What to expect

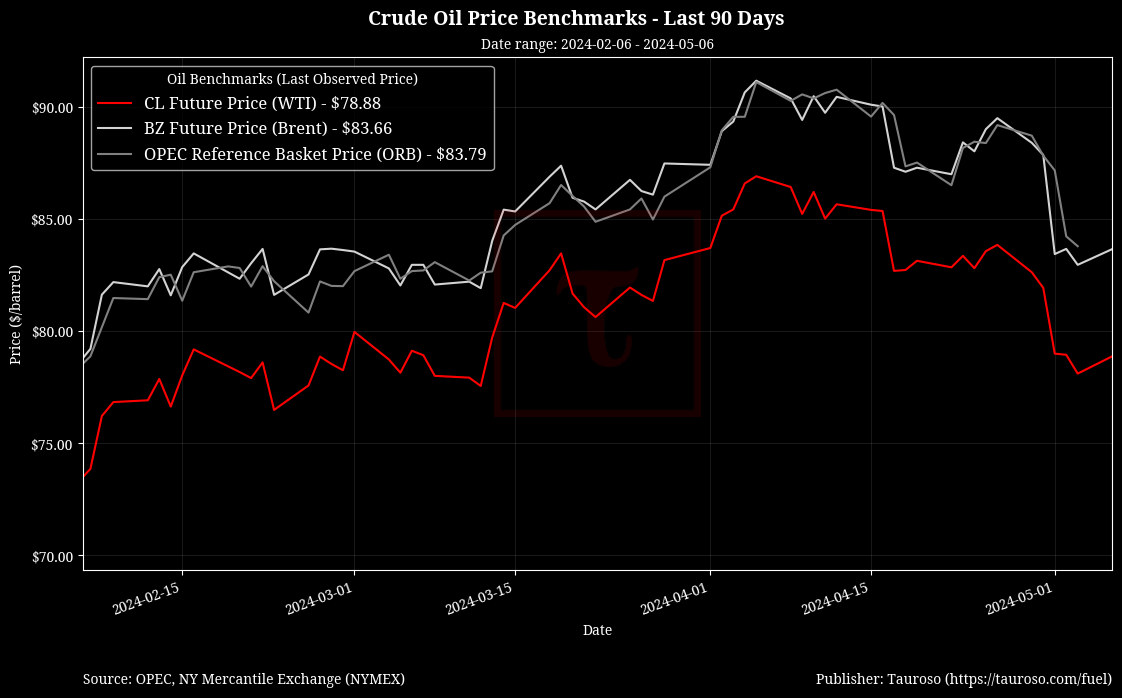

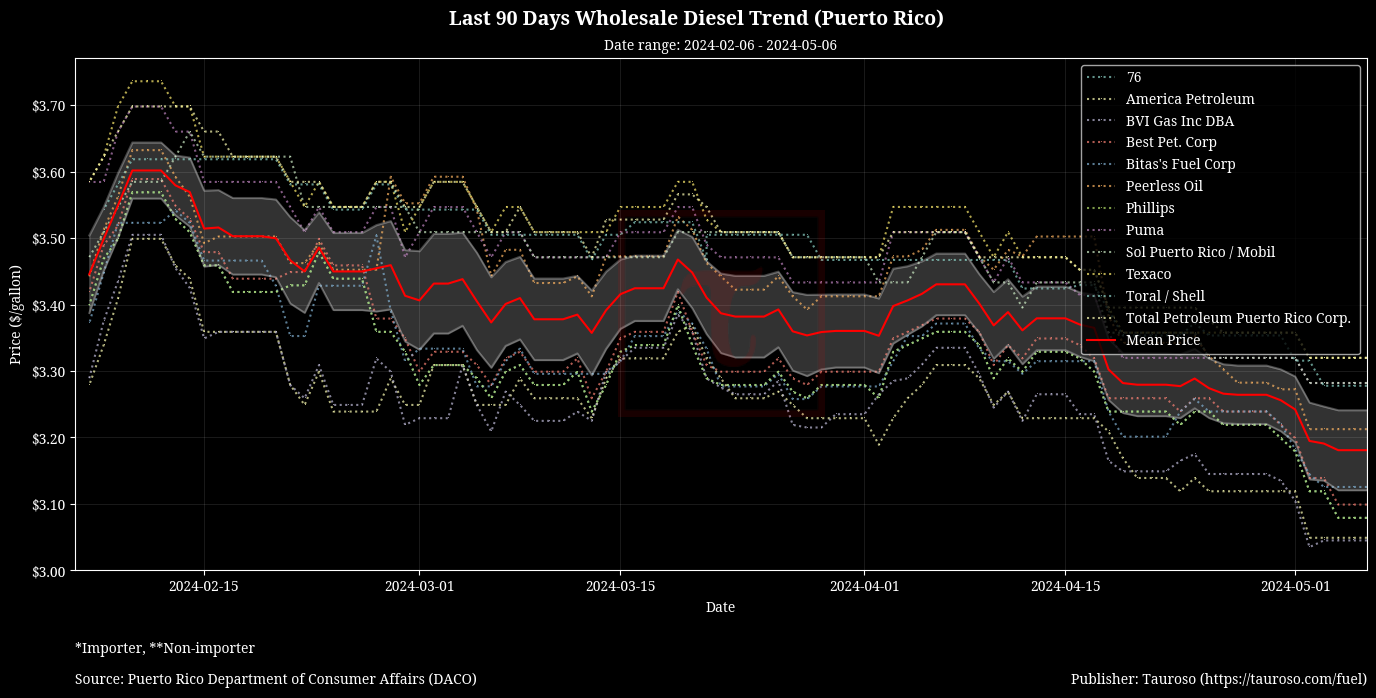

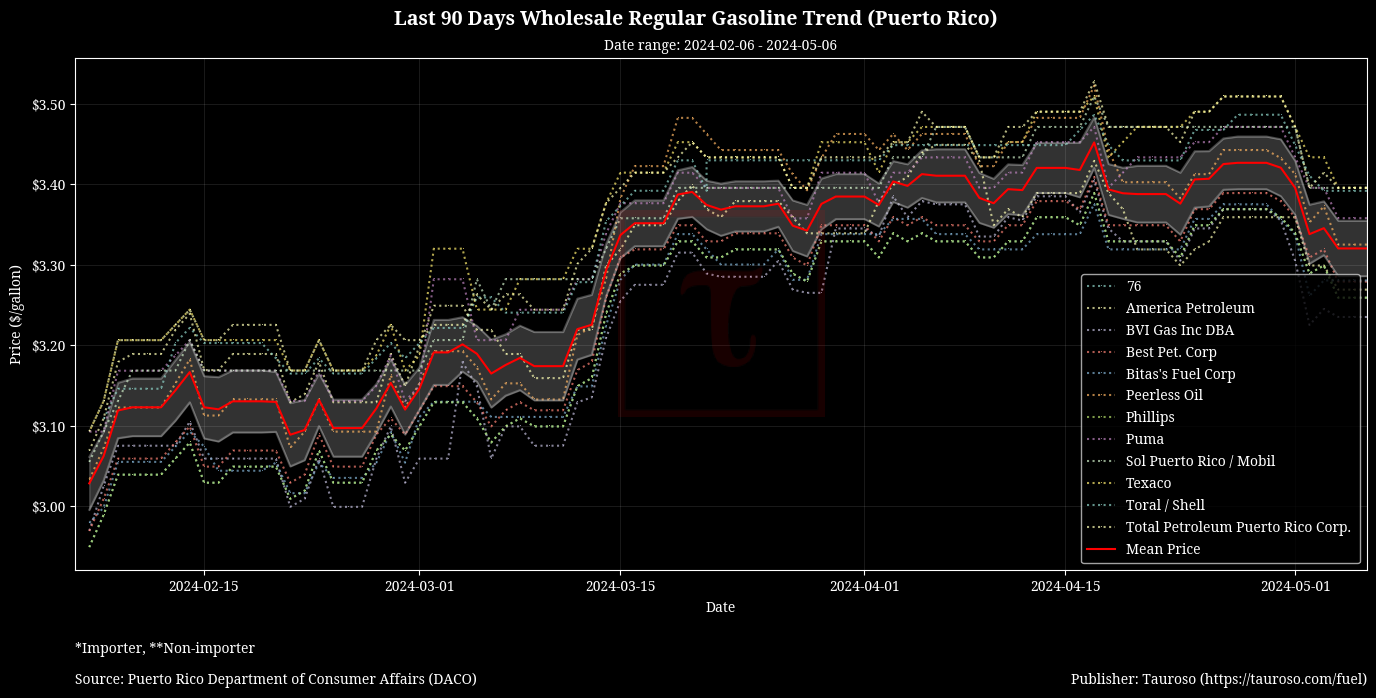

Last week saw a large drop in crude oil and local fuel prices, driven by a variety of factors, most strongly by events in the US and heightened expectations of ceasefire talks between Israel and Hamas.

Should market activity remain the same, we should continue to expect further price relief in both crude oil and local fuel markets.

Highlights

- Fuel price relief starts kicking in: As reported in our previous week review, events that would see some noticible price activity has kicked in as witnessed by a shart drop in crude oil and local fuel prices (see wholesale trends for last week).

- Softening demand for gasoline: EV sales and gasoline inventory supply increases have some organizations expecting a softening in demand for gasoline in 2024

U.S. gasoline consumption fell to about 376 million gallons per day (8.94 million bpd) in 2023 after hitting a record 392 million gallons in 2018, according to the U.S. Energy Information Administration.

- Geopolitical outlook: Expectations of a ceasefire in Gaza have increased amid a renewed push from Egypt to revive talks between Hamas and Israel.

"Futures have been on the defensive on calming Geopolitical issues ... traders are realizing no real barrels are being pulled off the global stage (other than [from] Ukraine attacks on Russia) which so far have been temporary disruptions," - Dennis Kissler, senior vice president at BOK Financial

- Commodity gains on softening dollar

Investors are closely monitoring the commodity sector, which is experiencing a broad-based rally as the U.S. dollar (DX-Y.NYB) exhibits signs of weakness. Commodities like copper (HG=F) and gold futures (GC=F) are among the notable gainers, capitalizing on the dollar's softening momentum.

Crude Oil Benchmarks