://finance.yahoo.com/quote/RB=F/

- https://finance.yahoo.com/news/u-gasoline-prices-3-week-173000293.html

- https://finance.yahoo.com/news/oil-to-rise-to-86-per-barrel-this-quarter-on-solid-summer-demand-goldman-says-160132707.html

- https://oilprice.com/Latest-Energy-News/World-News/Goldman-Sachs-Sees-Oil-Prices-Rising-to-86-This-Summer.html